Bitcoin (BTC) bounced from $76,606 on March 11, however the bulls might not sustain the rate above $84,500 on March 12.

Nansen primary research study expert Aurelie Barthere informed Cointelegraph that Bitcoin remains in a macro correction in a booming market, with the next essential level being “$ 71,000-$ 72,000, top of the pre-election trading variety.”

Glassnode likewise forecasted a comparable target in its March 11 market report. The onchain analytics company stated the current sell-off had actually been activated by the short-term holders who might have bought near the peak in January. Glassnode included that Bitcoin might bottom out near $70,000 if offering continues.

Crypto market information day-to-day view. Source: Coin360

It is not just the crypto markets; even the United States stock exchange has actually been under pressure in the previous couple of days. Nevertheless, a silver lining for the bulls is that the United States Dollar Index (DXY) has actually fixed from its multi-year high above 110 to under 104. Bitcoin typically relocates inverted connection with the dollar, recommending that a bottom might be around the corner.

Could Bitcoin retest the assistance at $76,606 or increase above $85,000? What are the crucial assistance and resistance levels to keep an eye out for in altcoins? Let’s evaluate the charts of the leading 10 cryptocurrencies to discover.

Bitcoin rate analysis

Bitcoin broke listed below the $78,258 level on March 10 and was up to $76,606 on March 11, however the bears might not sustain the lower levels. This recommends strong purchasing by the bulls.

BTC/USDT day-to-day chart. Source: Cointelegraph/TradingView

The relief rally is dealing with offering near the 20-day rapid moving average ($ 87,262), however a small favorable in favor of the bulls is that the relative strength index (RSI) is revealing a favorable divergence. Purchasers will need to drive the rate above the 20-day EMA to recommend that the correction might be ending. The BTC/USDT set might then rise to the 50-day basic moving average ($ 94,654).

On the disadvantage, the bulls are anticipated to protect the $73,777 level with all their may since a break listed below it might sink the set to $67,000.

Ether rate analysis

Ether (ETH) fell listed below the $1,993 assistance on March 9 and extended the decrease, reaching $1,754 on March 11.

ETH/USDT day-to-day chart. Source: Cointelegraph/TradingView

The bulls are attempting to begin a healing, which is anticipated to deal with considerable resistance at the breakdown level of $2,111. If the rate denies greatly from $2,111, it will indicate that the bears have actually turned the level into resistance. That increases the danger of a break listed below $1,754. The ETH/USDT set might then drop to $1,500.

On the other hand, a break above the 20-day EMA ($ 2,235) recommends that the marketplaces have actually declined the break listed below $2,111. The set might then reach $2,800, where the bears are anticipated to action in.

XRP rate analysis

XRP (XRP) fell listed below the $2 assistance on March 11, however the bears might not sustain the lower levels, as seen from the long tail on the candlestick.

XRP/USDT day-to-day chart. Source: Cointelegraph/TradingView

The bears are attempting to stall the healing at the 20-day EMA ($ 2.35). If the rate continues lower, the possibility of a break listed below $2 boosts. If that occurs, the XRP/USDT set will finish a bearish head-and-shoulders pattern. There is small assistance at $1.77, however if the level fractures, the decrease might reach $1.28.

Contrary to this presumption, if the rate breaks above the 20-day EMA, the set might increase to the 50-day SMA ($ 2.58) and later on to $3.

BNB rate analysis

BNB (BNB) showed up from $507 on March 11, showing that the bulls are strongly protecting the $500 to $460 assistance zone.

BNB/USDT day-to-day chart. Source: Cointelegraph/TradingView

The relief rally is anticipated to deal with costing the 20-day EMA ($ 592). If the rate denies greatly from the 20-day EMA, the bears will attempt to sink the BNB/USDT set listed below $500. The set might drop to $460 if they can pull it off.

Rather, if the rate increases above the 20-day EMA, it will indicate that the set might stay inside the $460 to $745 variety for a while longer. The bulls will be back in the motorist’s seat on a break and close above the 50-day SMA ($ 628).

Solana rate analysis

Solana (SOL) showed up from $112 on March 11, signifying that the bulls are increasingly protecting the $110 assistance.

SOL/USDT day-to-day chart. Source: Cointelegraph/TradingView

The RSI reveals early indications of forming a favorable divergence, showing that the bearish momentum might compromise. The very first indication of strength will be a break and close above the 20-day EMA ($ 145).

If the rate denies from the present level or the 20-day EMA, it recommends that every small rally is being offered into. That increases the danger of a break listed below $110. The SOL/USDT set might topple to $98 and consequently to $80.

Cardano rate analysis

Cardano (ADA) rebounded off the uptrend line on March 11, recommending that the bulls are attempting to stop the decrease.

ADA/USDT day-to-day chart. Source: Cointelegraph/TradingView

The bears are not likely to quit quickly and are anticipated to cost the moving averages. If the rate denies from the moving averages, it will indicate selling on rallies. The bears will then attempt to reinforce their position by pulling the rate listed below the uptrend line. If they do that, the ADA/USDT set might drop to $0.60 and after that to $0.50.

Contrary to this presumption, a break and close above the moving averages recommends that the bulls are back in the video game. The set might then rally to $1.02.

Dogecoin rate analysis

Dogecoin (DOGE) continued its slide and reached the $0.14 assistance on March 11. The bulls are attempting to protect the level however might deal with costing greater levels.

DOGE/USDT day-to-day chart. Source: Cointelegraph/TradingView

If the rate denies from the 20-day EMA ($ 0.20), it will recommend that the belief stays unfavorable and traders are offering on rallies. That increases the danger of a break listed below $0.14. The DOGE/USDT set might come down to $0.10 if that occurs.

