Bottom line:

-

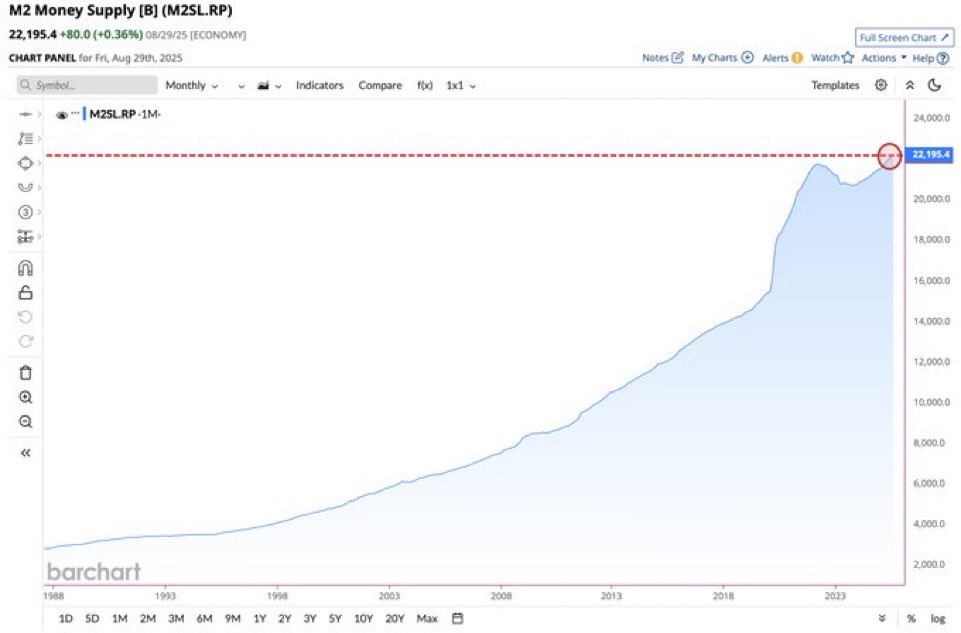

Worldwide M2 cash supply might send out Bitcoin to $500,000 if it duplicates its 2020 growth.

-

The rate increased 6 times after the around the world COVID-19 cash printing spree.

-

The current M2 dive comes as reserve banks cut rate of interest while inflation remains.

Bitcoin (BTC) might reach $500,000 if it duplicates its response to growing worldwide M2 cash supply development.

Analysis from Onramp Bitcoin co-founder Jesse Myers, published to X Tuesday, verifies the most significant M2 supply dive because the COVID-19 pandemic started.

Bitcoin vs. M2 supply: 2020 all over once again?

Bitcoin bulls can anticipate severe gains if BTC rate action copies its relocations through completion of 2020.

Worldwide M2, which tends to lead Bitcoin upside with a small hold-up, is presently increasing at a rate not seen because after the COVID-19 cross-market crash in March 2020.

” The cash printer hasn’t run this hot because COVID. Worldwide M2 cash supply now ~$ 137T Was $129T simply 6 months back,” Myers composed together with information assembled from TradingView.

” Gold has actually rallied in action. Bitcoin appears to be lagging – simply as it performed in 2020.”

The 6.2% M2 boost because March this year leaves some method to precede reaching 2020 levels. Then, Myers kept in mind, the supply included 21% by the end of the year.

” With a little hold-up, Bitcoin went on a 6x rally Q4 2020 – Q1 2021,” he continued.

” What will take place over the next 6 months?”

While a Bitcoin copycat relocation appears not likely, it would take BTC/USD over the $500,000 mark into 2026.

Recently, the United States M2 supply reached a brand-new all-time high of over $22 trillion, according to information from Barchart.

BTC rate “launch coming” as printing continues

Reacting, property supervisor Lawrence Lepard still anticipated that the pattern would have a traditional ripple effect on Bitcoin.

Related: Bitcoin’s MVRV Ratio mean ‘cyclical bottom’ forming listed below $110K

12% annualized development rate in worldwide M2. far cry from the Fed’s 2% target and they have not actually even switched on the printer yet. Bitcoin launch coming. Await it … https://t.co/nfosCEG505

— Lawrence Lepard, “repair the cash, repair the world” (@LawrenceLepard) October 21, 2025

Going over the concept, Lepard explained M2 as the “genuine rate of inflation,” dismissing central-bank inflation targets such as the United States Federal Reserve’s 2% objective.

As Cointelegraph reported, doubts have actually been cast regarding whether the long-running 2% mark can be recovered.

Markets, on the other hand, see interest-rate cuts sustaining the fire in 2025, consisting of at the Fed’s October conference next week.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.