Bitcoin (BTC) and Ether (ETH) continue to diverge, and they presently run in various financial universes, according to a brand-new joint report from Glassnode and Keyrock. The research study kept in mind that Bitcoin is wandering deeper into a savings-driven, low-velocity profile, while Ether is quickly developing into an efficient onchain possession powering staking, security, and institutional wrappers.

Secret takeaways:

-

Bitcoin’s inactivity and turnover now look like gold even more than fiat.

-

Ether’s long-lasting holders are investing coins 3 times faster than BTC holders.

-

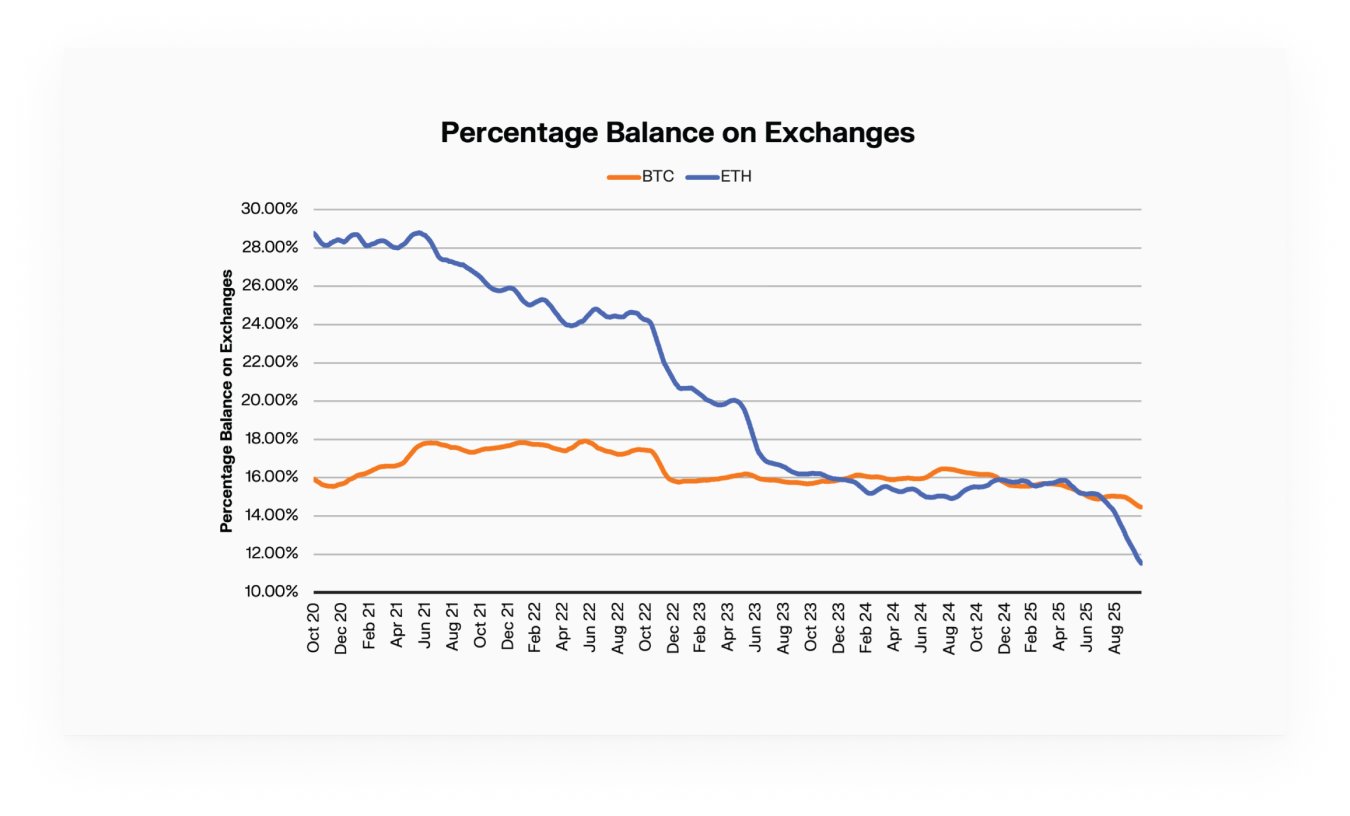

Both possessions are leaving exchanges for ETFs, DATs, and staking at speeding up rates.

Bitcoin secures, Ether accelerate

Glassnode highlighted that 61% of Bitcoin hasn’t relocated a year, with turnover at simply 0.61% of totally free float daily, among the lowest-velocity profiles amongst significant worldwide possessions. “Bitcoin sits strongly in Store-of-Value area,” the report kept in mind, acting more like gold than cash in movement.

