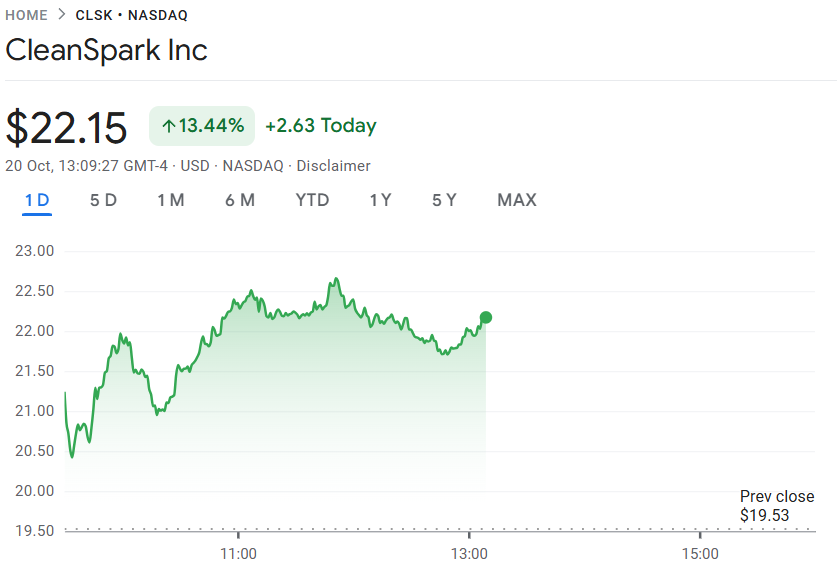

Nasdaq-listed Bitcoin mining business CleanSpark’s shares skyrocketed over 13% on Monday, after the business revealed a tactical growth into expert system.

CleanSpark, the fifth-largest Bitcoin (BTC) mining business by market capitalization, revealed a brand-new technique to broaden into AI information center facilities, intending to diversify its earnings streams and reinforce long-lasting capital capacity.

To lead the effort, the business designated Jeffrey Thomas as senior vice president of AI information centers, CleanSpark revealed on Monday.

Thomas formerly led Saudi Arabia’s multi-billion AI information center program as previous president of AI Data focuses at Saudi AI business Humain. Through his profession, he developed over $12 billion worth of investor worth throughout 19 endeavors, according to the statement.

” We have actually been examining the whole portfolio from very first principals to examine AI viability and have actually determined Georgia as a tactical area for both possible conversion along with growth,” composed Scott Fort, primary advancement officer and executive vice president at ClearSpark, including:

” We just recently contracted for extra power and property in College Park to provide high-value calculate to the higher Atlanta city location and are assessing giga-campus chances throughout the portfolio and pipeline that are well placed to please substantial off-taker need.”

Investors invited the tactical growth, as CleanSpark’s stock rate increased over 13% on Monday, after increasing 140% year-to-date in 2025, according to information from Google Financing.

Related: Elon Musk promotes Bitcoin as energy-based and inflation-proof, unlike ‘phony fiat’

Bitcoin miners are looking for brand-new earnings sources amidst post-halving pressure

CleanSpark’s tactical pivot comes as the post-Bitcoin halving pressure is driving other mining business to check out brand-new sources of earnings.

A few of the biggest Bitcoin mining companies have actually revealed comparable tactical pivots to AI given that the start of 2024, consisting of Core Scientific, Hut 8 and Iris Energy.

In June 2024, Core Scientific revealed a $3.5 billion handle AI cloud supplier CoreWeave to supply an extra 200 megawatts of facilities to host CoreWeave’s high-performance computing (HPC) operations.

The offer is anticipated to create an overall cumulative earnings of over $3.5 billion for the world’s biggest Bitcoin mining company, throughout the preliminary 12-year regards to the agreements, Cointelegraph reported.

The tactical growth into AI has actually conserved the Bitcoin miner’s organization design, as Core Scientific applied for Chapter 11 personal bankruptcy in 2022, 2 years before getting relisted on the Nasdaq ahead of its AI pivot.

Related: Grok, DeepSeek outshine ChatGPT, Gemini with legendary crypto market long

Bitcoin mining business Hut 8 ventured into AI services in September 2024, after introducing a GPU-as-a-Service offering through a brand-new subsidiary, Highrise AI.

June, Hut 8 got a $150 million financial investment from tech-focused financial investment supervisor Coatue Management, to assist the business “capitalize” on the growing need for AI calculating power.

Publication: Bitcoin mining market ‘going to be dead in 2 years’– Bit Digital CEO