Bitcoin (BTC) cost rose above $94,000 on Tuesday, a day before the Federal Free Market Committee (FOMC) rate of interest choice, and history recommends that traders need to brace for volatility.

Throughout 2025, BTC’s efficiency around FOMC conferences exposed that macroeconomic expectations are frequently priced in, and this front-running by traders can eclipse the real effect of the policy choice itself.

Secret takeaways:

-

Bitcoin has actually traditionally sold after a lot of FOMC occasions, consisting of throughout rate-cut cycles.

-

BTC’s greatest inflows and utilize developed before FOMC occasions, thinning area liquidity and enhancing cost volatility after the Fed choice.

FOMC results highlight a distinct Bitcoin cost pattern

Bitcoin’s responses to the 7 FOMC choices in 2025 exposed a pattern of anticipatory prices followed by irregular, frequently unfavorable post-event relocations. Here is how BTC responded over the seven-day window after each conference:

-

Jan. 29– No modification: -4.58%

-

March 19– No modification: +5.11%

-

Might 7– No modification: +6.92%

-

June 18– No modification: +1.48%

-

July 30– No modification: -3.15%

-

Sept. 17– Cut 25 bps: -6.90%

-

Oct. 29– Cut 25 bps: -8.00%

Seven-day BTC returns after each conference varied from +6.9% to– 8%, with interest rate-cut conferences providing the weakest efficiency. That divergence ended up being clearer when seen through market structure instead of macroeconomic headings. These results indicated a set of constant structural motorists behind BTC’s responses:

1. Placing determined results:

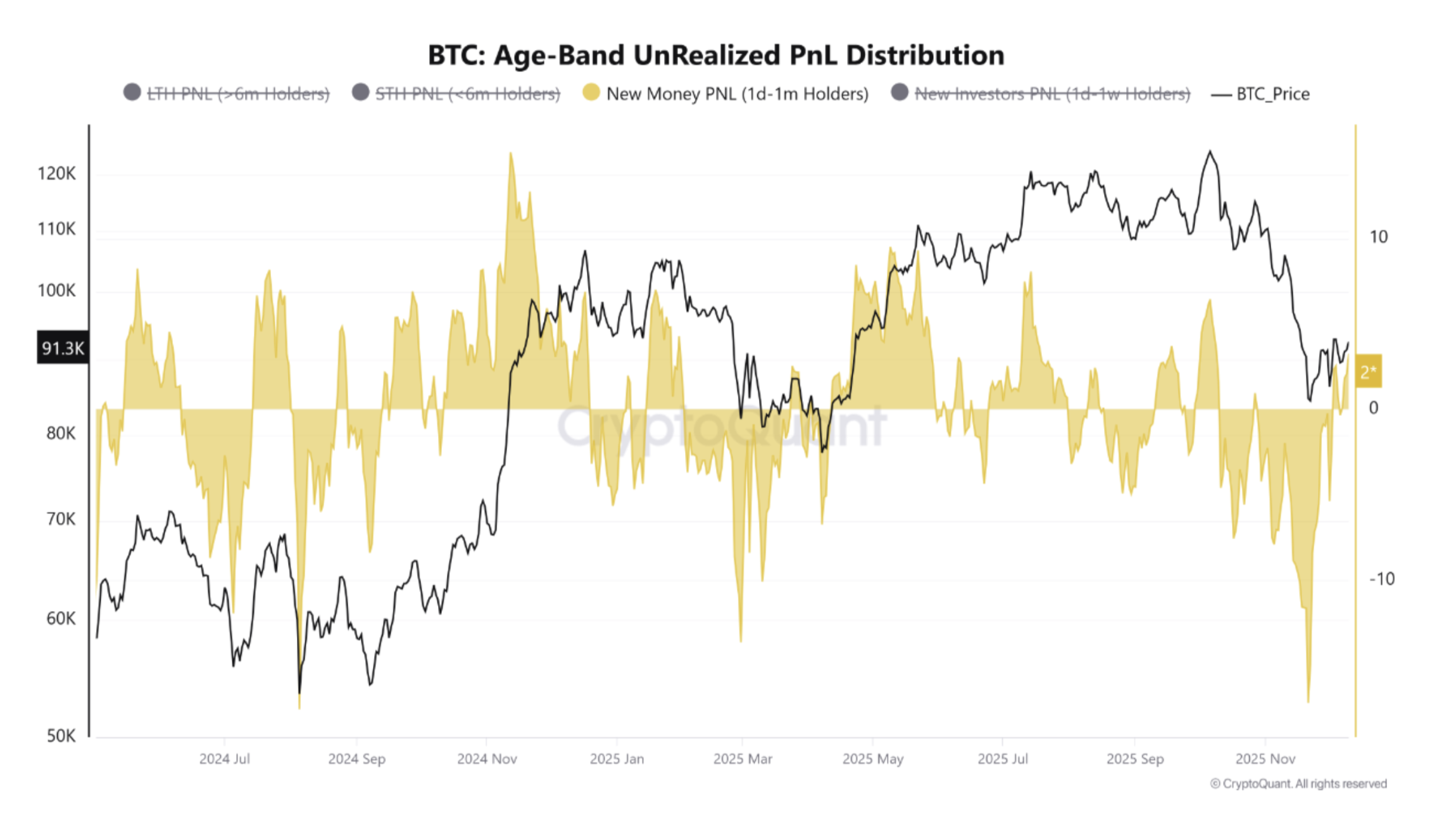

Before numerous conferences, most significantly July, September and October, financing rates and open interest increased greatly, suggesting an over-leveraged market. As highlighted in the chart, new-money (one day to one month) earnings understood peaked in Might, July and September, which likewise marked the current BTC peak.

Much of the “dovish benefit” was currently embedded in the cost, leaving BTC with restricted minimal purchasing power once the FOMC statement was made.

2. Rate cuts produced the biggest drawdowns:

The September and Oct. 25-BPS cuts were followed by– 6.9% and– 8% seven-day decrease. The reducing cycle was currently priced in through pre-FOMC inflows and aggressive long positioning, developing vulnerability instead of assistance when the cut ended up being authorities.

3. Priced in motion signified fragility, not stability:

When policy results ended up being near-certain, volatility compressed ahead of the conference and broadened instantly later as traders utilized validated news to decrease direct exposure, developing foreseeable short-term dislocations. Crypto expert Ardi anticipated a comparable result, composing,

” History will be on the side of gravity tomorrow. If we duplicate the typical drop (~ 8%), Bitcoin is because of review the $88k line of defence before any extension up.”

In general, the information revealed FOMC occasions acted less as directional drivers and more as reset points where overstretched positioning might loosen up, even if the rate of interest result was dovish.

Related: Secret Bitcoin cost levels to see ahead of 2025’s last FOMC conference

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.