Related: Here’s what took place in crypto today

On the contrary, a break and close above the 20-day EMA recommends that the bears are losing their grip. The set might reach the 50-day SMA ($ 0.25), which might present a strong obstacle once again.

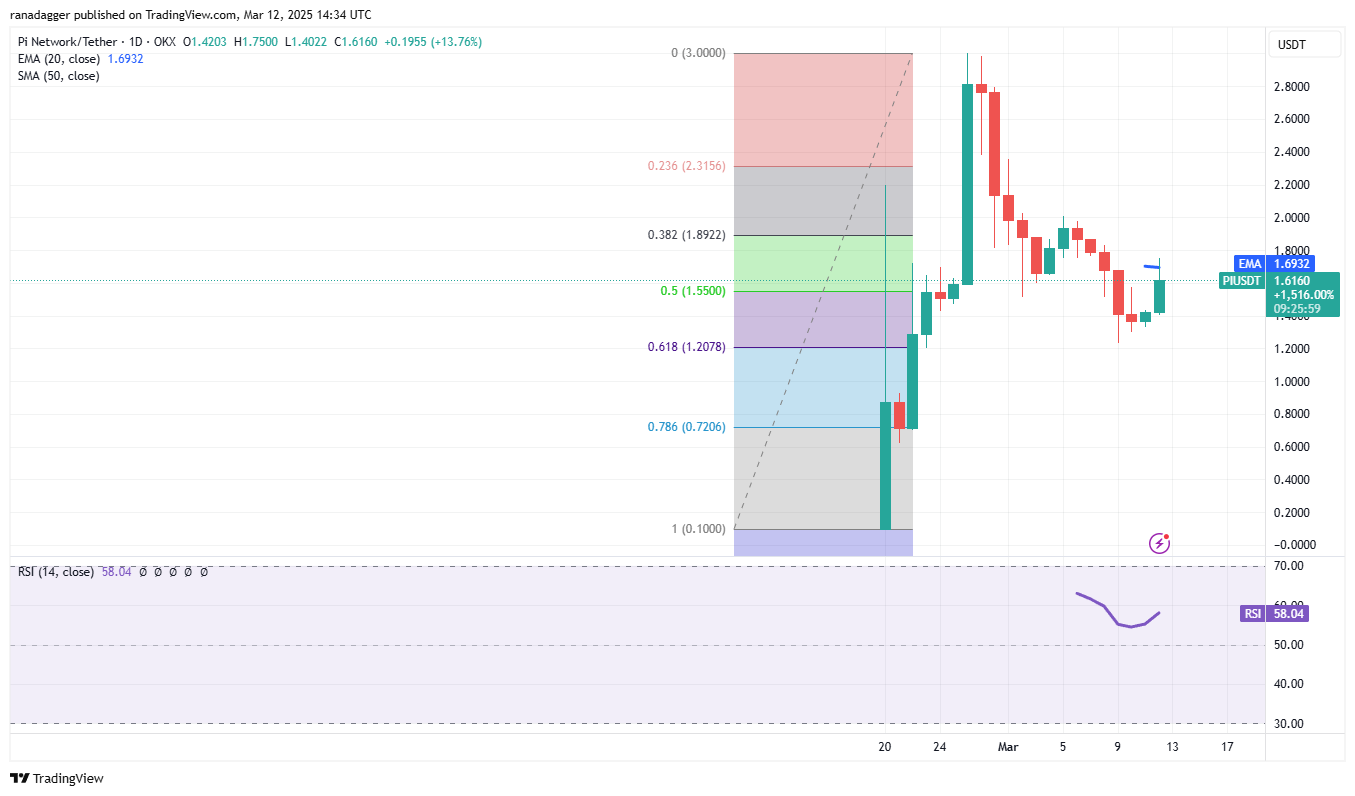

Pi rate analysis

Pi (PI) is taking assistance at the 61.8% Fibonacci retracement level of $1.20, showing purchasing at lower levels.

PI/USDT day-to-day chart. Source: Cointelegraph/TradingView

The relief rally is anticipated to deal with resistance at the 20-day EMA ($ 1.69) and after that once again at $2. If the rate denies from the overhead resistance, the PI/USDT set might vary in between $2 and $1.20 for a long time.

A break and close above $2 recommends that the correction might be over. The set might rally to $2.40. Additionally, a break and close listed below $1.20 might sink the set to the 78.6% retracement level of $0.72.

UNUS SED LEO rate analysis

UNUS SED LEO (LEO) has actually been combining simply listed below the $10 level for numerous days, showing that the bulls are hanging on to their positions as they expect another leg greater.

LEO/USD day-to-day chart. Source: Cointelegraph/TradingView

The LEO/USD set has actually formed a rising triangle pattern, which will finish on a break and close above $10. If that occurs, the set might resume the uptrend towards the target goal of $12.04.

This favorable view will be revoked in the near term if the rate denies and breaks listed below the uptrend line. That will negate the bullish setup, beginning a drop to $8.84 and later on to $8.30.

Hedera rate analysis

Hedera (HBAR) bounced off the $0.17 assistance on March 11, showing that the bulls are strongly protecting the level.

HBAR/USDT day-to-day chart. Source: Cointelegraph/TradingView

The healing is dealing with costing the 20-day EMA ($ 0.22), as seen from the long wick on the candlestick. If the rate continues lower, the bears will make one more effort to sink the HBAR/USDT set listed below $0.17. If they prosper, the set might plunge to $0.12.

Contrarily, a break above the 20-day EMA recommends that the selling pressure is minimizing. The set might increase to the drop line, which is an essential level to keep an eye out for. If purchasers press the rate above the drop line, the set might rally to $0.29.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.