BlackRock’s area Bitcoin exchange-traded fund (ETF) is nearing the $70 billion mark in possessions under management, signifying growing interest from institutional financiers even as retail inflows seem slowing.

BlackRock, the world’s biggest possession supervisor, has actually obtained over $69.7 billion worth of Bitcoin (BTC) through its iShares Bitcoin Trust (IBIT) ETF, representing over 3.25% of the overall BTC supply.

BlackRock’s IBIT ETF now manages over 54.7% of the marketplace share of all United States area Bitcoin ETFs, which hold 6.12% of the existing Bitcoin supply, according to Dune information.

BlackRock’s turning point comes less than a year and a half after United States area Bitcoin ETFs debuted for trading on Jan. 11, 2024.

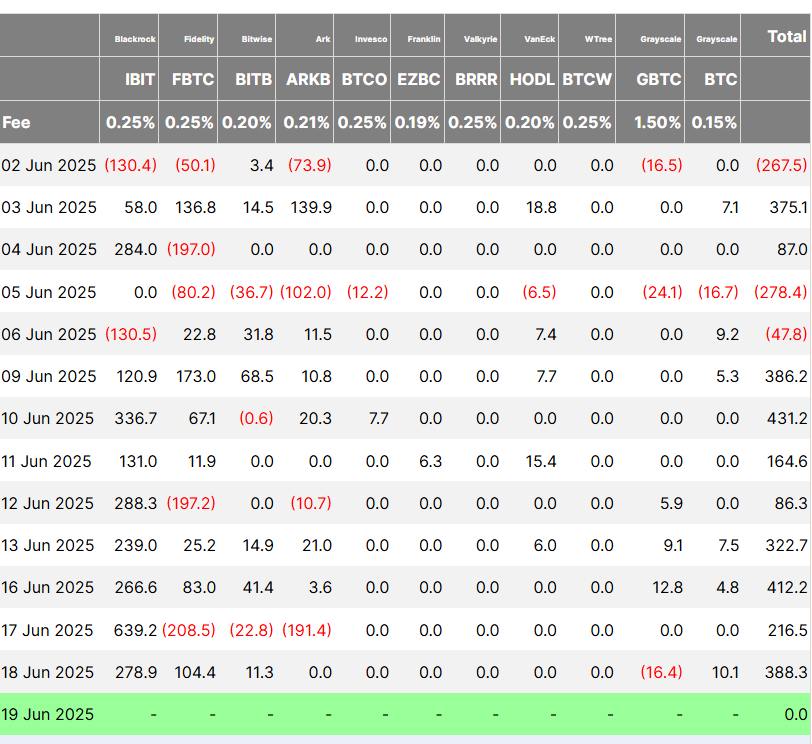

The turning point comes amidst continual inflows into the ETF market. United States Bitcoin ETFs logged 8 successive days of net favorable circulations, generating $388 million in Bitcoin on Wednesday, according to Farside Investors.

IBIT has actually likewise gotten in the world’s leading 25 biggest ETFs by possessions under management.

BlackRock’s fund has actually grown to end up being the world’s 23rd biggest ETF amongst crypto and standard financing items, according to information from VettaFi.

Still, some experts state that the need for ETFs is being balanced out by profit-taking and selling pressure from miners.

” A breakout might require a brand-new driver or belief shift,” Iliya Kalchev, an expert at Nexo, informed Cointelegraph. He included that long-dormant wallets are presently soaking up more supply than miners are producing, and included that business treasury methods and build-up from big financiers continue to balance out profit-taking.

