Secret takeaways:

-

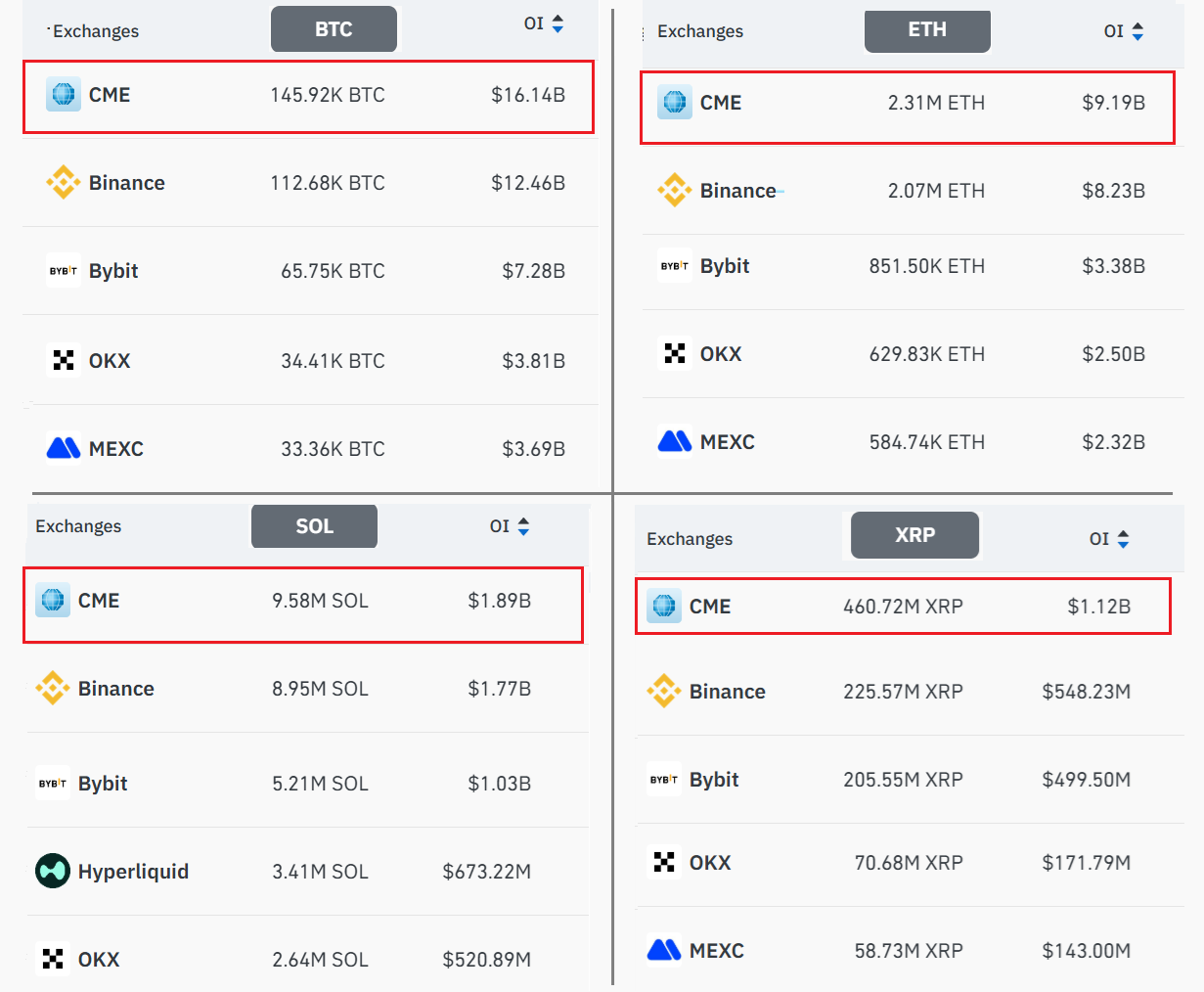

CME’s futures open interest in the leading 4 cryptocurrencies reached $28.3 billion, exceeding Binance’s $23 billion and Bybit’s $12.2 billion.

-

Regardless of CME’s lead in open interest, uncontrolled exchanges still control trading volumes, specifically in altcoin and continuous futures.

