Bitcoin’s (BTC) cost has actually had a hard time to restore momentum following Wednesday’s drop to $100,700, leaving BTC down approximately 3.5% on the weekly candle light. Market information reveals long-lasting holders have actually offered more than 815,000 BTC over the previous thirty days, heightening the concentrate on lower liquidity pockets. Experts now indicate the June 2025 lows near $98,000 as the next most likely target if volatility speeds up.

Secret takeaways:

-

Liquidity clusters reveal drawback pressure structure near $98,000 for Bitcoin.

-

A 4th retest of $102,000 to $100,000 assistance signals a weakening structure.

-

Futures trader positioning stays long-heavy regardless of increasing technical threats.

BTC liquidity compression magnifies drawback focus

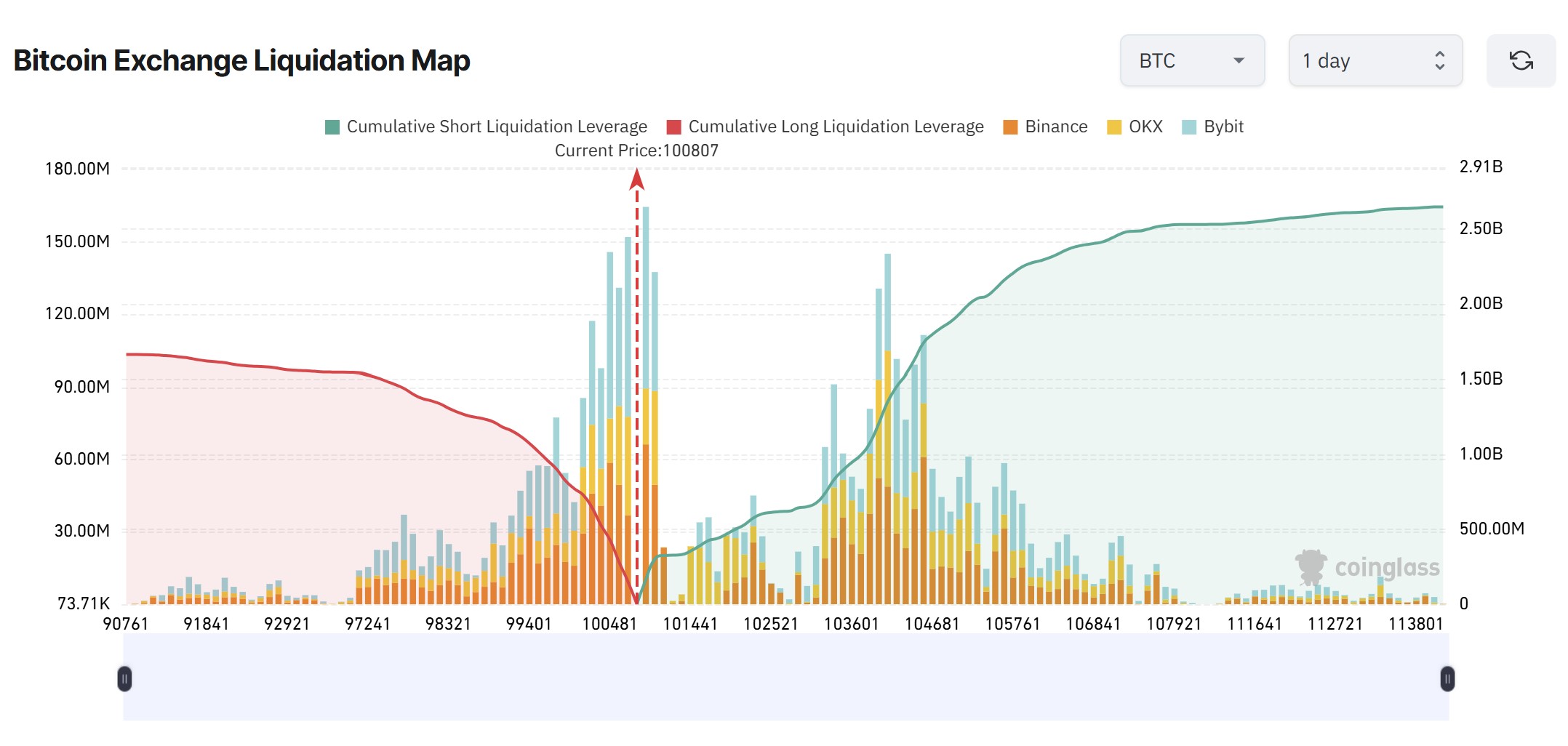

Experts tracking BTC’s liquidity map highlight a broadening imbalance in between assistance and overhead resistance. Crypto trader Daan kept in mind that a “big cluster of liquidity sits listed below the regional lows at $98,000–$ 100,000,” including that this lines up with the series of partially greater lows that have actually formed above the zone.

The trader likewise indicated significant advantage levels at $108,000 and $112,000 however worried that just the previous is presently actionable offered the marketplace structure, with whichever band breaks initially most likely setting off a sharp capture.

Futures trader Byzantine General echoed the belief, observing that present cost habits recommends Bitcoin “is most likely to sweep the lows around $98,000”.

Supporting this view, CoinGlass information reveals almost $1.3 billion in cumulative long leveraged liquidity focused at the $98,000 level, a high increase from earlier in the week, while futures traders had actually formerly gone for upside liquidity near $110,000, following the current flush listed below $100,000 last Friday.

Related: Crypto most ‘afraid’ considering that March as Bitcoin eyes 1 year lows versus gold

Repetitive assistance retests deepen structural danger

Bitcoin has actually now evaluated the $102,000–$ 100,000 assistance band for the 4th time considering that the variety was very first developed in Might 2025. Numerous retests of the exact same assistance frequently suggest structural fatigue: each subsequent see compromises purchaser conviction, minimizes resting quote liquidity, and increases the possibility of a breakdown.

Expert UBCrypto kept in mind that the most recent relocation looked like a stopped working breakout, including that it is “not a level worth purchasing into” up until cost validates strength, even if that suggests returning to a couple of portion points greater.

In spite of this, information from Hyblock Capital reveals that long positioning stays dominant, with 68.9% of international BTC orders leaning long on Binance, showing that numerous traders continue to rely on the $100,000 flooring.

Nevertheless, both the everyday and weekly charts show a softness at greater timespan, increasing the possibility of a liquidity sweep towards $98,000, even as much deeper order book assistance seems stacked above the present cost.

Related: Bitcoin’s second-largest whale build-up stops working to press BTC past $106K

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.