Related: Genius Group Bitcoin treasury grows 52% as 1,000 BTC objective declared

High-value financiers control BTC deals

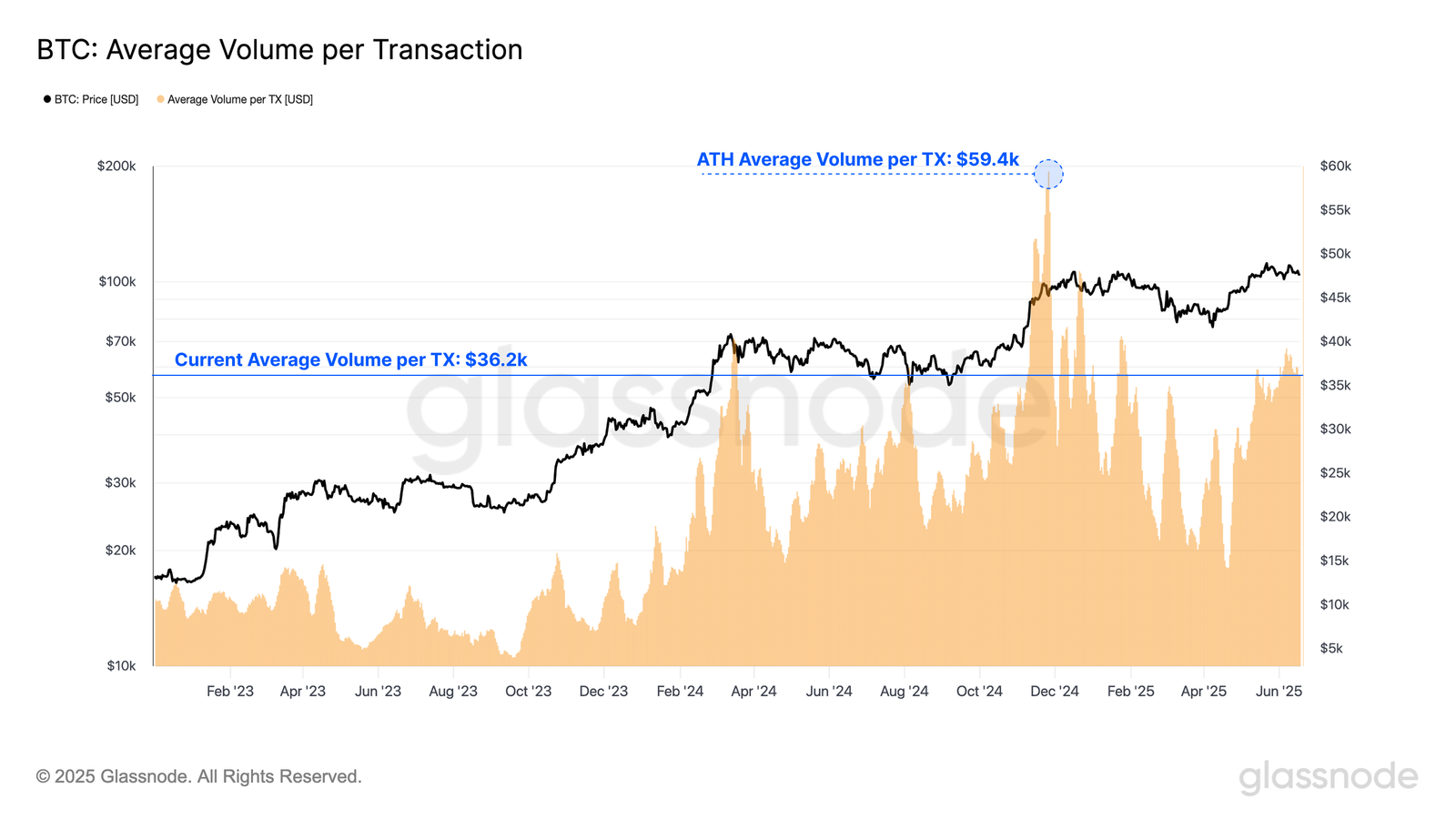

Onchain information from Glassnode reveals that large-value transfers are controling Bitcoin network activity. Although the overall variety of deals has actually decreased, the typical deal size is now $36,200.

