Secret takeaways:

-

Bitcoin reached a brand-new all-time high of $126,200, backed by a record $5.67 billion ETP inflows.

-

Fiscal and geopolitical unpredictability have actually restored the “debasement trade” story.

-

Institutional inflows control while retail involvement continues to decrease.

Bitcoin (BTC) stormed to a brand-new all-time high of $126,200 on Monday, following among the greatest weeks on record for digital possessions as worldwide crypto exchange-traded items (ETPs) logged $5.67 billion in net inflows, the biggest ever weekly haul. The rise showed the return of financier conviction, sustained by restored faith in the “debasement trade” as financial and geopolitical dangers install.

As kept in mind in Bitwise’s weekly crypto market compass report, the present crypto rally highlights how damaging fiat self-confidence and increasing macroeconomic unpredictability are driving a structural need for store-of-value possessions, such as Bitcoin and gold.

Director and Head of Research Study André Dragosch, Senior Citizen Research Study Partner Max Shannon, and Research Study Expert Ayush Tripathi highlighted that the United States Dollar Index (DXY) has actually fallen 10% year-to-date, while gold has actually risen 50%, surpassing Bitcoin’s 27% gain over the very same duration. Yet, numerous financiers now see BTC as a digital hedge offering higher uneven advantage in the race versus currency debasement.

According to Bitwise, area Bitcoin exchange-traded funds (ETFs) led inflows with $3.49 billion, followed by Ethereum’s $1.49 billion, and $685 million into ex-Ethereum altcoin items. United States area ETFs controlled activity, with BlackRock’s iShares Bitcoin Trust (IBIT) and Bitwise’s BITB drawing in the bulk of brand-new allotments.

On the other hand, onchain information mentioned in the report exposed over 49,000 BTC withdrawn from exchanges by whale entities, while favorable area purchasing and moderate utilize recommend a sustainable, instead of blissful, advance.

With Q4 traditionally bullish and liquidity tailwinds collecting, Dragosch and the Bitwise group concluded,

” Financiers placed on either side of the store-of-value argument might eventually assemble towards the very same result, restored capital inflows into digital possessions.”

Related: Bitcoin trader calls $124K ‘essential’ as BTC backtracks from brand-new all-time high

Financial fragility fuels long-lasting Bitcoin advantage

Bitcoin supporter Paul Tudor Jones echoed a growing view that the United States financial landscape is now the crucial macro motorist for danger possessions. With the federal deficit swelling and yearly interest expenses set to go beyond $1 trillion, markets are progressively pricing in continual financial easing, which is traditionally a tailwind for BTC.

Cointelegraph reported that as foreign holders pull back from United States Treasurys and the dollar damages, capital rotation towards “tough possessions” like Bitcoin might speed up. Tudor’s contrast to the late-1990s bull cycle, keeping in mind that while appraisals might be extended, the lack of ecstasy and continuous institutional inflows recommend the rally has space to run.

In essence, financial fragility, dovish policy expectations, and lessening genuine yields are assembling to produce an environment ripe for Bitcoin’s structural development. Nevertheless, not all onchain signals line up with this story.

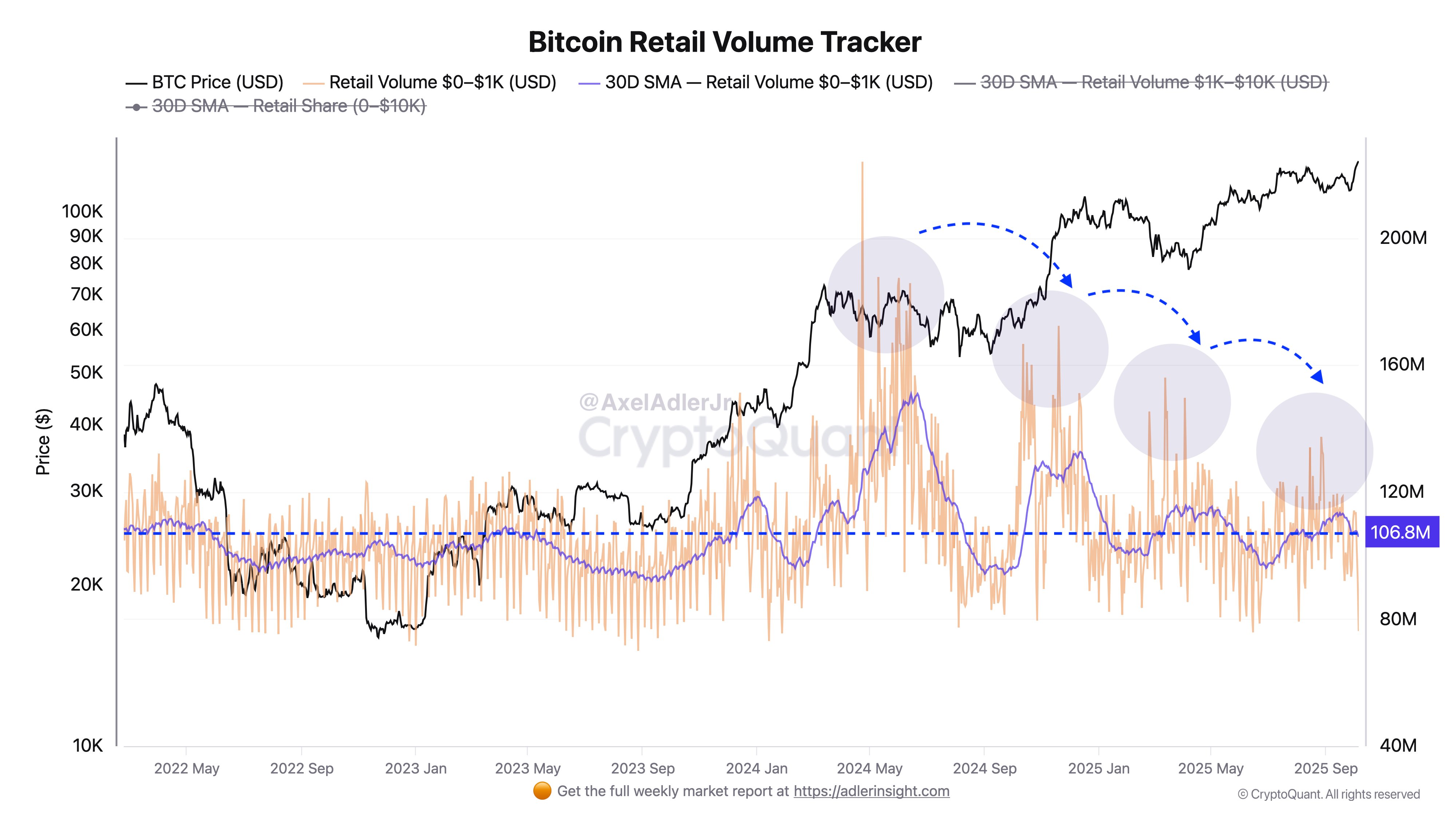

Bitcoin scientist Axel Adler Jr. explained that little deal activity, generally driven by retail traders, has actually been progressively decreasing considering that spring 2024, even as Bitcoin’s cost has actually reached brand-new highs.

This divergence in between cost increase and subsiding retail involvement recommended that the present advance might be disproportionately institution-led, meaning retail tiredness below the surface area of Bitcoin’s bullish momentum.

Related: United States Bitcoin ETFs publish 2nd-highest inflows considering that launch on crypto rally

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.