Nevertheless, Ether is moving in the opposite instructions. ETH long-lasting holders are activating inactive coins 3 times faster than BTC holders, a pattern Keyrock described shows “utility-driven habits instead of hoarding.”

ETH’s turnover relaxes 1.3% daily, double Bitcoin’s, and 1 in 4 Ether is now secured staking or ETFs, producing a huge efficient float that continues to power DeFi and liquid staking systems.

Exchange balances for both possessions are collapsing– BTC by 1.5%, ETH by nearly 18%, as coins circulation into area ETFs and digital possession financial investment lorries. Experts state this migration into “sticky” institutional custody might be the most essential structural shift as Bitcoin is ending up being more like a digital cost savings bond, while Ether is ending up being the functional foundation of onchain activity.

Related: 3 factors Bitcoin has a hard time to conquer each brand-new overhead resistance level

Experts see increasing structural threat in ETH versus BTC

In spite of this expanding behavioral space, some experts translate the BTC– ETH dynamic in really various methods. Instead of seeing Ethereum’s high activity as an indication of strength, 10x Research study argued it might show structural fragility, specifically as Bitcoin continues to control institutional treasury circulations.

A current 10x report recommended that shorting ETH might work as a hedge versus Bitcoin’s increasing institutional momentum. The company declared Ether-focused business are running low on dry powder, damaging the “digital possession treasury” story that as soon as drove build-up.

Mentioning BitMine as an example, the scientists kept in mind that particular treasury structures made it possible for organizations to get ETH at a low expense and later on offer it to retail financiers at a premium, a cycle they think is now breaking down.

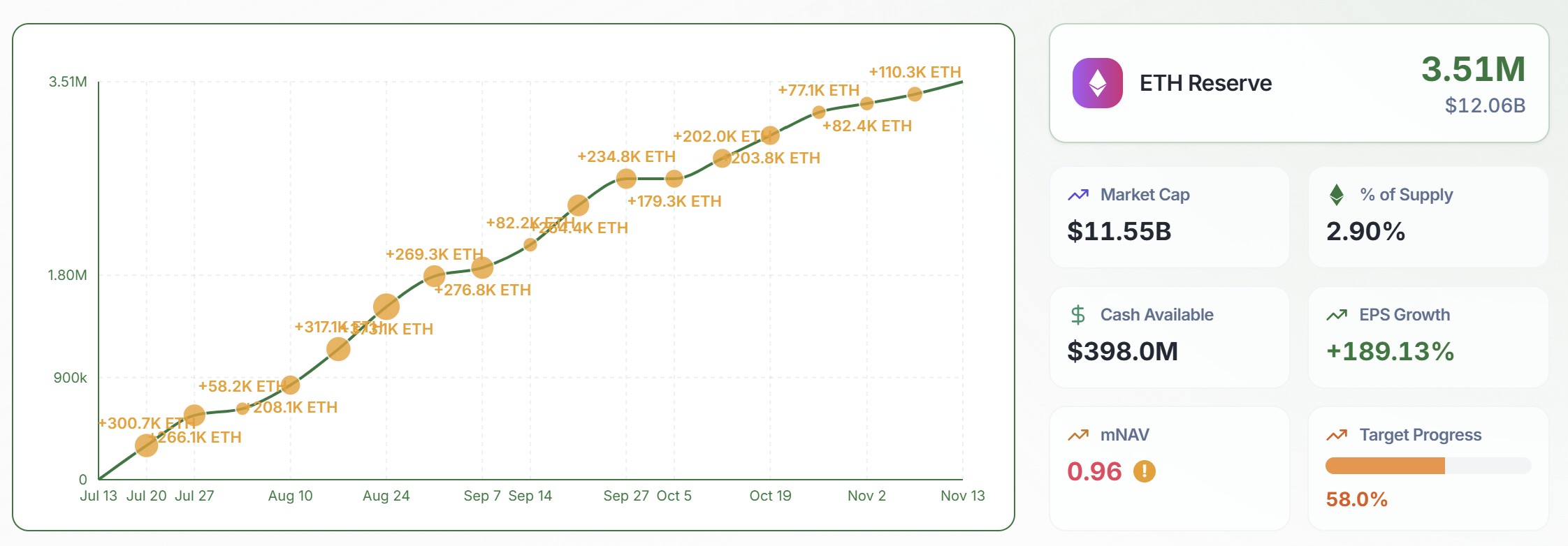

Although strong ETH inflows into Ether Treasuries held by business have actually stagnated in Q4 (for context, it increased 124% in Q3), Bitmine continued to include more ETH to its allowance, increasing its overall to 3,505,723 ETH, including 110,288 ETH on Nov. 10.

Related: Altcoin index metric mean early revival: Is the next rally close?

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.