Bitcoin (BTC) requires a breakout as a crucial leading sign reaches its greatest levels considering that January.

Information from Cointelegraph Markets Pro and TradingView reveals the relative strength index (RSI) meaning more BTC rate gains next.

Bitcoin RSI breakout has days to “complete verification”

Bitcoin bull runs typically start with obvious RSI signals, and on day-to-day timeframes, conditions are ripe for a traditional BTC rate rebound.

As BTC/USD made lower lows over the previous month, RSI started trending in the opposite instructions, setting greater lows and trying a kind of bullish divergence.

More just recently, the day-to-day RSI broke above the 50 midpoint, just to effectively retest it as assistance from above before making brand-new multimonth highs.

BTC/USD 1-day chart with RSI information. Source: Cointelegraph/TradingView

Amongst those keeping track of the subject is popular trader and expert Rekt Capital.

” Bitcoin has actually effectively retested red as assistance & & the Daily RSI Greater Low continues to preserve itself also,” he commented together with a chart in an X post this weekend.

” Growing indications of a developing Bullish Divergence here, with rate simply listed below the crucial Cost Sag (blue).”

BTC/USD 1-day chart with RSI information. Source: Rekt Capital/X

Rekt Capital likewise reported that RSI patterns recommended a long-lasting BTC rate flooring at around $70,000.

On the other hand, fellow expert Kevin Svenson recorded likewise appealing signals on weekly RSI today.

” As soon as verified, weekly RSI breakout signals have actually shown to be amongst the most trusted macro breakout indications,” he informed X fans.

” 6 Days till complete verification.”

BTC/USD 1-week chart with RSI information. Source: Kevin Svenson/X

As Cointelegraph reported, another crucial breakout presently under the microscopic lense for Bitcoin market individuals includes a downward-sloping trendline in location considering that January’s all-time highs.

April BTC rate efficiency far listed below average

Countering the bullish anticipation is an analysis concentrating on the bothersome macroeconomic conditions in which Bitcoin now discovers itself.

Related: Bitcoin rate metric that called 2020 bull run states $69K brand-new bottom

The continuous United States trade war and risk-asset thrashing produce a not likely increase of capital to BTC, which has actually carefully followed stocks while gold sets duplicated all-time highs.

In his most current projection for April, network economic expert Timothy Peterson saw little factor to commemorate.

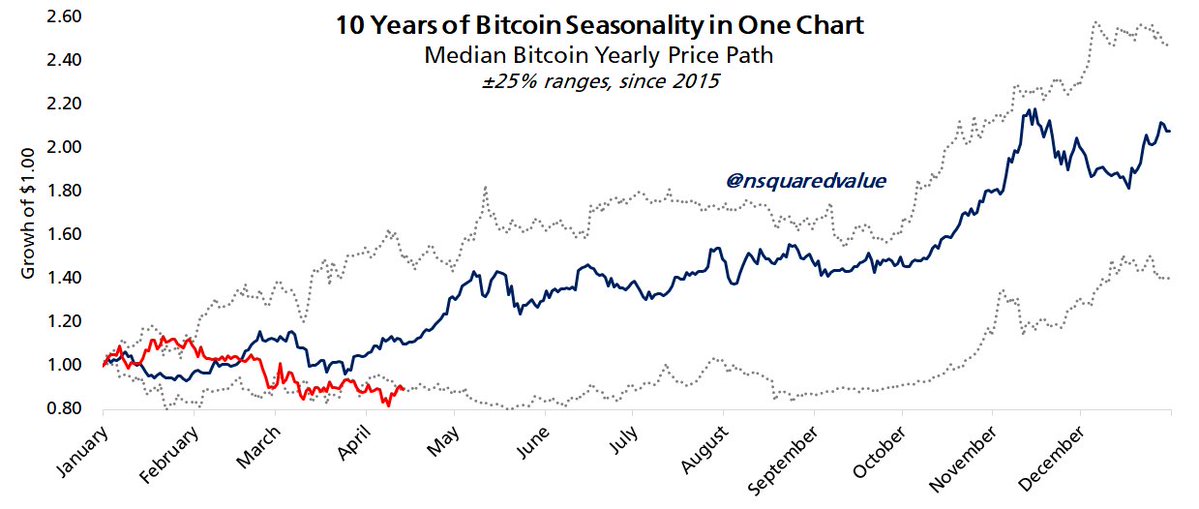

Publishing a chart of the average annual rate course for BTC/USD, he concluded that this year was a company underperformer.

” Half the days are above the blue line and half are listed below it. This April is undoubtedly a ‘listed below’ month,” part of accompanying commentary read.

” That is probably not going to alter, offered the level of rates of interest and other threat aspects at work in the market and economy.”

BTC rate seasonality. Source: Timothy Peterson/X

Other viewpoints similarly see a dull April before bullish undercurrents overtake Bitcoin, these in the type of record international M2 cash supply and a weakening United States dollar index (DXY).

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.