Secret takeaways:

-

The Bitcoin double bottom pattern might enhance bullish momentum towards $110,000.

-

The CME space near $104,000 might set off a short-term retracement.

-

Stablecoin accumulation and short-term holders’ tension mean near-term volatility.

Bitcoin (BTC) staged a book double bottom pattern over the weekend, leading BTC to protect a bullish weekly close above its 50-week moving average. The development accompanied the day-to-day order block in between $98,100 and $102,000, where BTC consistently checked the $100,000 zone before rebounding.

Following a bullish break of structure on the four-hour chart, Bitcoin now deals with resistance near $111,300, a level that might be checked if short-term momentum holds. Nevertheless, onchain information recommended this advance might not come as quickly.

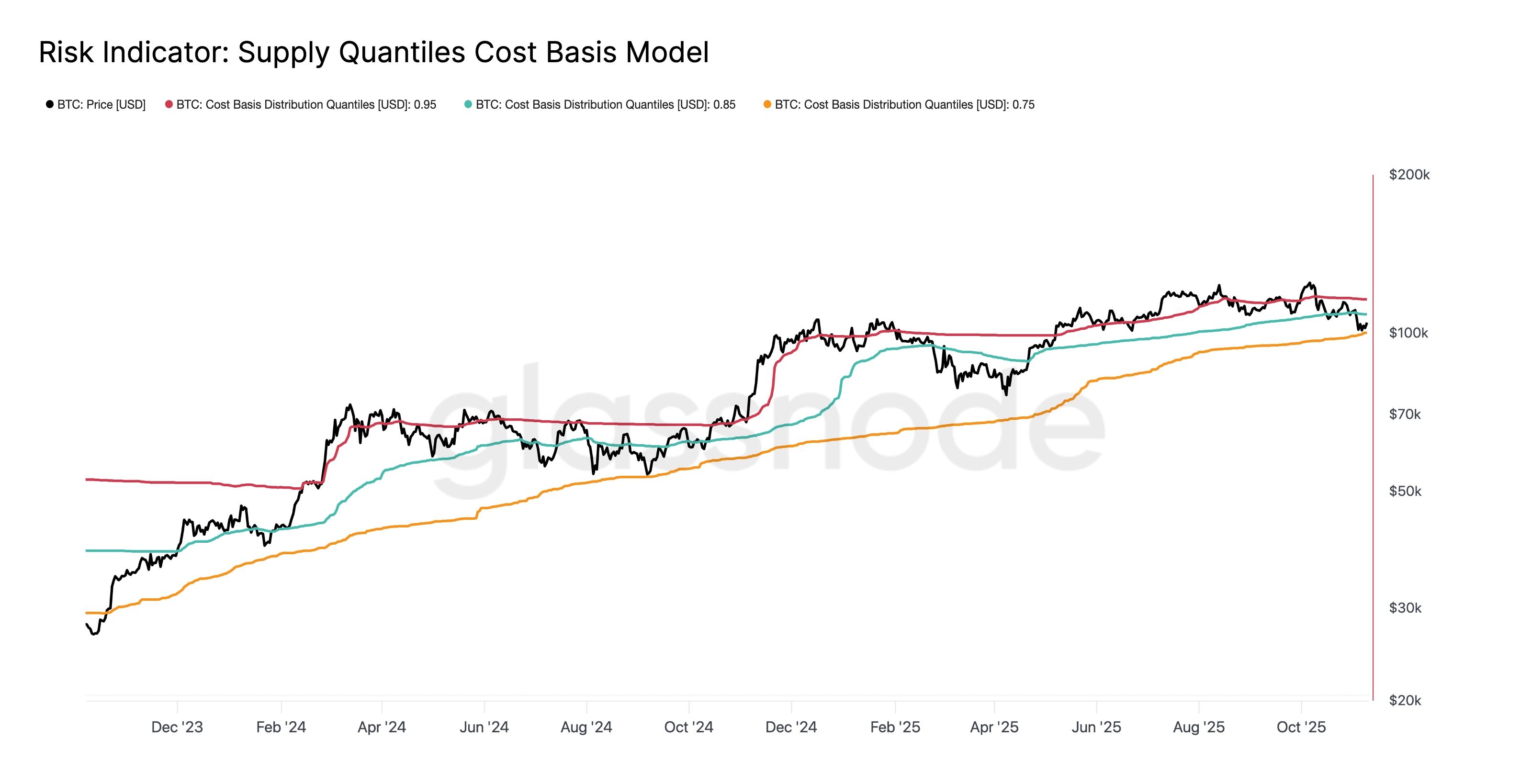

Glassnode discussed that Bitcoin rebounded from the 75th percentile expense basis near $100,000. The next substantial difficulty lies near the 85th percentile expense basis, approximately $108,500, a level that has actually traditionally functioned as resistance throughout healing relocations. The percentile expense basis metric steps where most of financiers got their BTC, successfully mapping the expense circulation throughout the marketplace.

Nevertheless, Cointelegraph kept in mind a possible liquidity grab above $115,000, which lines up with a day-to-day resistance level, with long-side liquidity near $100,000 tired.

Furthermore, a CME space in between $103,100 and $104,000 stays an essential short-term threat. CME spaces take place when Bitcoin’s weekend rate motion produces a distinction in between Friday’s closing and Monday’s opening rate on the Chicago Mercantile Exchange, and these spaces frequently get “filled” as traders review these levels, recommending BTC might quickly backtrack before resuming its uptrend.

With liquidity and involvement weakening, BTC might review $101,000–$ 102,500, retesting the weekend’s one-hour and four-hour order obstructs before making a definitive relocation higher.

Related: ‘ The majority of disliked bull run ever?’ 5 things to understand in Bitcoin today

Stablecoin strength might form short-term BTC outlook

CryptoQuant information suggested the Stablecoin Supply Ratio (SSR) has actually plunged from above 18 previously this year to 13.1, among the most affordable levels in 2025. The drop shows increasing stablecoin reserves relative to Bitcoin’s market cap, an indication of offchain liquidity build-up waiting for a market signal.

Over the previous month, SSR fell from 15 to 13 while BTC hovered near $105,000, hinting that purchasers are awaiting verification before releasing capital.

On the other hand, crypto expert Darkfost observed a sharp 40% increase in short-term holder (STH) inflows to Binance because September, up from 5,000 BTC to 8,700 BTC. With the understood rate for STHs around $112,000, numerous stay undersea and are progressively reactive to short-term volatility. This associate’s selling pressure frequently precedes mid-cycle shakeouts before more comprehensive bullish extensions, including a layer of short-term instability.

Related: Bitcoin, ETH ETFs see $1.7 B outflow however whale purchasing softens the rate effect

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.