Bitcoin (BTC) was up to $80,600 on Friday, extending weekly losses to more than 10%. Its month-to-month drawdown has actually now reached 23%, the steepest decrease considering that June 2022. The drop listed below $84,000 likewise pressed BTC to evaluate the 100-week rapid moving average for the very first time considering that October 2023, lining up precisely with the start of the existing bull cycle.

Bitcoin futures liquidations went beyond $1 billion, highlighting the seriousness of this recession, explained by the Kobeissi Letter as the “fastest bearish market ever.”

Secret takeaways:

-

Crypto market cap has actually eliminated 33% considering that October, marking a quick structural loosen up.

-

A record fund outflow and unfavorable ETF streams signal relentless institutional selling pressure.

-

A significant macroeconomic liquidity indication (NFCI) is trending lower, traditionally preceding BTC rallies by 4 to 6 weeks.

Crypto market cap collapses as “structural” selling speeds up

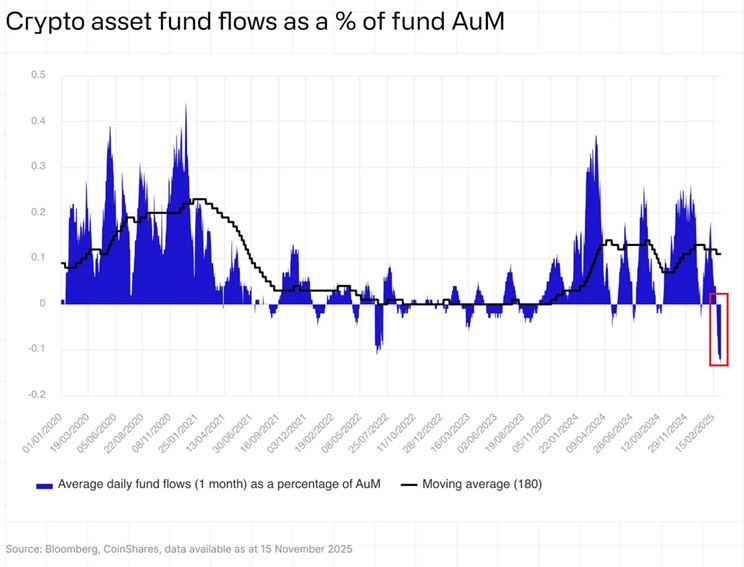

Because Oct. 6, the overall crypto market cap has actually been up to $2.8 trillion from $4.2 trillion, a 33% drawdown. The Kobeissi Letter called it “among the fastest-moving crypto bearishness ever,” with offering magnifying throughout all significant sectors. The newsletter stated digital possession financial investment items are showing the exact same tension, with crypto funds tape-recording $2 billion in weekly outflows, the biggest considering that February.

This marked the 3rd successive week of net selling, leading to overall outflows of $3.2 billion over that duration. Bitcoin represented the bulk of the withdrawals with $1.4 billion in redemptions, while Ether followed with $689 million, representing a few of the greatest weekly losses either possession has actually seen in 2025.

Typical everyday outflows as a share of properties under management (AUM) struck all-time highs, dragging overall AUM to $191 billion, down 27% from October. Experts categorized this as a clear structural decrease, not simply short-term panic.

United States exchange-traded fund (ETF) streams intensify the pressure. Area BTC ETF streams stay listed below absolutely no, strengthening the sell-off. On the other hand, BlackRock’s area ETF is on speed for its biggest weekly outflow ever, near going beyond the $1.17 billion record from February.

Related: Bitcoin downturn to $86K brings BTC closer to ‘max discomfort’ however terrific ‘discount rate’ zone

A macroeconomic shift might offer Bitcoin a liquidity lead

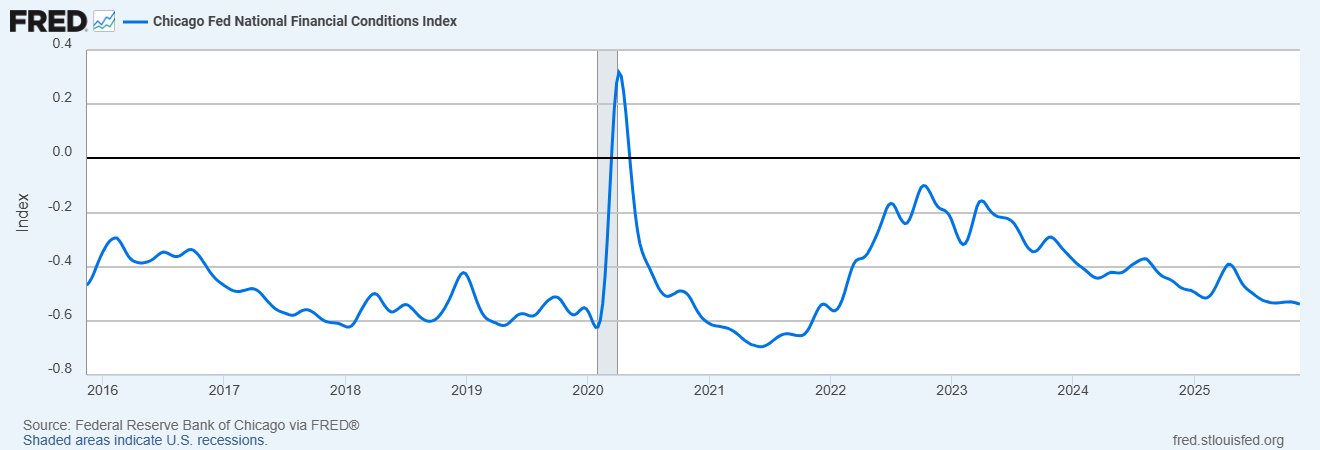

While numerous experts continued to require a Bitcoin bottom based upon technical charts and onchain information, Miad Kasravi took a various method. Kasravi performed a decade-long backtest of 105 monetary indications, showing that the National Financial Issue Index (NFCI) is among the couple of metrics that dependably leads Bitcoin by 4 to 6 weeks throughout significant macroeconomic routine shifts.

This dynamic appeared in October 2022, when reducing monetary conditions preceded a 94% rally, and once again in July 2024, when tightening up conditions signified tension numerous weeks before Bitcoin rose from $50,000 to $107,000.

At the minute, NFCI sits at -0.52 and is trending lower. Historically, every 0.10 point decrease in the index has actually lined up with approximately 15%– 20% benefit in Bitcoin, with a much deeper approach -0.60 usually marking a velocity stage. December likewise presents an essential driver: the Federal Reserve’s strategy to turn mortgage-backed securities into Treasury costs.

Kasravi kept in mind that although it is not identified Quantitative Easing (QE), the operation might inject liquidity in a comparable method to the 2019 “not-QE” occasion that preceded a 40% Bitcoin rally.

If the NFCI continues to decrease into mid-December, it would indicate the early phases of a brand-new liquidity growth window. Based upon the index’s constant four-to– 6 week preparation throughout previous routine shifts, Bitcoin’s next significant cyclical relocation would line up with early to mid-December 2025, using a possibly considerable inflection point for market individuals tracking macroeconomic conditions.

Related: Bitcoin understood losses increase to FTX crash levels: Where is the bottom?

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.