United States Treasury Secretary Scott Bessent just recently required “Bretton Woods organizations,” such as the International Monetary Fund (IMF), to reorient themselves, a signal that the international financial order might be moving.

Speaking at the Institute of International Financing (IIF) on April 23, Bessent got in touch with the IMF and the World Bank to fix trade imbalances and secure the worth of fiat currencies versus currency exchange rate danger.

” The Bretton Woods organizations should go back from their vast and unfocused programs,” Bessent stated. He included:

” The IMF’s objective is to promote global financial cooperation, help with the well balanced development of global trade, motivate financial development, and dissuade damaging policies like competitive currency exchange rate devaluation.”

Bessent’s require the IMF to fix trade imbalances in between nations, particularly the United States and China, accompanies a decrease in the United States dollar to three-year lows, $36 trillion in United States federal government financial obligation, and stiff financial competitors from China.

Financier and hedge fund supervisor Ray Dalio argues that the world is experiencing an international macroeconomic shift that will overthrow the post-WWII monetary order and ultimately change the United States dollar as the international reserve currency, possibly with a digital kind of cash.

Related: Trump tariffs reignite concept that Bitcoin might last longer than United States dollar

The Bretton Woods Contract

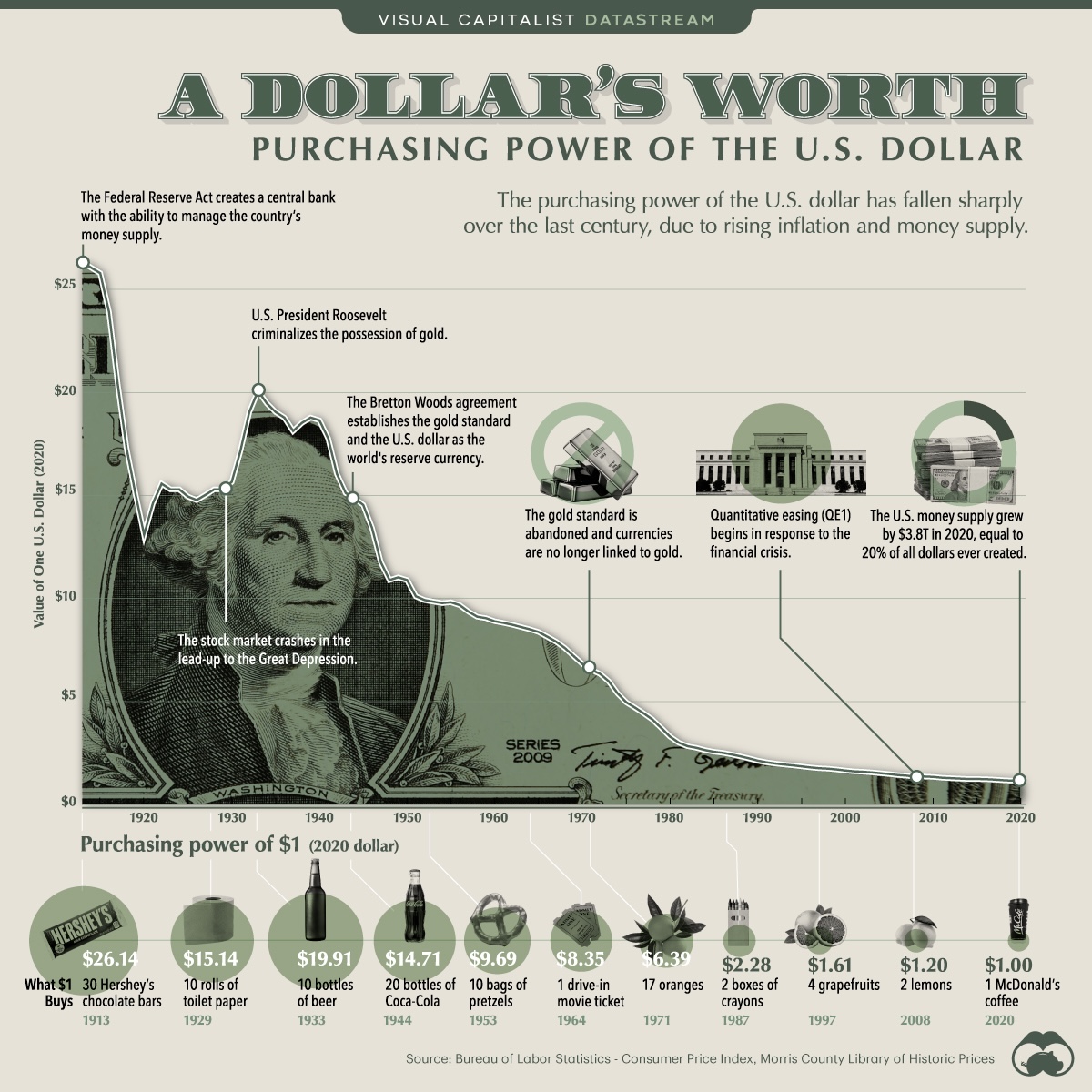

The Bretton Woods Contract was checked in 1944 and pegged the currencies of 44 nations to the worth of the United States dollar, which, at that point, was pegged to the worth of gold at $35 per ounce.

Removing intricate forex threats in between easily drifting currencies to make international trade more effective was the main objective of the arrangement.

In August 1971, United States President Richard Nixon revealed completion of the dollar’s convertibility to gold– officially ending the Bretton Woods arrangement in a relocation that was expected to be momentary.

” Your dollar will deserve simply as much tomorrow as it does today,” Nixon improperly informed Americans throughout his now-infamous address.

The IMF and the World Bank, which were generated from the Bretton Woods arrangement, continue running in an effort to suppress the results of free-floating fiat currencies on the forex market.

Bessent eyes stablecoins to secure the United States dollar, BTC supporters have another concept

Speaking at the White Home Digital Property Top on March 7, Bessent stated stablecoins might drive global need for United States dollars and United States federal government financial obligation instruments.

Bessent included that the Trump administration will utilize stablecoins to secure the United States dollar and its status as the international reserve currency.

Bitcoin maximalist Max Keiser refuted this strategy, forecasting that gold-backed stablecoins would outcompete dollar-pegged tokens due to the desire for low-volatility, inflation-resistant cash.

In March this year, BlackRock CEO Larry Fink composed that the $36 trillion United States nationwide financial obligation might drive financiers to Bitcoin (BTC) as market individuals begin to see BTC as a much better shop of worth than the United States dollar.

Bitwise executive Jeff Park voiced a comparable forecast in February, concentrated on the results of United States President Donald Trump’s trade tariffs.

The expert composed that the tumult from the continuous trade war would trigger around the world inflation, which would trigger people to look for alternative shops of worth like Bitcoin, driving its cost much greater in the long term.

Publication: Bitcoin payments are being weakened by central stablecoins