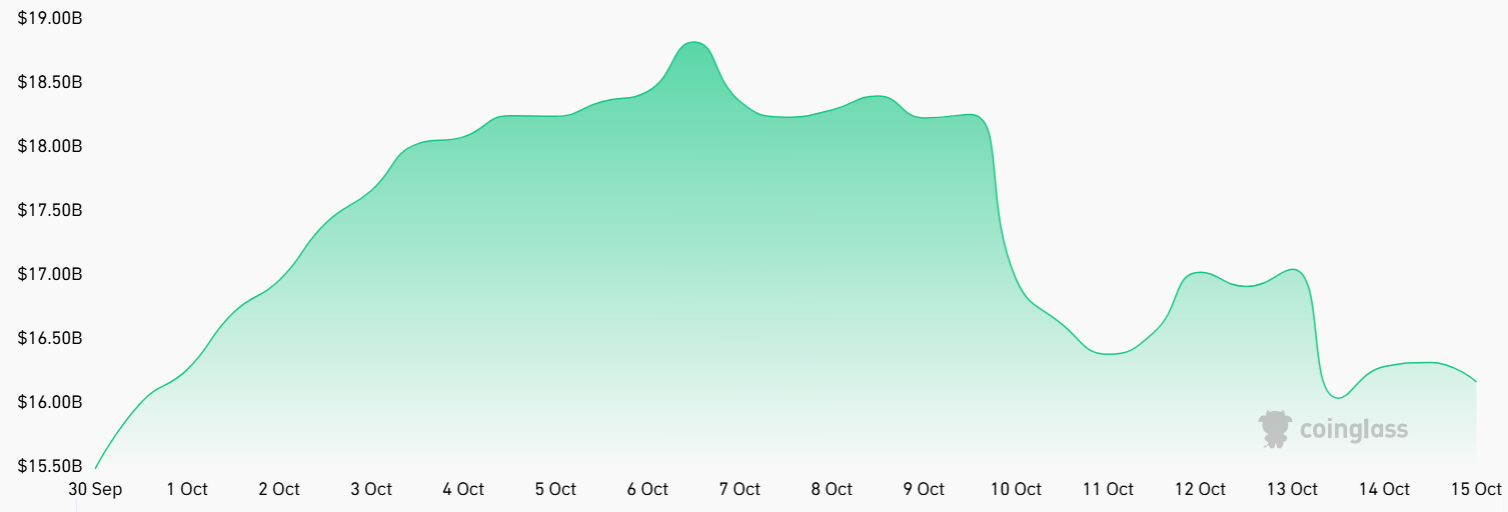

Friday’s cryptocurrency market crash erased a record $74 billion in leveraged positions throughout the market. Although costs recuperated majority of the losses within a couple of hours, the damage to futures open interest had actually currently been done. The motion activated an unanticipated shift that might mark the “end of a period” for uncontrolled cryptocurrency derivatives markets.

Exchanges dealt with enormous liquidations and auto-deleveraging as traders’ margins failed, permitting the conventional Chicago Mercantile Exchange (CME) to take the lead in Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP (XRP) futures. Overall liquidations reported by CoinGlass reached a record-high $19.2 billion, while the efficient number ought to be far greater as some exchanges underreport their information.

Aggregate CME futures open interest in the leading 4 cryptocurrencies reached $28.3 billion on Wednesday, exceeding Binance’s $23 billion and Bybit’s $12.2 billion. While this marks a significant action towards institutional capital driving rate discovery, it does not imply exchanges have actually lost their one-upmanship.

CME leads open interest, however trading remain on exchanges

Binance still controls smaller sized altcoin futures with $7 billion spread throughout BNB, DOGE, BUZZ, and comparable properties, while Bybit holds another $4.4 billion. In addition, the leading 3 exchanges– Binance, OKX, and Bybit– jointly trade over $100 billion each day in BTC, ETH, SOL, and XRP futures, compared to CME’s $14 billion everyday average.

Even as CME becomes the leading market in open interest, trading activity stays greatly focused on lesser-regulated cryptocurrency exchanges, where continuous futures agreements (inverted swaps) control rather of weekly or month-to-month expirations.

Bitcoin futures open interest at CME stood at $16.2 billion on Wednesday, down 11% from $18.3 billion before Friday’s crash. By contrast, Binance saw a sharper 22% drop over the very same duration. The distinction mostly comes from Binance’s greater take advantage of, wider usage of cross-collateral, and its considerably bigger share of retail traders.