” This pattern indicates that bigger entities continue to make use of the Bitcoin network, with the throughput per deal increasing even as total activity by count decreases,” according to a Glassnode report launched on Thursday.

Furthermore, deals going beyond $100,000 now represent over 89% of network activity, which “enhances the view that high-value individuals are ending up being significantly dominant,” Glassnode stated.

Related: Nasdaq-listed Lion Group bets huge on Hyperliquid with $600M treasury

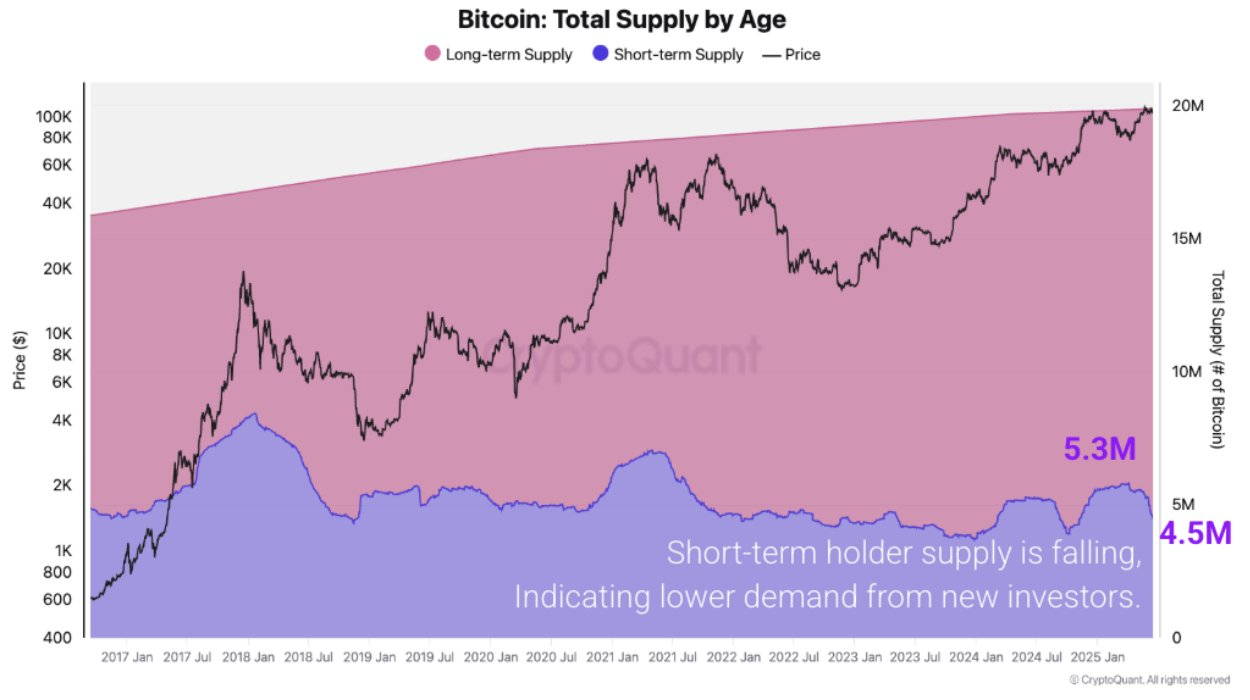

While big gamers collect, less brand-new retail financiers seem getting in the marketplace.

Bitcoin’s short-term holder friend has actually been up to simply 4.5 million BTC, down over 800,000 BTC from holding 5.3 million BTC on Might 27, signifying that “brand-new cash is drying up in Bitcoin,” according to a Friday report from analytics platform CryptoQuant.

If financier need continues to deteriorate, Bitcoin might discover its next substantial assistance near the $92,000 mark, which is the traders’ onchain recognized rate that functions as a substantial assistance level throughout bull cycles, according to CryptoQuant.

Publication: United States dangers being ‘front run’ on Bitcoin reserve by other countries: Samson Mow