Secret takeaways:

-

Bitcoin marks its steepest pullback in a month, with the ghost month pattern meaning additional drawback to $105,000.

-

Onchain information reveals an increase in United States and Korean area need, indicating a short-term healing.

Bitcoin (BTC) saw a sharp correction on Thursday, slipping listed below $117,000 on Aug. 14, marking its steepest pullback in a month. The day-to-day chart flashed a bearish engulfing pattern for the very first time because July 15, raising issues that seasonal weak point throughout Asia’s “ghost month” might extend the slump.

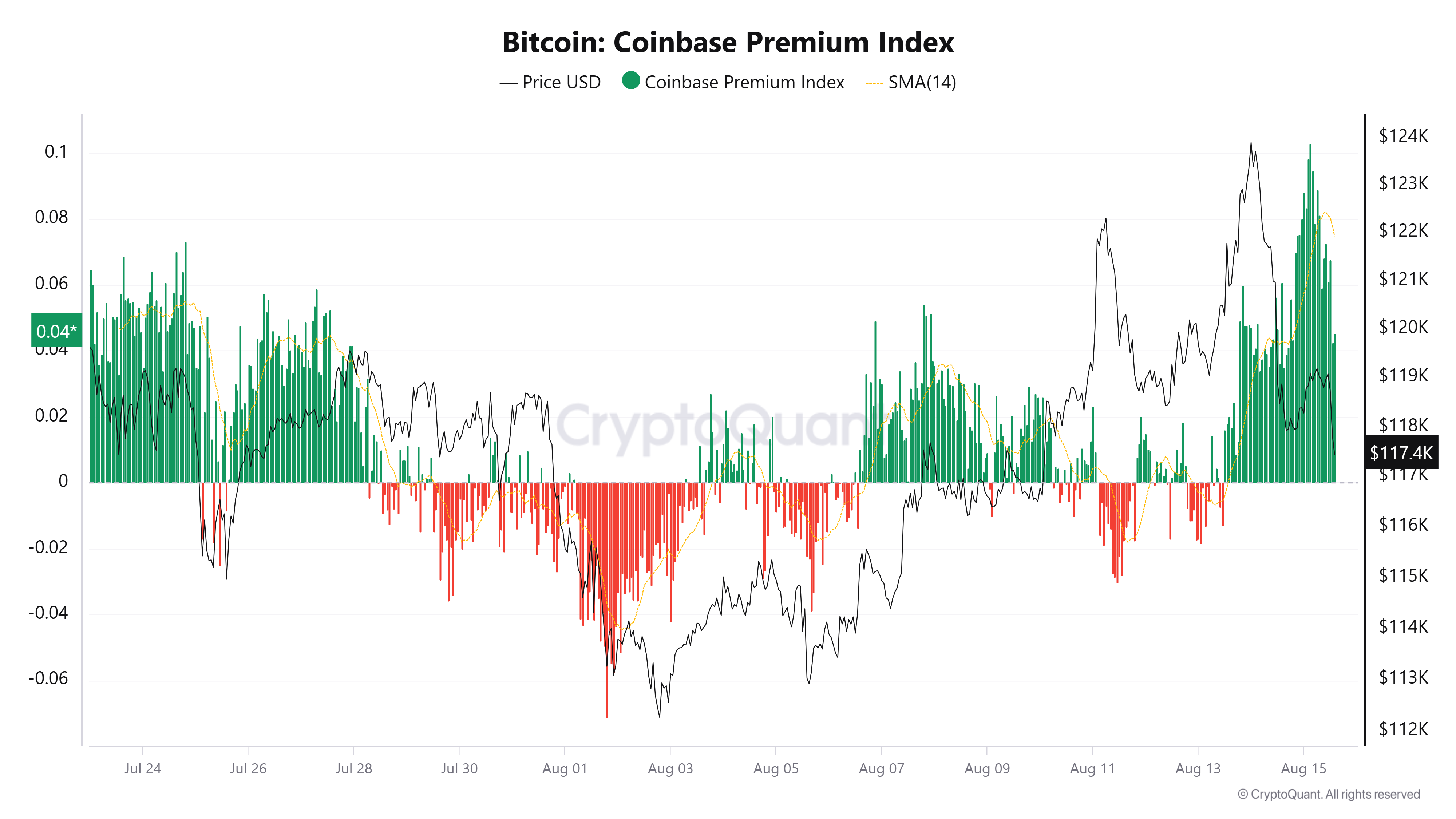

In spite of the dip, onchain information indicate resistant dip-buying activity. The Coinbase Premium Index reached a regular monthly high the other day, signifying strong United States area need. In Asia, the Kimchi Premium Index turned favorable, showing renewed Korean purchasing pressure.

Crypto trader Hansolar summarized the belief and stated cumulative buy quotes were spread out throughout Coinbase, Bitfinex, and the South Korean market.

The bullish undertone is additional supported by stablecoin circulations. According to crypto expert Maartunn, USDC inflows to exchanges rose to $3.88 billion because the cost dip, recommending traders are preparing to release capital.

Information likewise suggests that capitulation indications were silenced. Simply 16,800 BTC were transferred to exchanges at a loss by short-term holders (STHs), well listed below volumes seen in previous sell-offs. For context, formerly, when Bitcoin dipped more than 5%, over 48,000 BTC were cost a loss by STHs.

MARKET UPDATE: #Bitcoin slipped 5% on Aug. 14, however capitulation indications were silenced with simply 16.8 K $BTC transferred to exchanges at a loss from Short-Term Holders, far less than in previous drawdowns.

