BlackRock, the world’s biggest possession supervisor with around $11.6 trillion in properties under management, presently holds over 567,000 Bitcoin (BTC), valued at over $47.8 billion– making the possession supervisor among the biggest holders of BTC worldwide.

According to Arkham Intelligence, the possession supervisor’s latest BTC acquisition happened on March 14 when a Coinbase Prime wallet moved 268 BTC, valued at over $22 million, to the possession supervisor’s iShares Bitcoin ETF (IBIT) wallet.

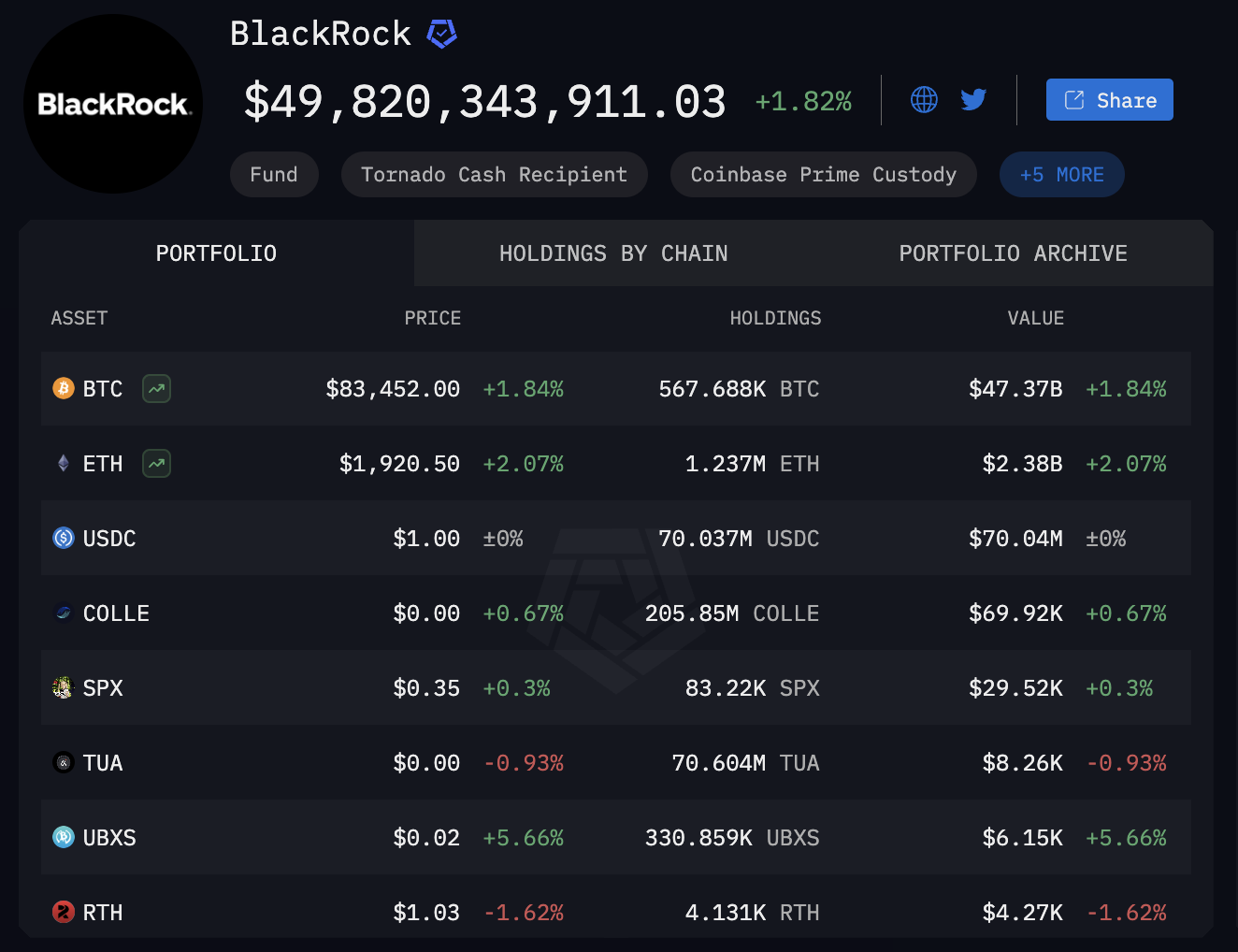

Tracking onchain funds to and from BlackRock. Source: Arkham Intelligence

Information from Arkham likewise reveals that the possession supervisor holds over 1.2 million Ether (ETH), valued at over $2.3 billion, approximately 70 countless the USDC (USDC) stablecoin and a long list of altcoins.

The Bitcoin exchange-traded funds (ETFs) are extensively mentioned as the most effective ETF launch in history, as possession supervisors like BlackRock drive 10s of billions in liquidity to the crypto markets and interfere with the cyclical capital rotation that identifies crypto financial investment.