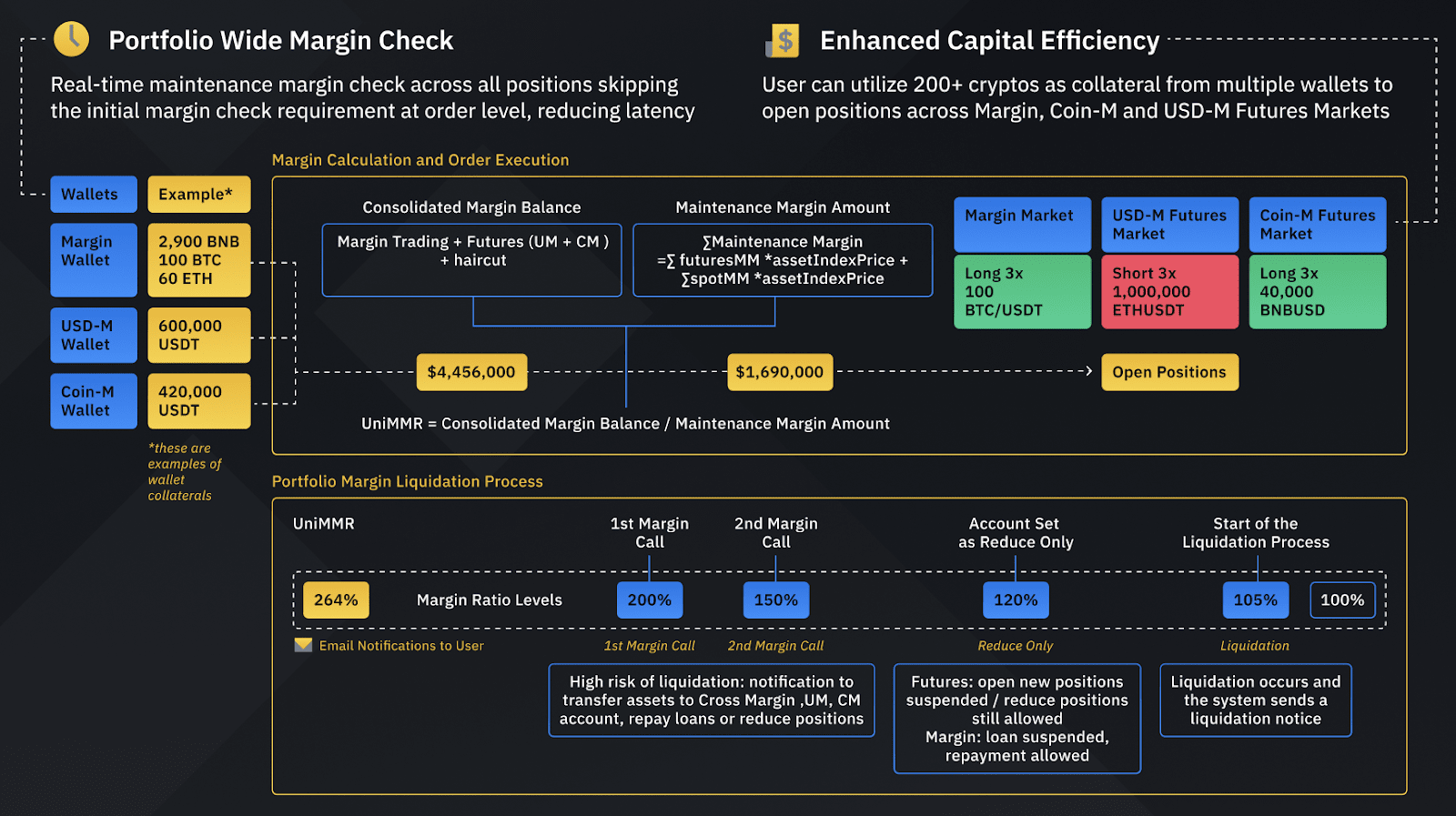

The complicated liquidation procedure connected to portfolio margin and the abrupt flash crash in a number of cryptocurrencies on Binance activated auto-deleverage systems throughout the wider market, likewise interrupting rates oracles utilized by decentralized exchanges. CME futures were untouched considering that trading stops at 4:00 pm Central Time on Friday and resumes on Sunday.

Related: Crypto ‘got a passing grade’ on weekend crash: Bitwise’s Matt Hougan

Another difference is that CME futures are cash-settled and need an upkeep margin of around 40%, approximately restricting traders to 2.5 x take advantage of. On the other hand, uncontrolled cryptocurrency derivatives platforms frequently provide to 100x take advantage of and accept a large range of security, consisting of altcoins and artificial stablecoins.

CME prepares to present 24-hour trading for futures and choices in early 2026, pending regulative approval, a relocation that might drive higher need and possibly shift trading volumes far from crypto exchanges. In the meantime, nevertheless, CME’s lead in open interest alone does not signify the “end of a period” for uncontrolled cryptocurrency derivatives markets.

This post is for basic details functions and is not meant to be and must not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.