Cathie Wood’s ARK Invest has actually gone back to acquiring shares of Jack Dorsey’s monetary services business Block after an extended sell-off.

ARK grabbed 262,463 shares of Dorsey’s Block (XYZ) on Monday, according to a trade notice seen by Cointelegraph. With the stock closing at $73, the purchase deserved $19.2 million.

The acquisition features Block seeing a noteworthy uptrend, rising 8% in the previous 1 month, according to TradingView.

ARK’s purchase of Block follows an extended period of offering the shares, with the business discarding another 279,047 XYZ recently for about $22 million.

ARK holds $193 million in Block

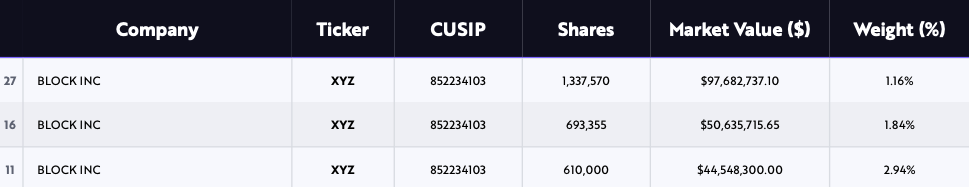

ARK’s Block share purchase consisted of deals from its 3 holding funds, consisting of the ARK Development ETF (ARKK), ARK Next Generation Web ETF (ARKW) and ARK Fintech Development ETF (ARKF).

ARKK, the biggest ARK fund by handled properties, purchased 152,980 Block shares on Monday and now holds about 1.34 million XYZ shares, worth $97.7 million.

With ARKK and ARKF jointly holding another 1.3 million XYZ since Tuesday, ARK Invest now holds an overall of 2.6 million Block shares, worth $193 million.

End of selling streak?

ARK Invest’s newest Block purchase is its very first in months, indicating a possible shift in the business’s financial investment technique.

In July alone, ARK discarded an overall of 551,834 Block shares, which are now worth $40.3 million, according to ARK’s trading information tracked by Cointelegraph.

Without any Block share purchases seen previously in 2025 or in 2024, the business’s last recognized acquisitions go back to 2023.

Block shares are down 21% from January highs

ARK’s newest financial investment in Block came quickly after Block recently reported a $2.54 billion revenue in the 2nd quarter, with year-over-year gross revenue rising 14%.

Block’s mobile payment service, Money App, was a significant development chauffeur, publishing $1.5 billion in gross revenue for the quarter, while the variety of Bitcoin (BTC) accounts reached 8 million.

Related: ARK Invest includes $20M in BitMine, cuts Coinbase, Block, Robinhood holdings

In spite of Block’s strong monetary outcomes, its cost decreased practically 7% following the release of its Q2 report. Although seeing a noteworthy rebound considering that Might, Block shares are down 21% from the cost levels seen in January, according to TradingView.

Following another strong quarter, Block supposedly prepares to introduce an extensive suite of Bitcoin banking tools developed for little and medium-sized business, with the very first combinations prepared for late 2025.

Cointelegraph approached Block to talk about the news however had actually not gotten a reaction by publication.

Publication: Buterin’s ETH treasury caution, Bitcoin $250K a ‘perhaps’: Hodler’s Digest, Aug. 3– 9