BlackRock’s crypto holdings. Source: Arkham Intelligence

Related: BlackRock Bitcoin fund sheds $420M as ETF losing streak strikes day 7

Crypto ETFs experience 4 weeks of outflows

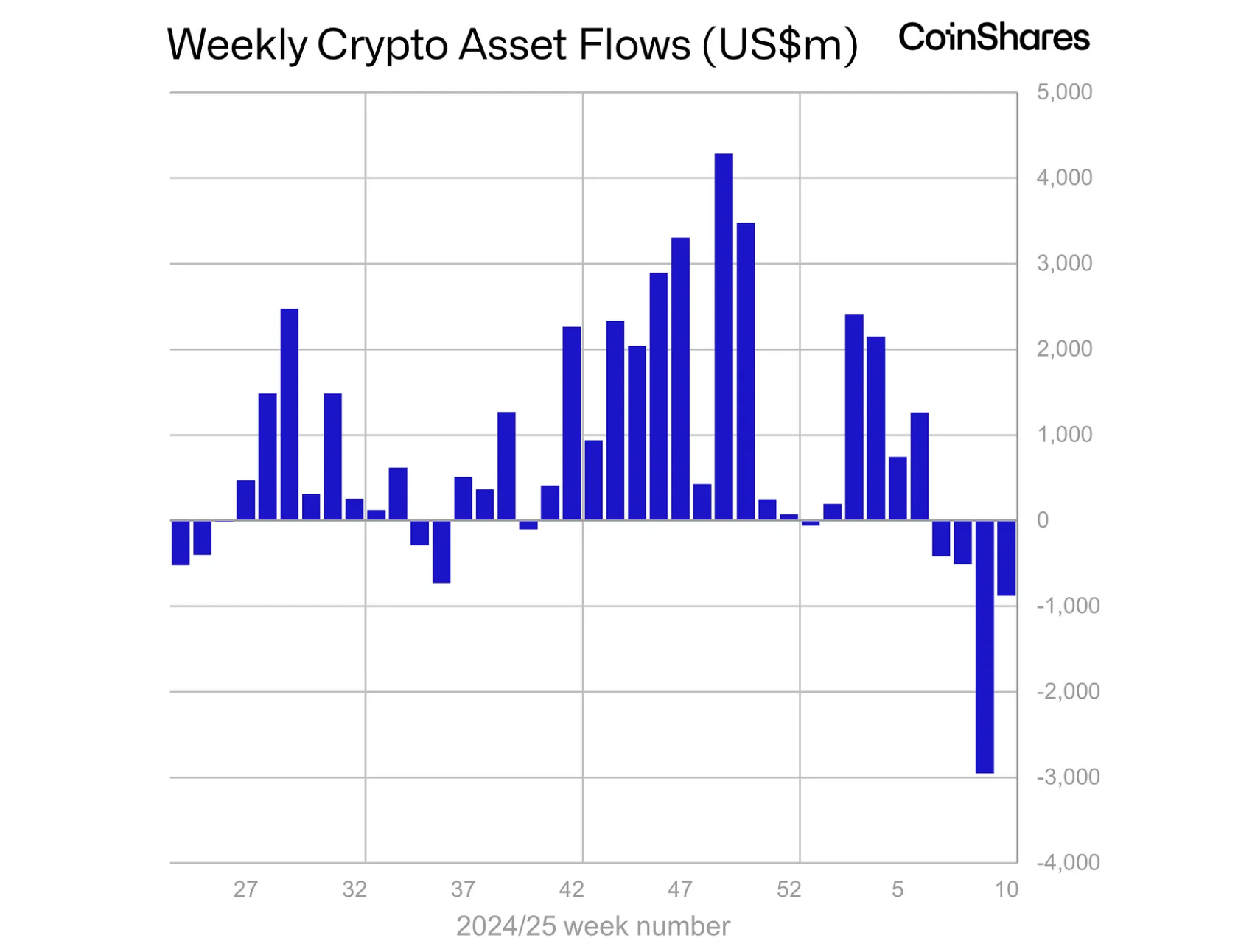

Crypto ETFs experienced 4 successive weeks of outflows in February 2025 and early March due to macroeconomic unpredictability and worries over an extended trade war.

According to CoinShares, outflows from the current market slump amounted to $4.75 billion, with the week of March 9 taping an overall of $876 million in outflows.

BlackRock’s iShares Bitcoin fund experienced $193 million in outflows for the week of March 9, with all BTC ETFs taping $756 million in month-to-date outflows.

Weekly crypto fund streams reveal a current slump including 4 weeks of successive outflows. Source: CoinShares

Regardless of the increased volatility and macroeconomic unpredictability, BlackRock included IBIT to its design portfolio in February 2025.

BlackRock’s design portfolios are pre-programmed financial investment strategies that include a series of varied monetary instruments and various threat profiles. The portfolios are promoted to possession supervisors, who pitch the pre-programmed financial investment strategies to financiers.

The addition of an ETF or a possession in the design portfolio can considerably increase inflows into the possession by bring in fresh capital.

When it comes to IBIT, consisting of the ETF in a pre-programmed financial investment portfolio will expose financiers, who might take a more passive technique, to Bitcoin without those financiers needing to self-custody the digital possession or make any onchain deals.

Publication: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and federal governments: Trezor CEO