Secret takeaways:

-

Bitcoin lost the $113,000 level as take advantage of usage cooled and speculative bets, producing space for benefit volatility.

-

A breakout above would $113,650 validate an inverted head-and-shoulders pattern, possibly driving BTC towards $120,000.

Bitcoin’s (BTC) current extended combination under $113,000 has actually required traders to downsize danger, however this careful position might be setting the phase for the next breakout. With take advantage of and speculative placing cooling, the marketplace presently looks primed for a sharp swing higher, possibly recovering $120,000.

Information suggests that Bitcoin rate momentum has actually enhanced a little, increasing from − 8% to − 5% over the previous week. While sellers still hold a small benefit, the bearish pressure has actually relieved, indicating the marketplace might be going into the lasts of its “repair work zone.”

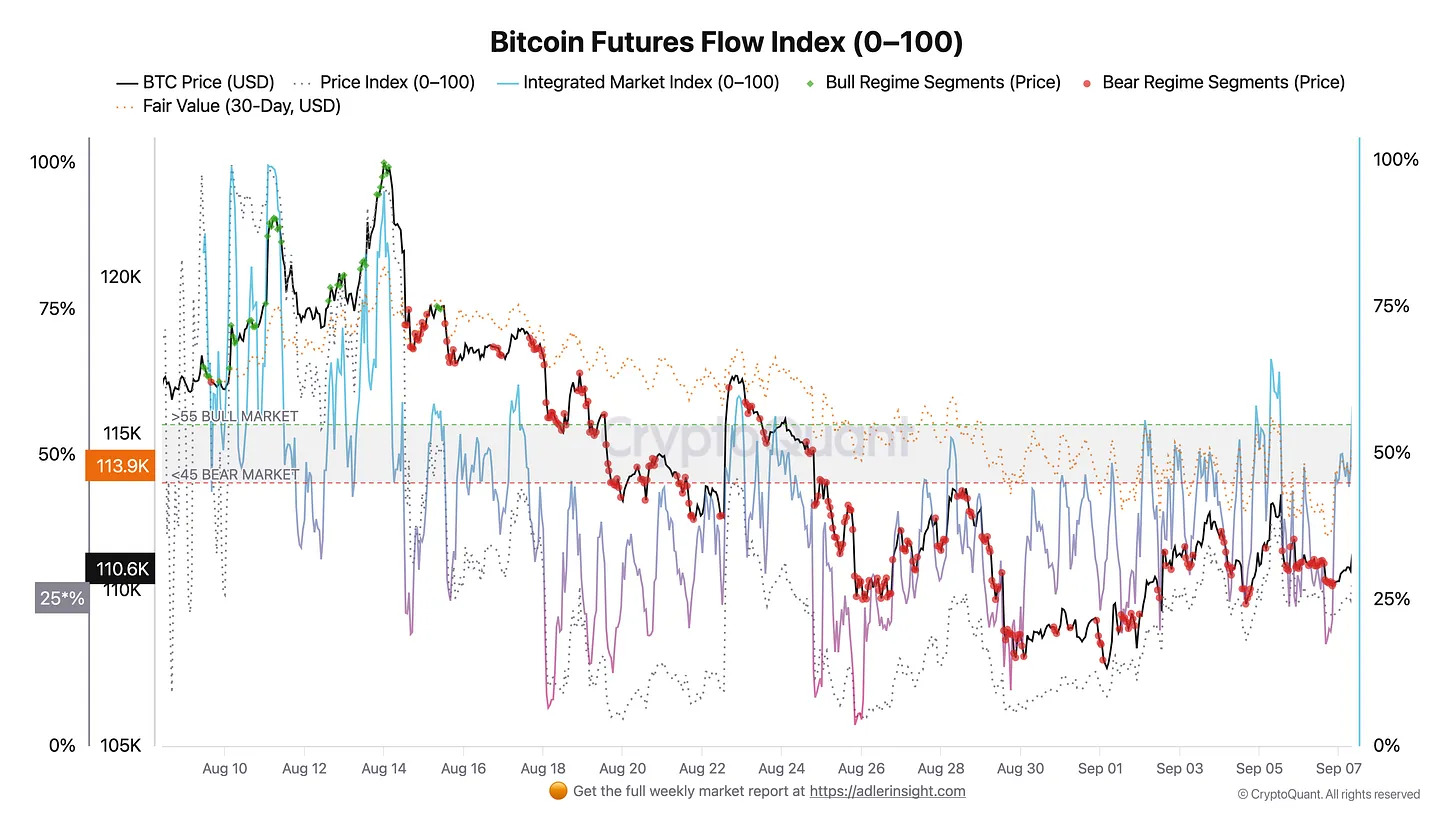

Bitcoin scientist Axel Adler Jr. even more kept in mind that futures information recommends traders are taking an action back instead of wagering strongly in either instructions. The Integrated Market Index, which had actually been weighed down by consistent selling, has actually steadied near neutral levels of 45-50.

Open interest has actually flattened, indicating lowered take advantage of and a shift to protective positioning. In result, the marketplace has actually gone into a balance stage where neither purchasers nor sellers remain in company control.

Historically, these cooling stages have actually frequently set the phase for more powerful uptrends. With approximately one-third of the present halving cycle finished, Bitcoin now seems forming a base just like it performed in Q2, when costs combined around $80,000 after bottoming near $74,000 before rallying greater.

The silver lining this time might be that there are less overcrowded long positions, minimizing the danger of forced liquidations. That produces area for benefit volatility to emerge when fresh need returns, possibly speeding up Bitcoin’s course back towards brand-new highs.

Related: Bitcoin taps $113K as analysis sees ‘go back to highs’ on Fed rate cut

Bitcoin eyes $120,000 as crucial breakout pattern kinds

Bitcoin is forming a bullish inverted head-and-shoulders pattern on the four-hour chart, with its neck line and significant resistance set at $113,650. A validated breakout above this level might open a test of crucial liquidity pockets, leading the way for a rally of almost 5.5% towards the $120,000 zone. A day-to-day close above $113,650 will likewise mark the very first bullish break of structure on the day-to-day chart in Q3, showing a strong pattern shift.

Momentum signals are currently turning encouraging. The relative strength index (RSI) has actually supported above 50, a limit that frequently marks the shift from neutral to bullish conditions. Sustaining this level recommends purchasers are gaining back control, moistening the effect of short-term sell pressure.

Contributing to the bullish background, Bitcoin is approaching an essential technical flip, with the 50-day, 100-day, and 200-day rapid moving averages (EMAs) clustering near present levels. If the rate closes above these signs, the moving averages might move into strong assistance, strengthening the bullish turnaround structure.

Related: Bitcoin long-lasting holders unload 241,000 BTC: Is sub-$ 100K BTC next?

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.