Blue arrow pattern reveals diminishing STH offer pressure. pic.twitter.com/sVUvRSVXj5

— Cointelegraph Markets & & Research Study (@CointelegraphMT) August 15, 2025

Related: Experts see Bitcoin purchaser fatigue as retail shifts to altcoins

Can ‘ghost month’ extend BTC’s correction duration?

Confidential expert Exitpump keeps in mind that Bitcoin might discover assistance in between $116,000 and $117,000, where both area and futures purchasing interest is appearing in the order books.

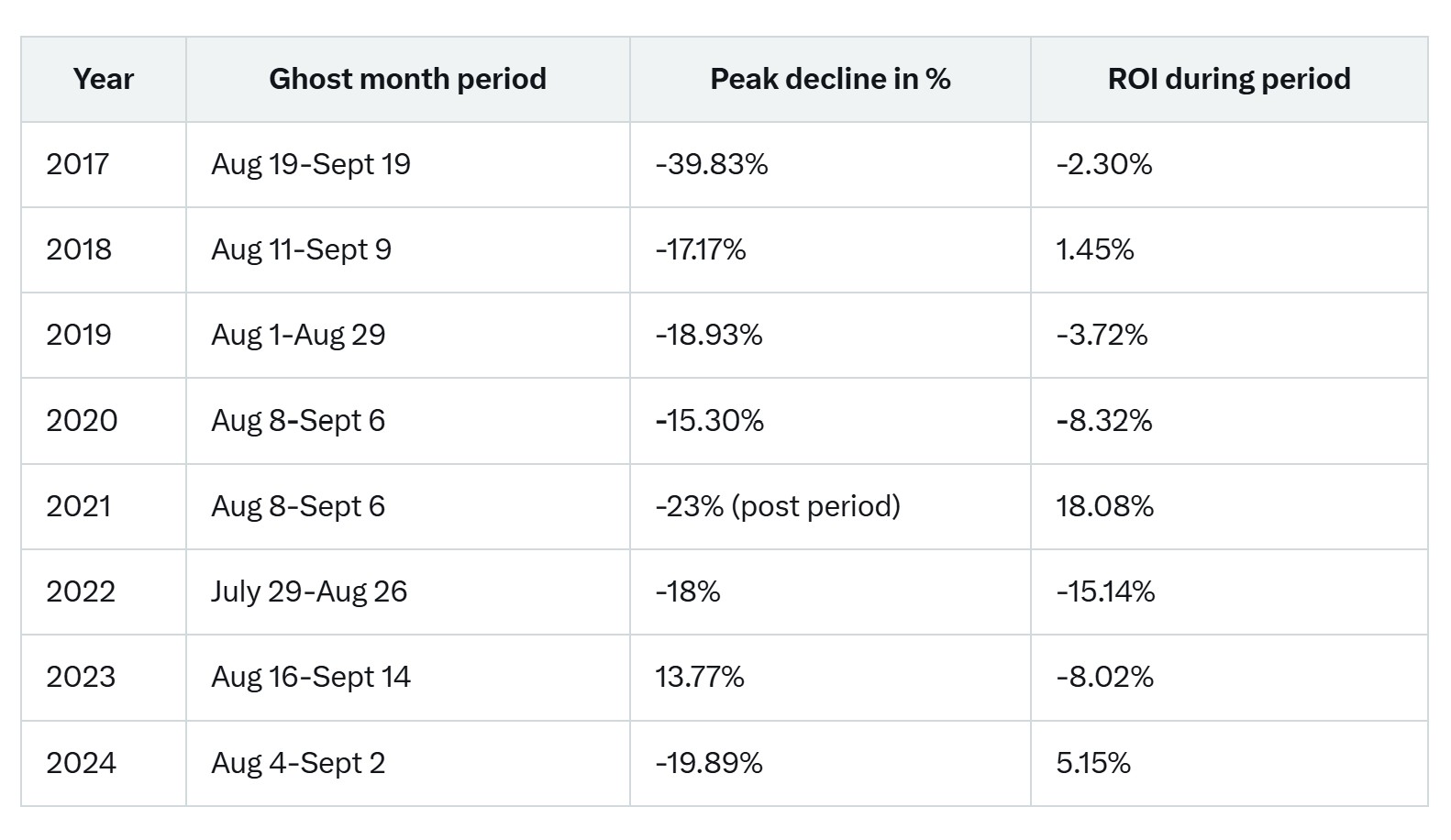

While this might cause speedy healing, a repeating seasonal pattern connected to Asia’s “ghost month” has actually typically accompanied sharp pullbacks.

This year’s ghost month ranges from Aug. 23 to Sept. 21. In the Chinese lunar calendar, it marks the seventh month of the year, a duration typically connected with misfortune in Asian culture. While the phenomenon does not straight effect markets, its mental result on traders can be substantial, affecting danger cravings and profit-taking habits.

Historically, Bitcoin has actually revealed a propensity to sell throughout ghost month. Given that 2017, BTC’s typical peak decrease in this duration has actually been approximately 21.7%, with significant drops such as -39.8% in 2017 and -23% in 2021.

With Bitcoin presently hovering near $117,320, a drawdown in line with the historic average might drag costs into the $105,000–$ 100,000 variety before any significant rebound. This lines up with essential technical assistance zones, where long-lasting purchasers might seek to action in.

While some years have actually ended ghost month with favorable ROI, the repeating mid-period volatility indicates traders ought to stay mindful. Any much deeper correction into late August might set the phase for a more powerful healing in Q4, after evaluating the willpower of short-term bulls.

Related: BlackRock Bitcoin, Ether ETFs purchase $1B as BTC cost mainly fills CME space

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.