Secret takeaway:

-

Bitcoin’s bullish loudspeaker pattern recommends $144,000-$ 260,000 remains in play this cycle.

-

Indications of panic from BTC short-term holders mean a prospective regional bottom.

Bitcoin (BTC) cost action has actually painted bullish loudspeaker patterns on several amount of time, which might move BTC to brand-new record highs, according to experts.

BTC cost can reach $260,000 this cycle

The bullish loudspeaker pattern, likewise called an expanding wedge, types when the cost develops a series of greater highs and lower lows. As a technical guideline, a breakout above the pattern’s upper border might activate a parabolic increase.

Bitcoin’s everyday chart reveals 2 loudspeaker patterns, as displayed in the figure listed below. The very first is a smaller sized one formed considering that July 11, and the current rebound from the pattern’s lower trendline at $108,000 recommends the development is undoubtedly playing out.

Related: Bitcoin can still strike $160K by Christmas with ‘typical’ Q4 return

The pattern will be validated once the cost breaks above the upper pattern line around $124,900, accompanying the brand-new all-time highs reached on Aug. 14. The determined target for this pattern is $144,200, or a 27% boost from the present level.

The 2nd is a larger loudspeaker pattern that has actually been forming for the “previous 280 days,” as expert Galaxy explained in a Thursday X post.

Bitcoin is trading near the upper trendline of the loudspeaker, which presently relaxes $125,000. Likewise, a break above this level would validate the pattern, clearing the course for a rally towards $206,800. Such a relocation would bring the overall gains to 82%.

On the other hand, crypto influencer Faisal Baig highlighted Bitcoin’s breakout from a huge loudspeaker pattern on the weekly amount of time with an even greater determined target: $260,000.

” The next upper hand is unavoidable.”

Bitcoin has actually broken out of this bullish loudspeaker pattern.

The next upper hand is unavoidable.

IN SHAA ALLAH pic.twitter.com/iEIpKROSvv— Faisal Baig Binance Usdt Signals (@fbmskills) August 20, 2025

As Cointelegraph reported, Bitcoin’s current pullback to $108,000 is most likely to be a shakeout before brand-new all-time highs.

BTC short-term holder metric hits April lows

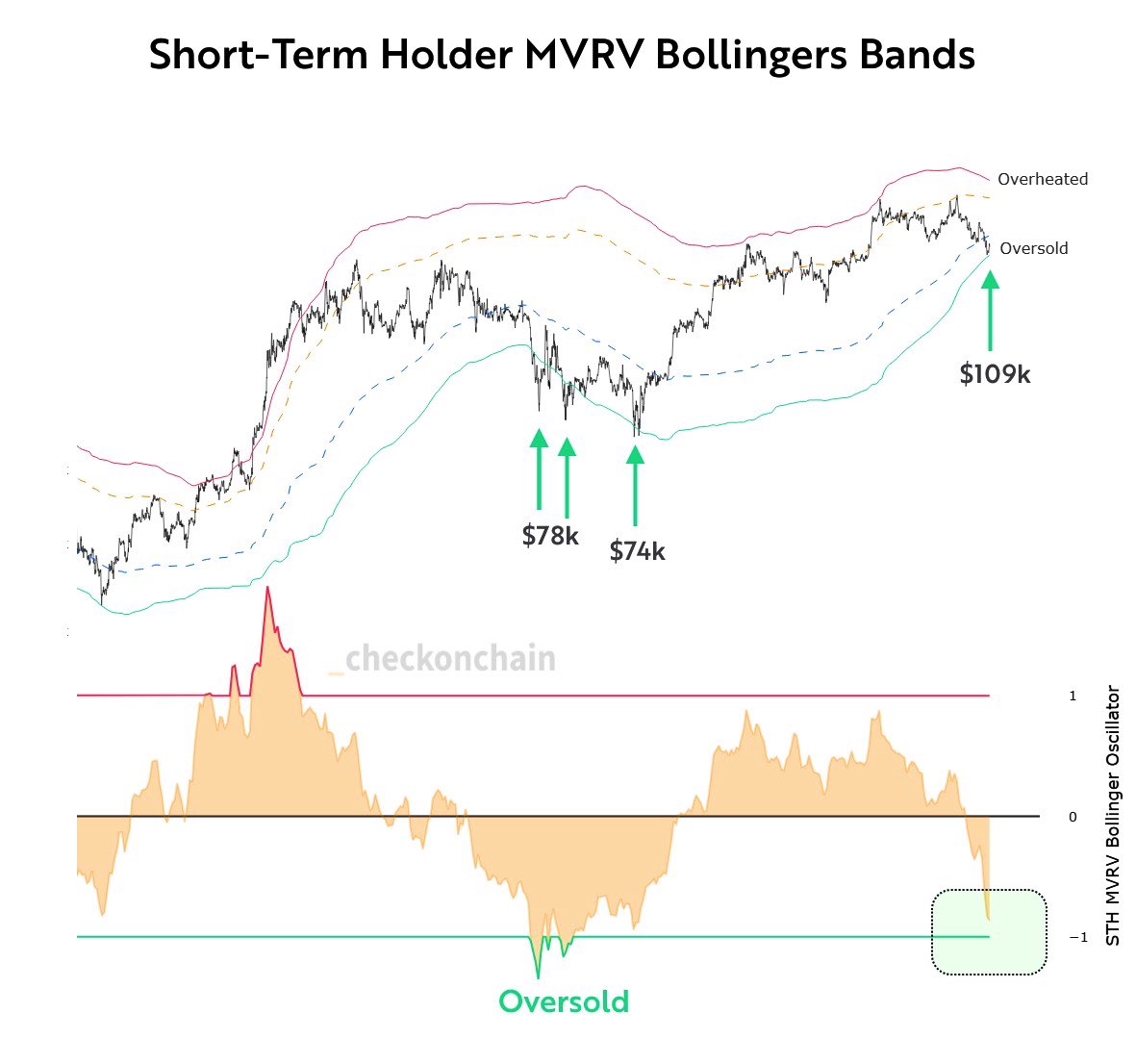

Bitcoin’s 12% drop from $124,500 all-time highs sent out short-term holders (STHs)– financiers who have actually held the property for less than 155 days– into panic mode as lots of cost a loss.

This has actually had severe ramifications on the STH market price recognized worth (MVRV) ratio, which has actually been up to the lower border of its Bollinger Bands (BB), signaling oversold conditions.

” On the pullback to $109K, $BTC tapped the ‘oversold’ zone on the short-term holder MVRV Bollinger Band,” stated expert Frank Fetter in an X post on Thursday.

An accompanying chart reveals a comparable circumstance in April when Bitcoin bottomed out at $74,000. The BB oscillator dropped to oversold conditions before Bitcoin began recuperating and is up 51% considering that.

With the current drawdown, the oversold STH MVRV recommended that the BTC cost was due for an upward relief bounce, perhaps staging a comparable healing to April and August.

As Cointelegraph reported, retail and institutional build-up have actually now been at their greatest considering that April’s dip listed below $75,000, which might be another indication that $108,000 was a regional bottom.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.