Method creator Michael Saylor states Covid-era constraints and United States reserve bank financial policy at the time are what eventually inspired him to buy Bitcoin in 2020.

Throughout an interview with Dr. Jordan B. Peterson that aired on June 9, Saylor stated he ended up being deeply thinking about Bitcoin (BTC) in 2020 following what he called a “war on currency” in the middle of pandemic-induced international lockdowns and lessened rate of interest in the United States.

” It wasn’t the war on Covid, it was the war on currency,” he informed Peterson.

In an e-mail to workers at the time, Saylor composed that the Covid constraints were “soul-stealing and disabling to welcome the idea of social distancing and financial hibernation.”

He explained the year 2020 as a “bifurcation of Main Street and Wall Street,” where little and medium-sized companies and employees were “damaged” by limiting policies that close down shops and offices, while financiers and Wall Street fatcats were doing extremely well.

Saylor stated his only lifeline was $500 million in money reserves held by MicroStrategy, however rate of interest were near no due to Federal Reserve intervention, so that money did not make a yield.

” Reserve banks were printing cash,” he stated, “requiring rates down.”

Cash printing trouble

” Covid lockdown happens and there is a huge panic,” however the most “perverse thing you can possibly imagine” was that stock exchange had actually recuperated by the summer season of 2020 due to the fact that the Federal Reserve was printing cash.

” We had run-away inflation in monetary possessions,” that made financial investment supervisors and stock traders abundant, he stated.

Related: Central Bitcoin treasuries hold 31% of BTC supply: Gemini

” I had a property [cash] that was now non-performing […] so I have an option in between a quick death or a sluggish death, therefore it was time to decide to pick a side.”

The war on currency

” It took me thirty years to collect the cash […] why need to I quit thirty years of my life,” Saylor regreted.

This was when he began trying to find a service, mentioning, “I wish to be among those guys who owns things, however I do not wish to own sovereign financial obligation.”

Saylor thought about realty, stock portfolios and even collectible art as financial investments, however the very first 2 had actually currently increased due to the zero-interest rate environment.

” How do I discover $500 million worth of Picassos and Monets beautifully priced?” he asked.

” I require a liquid fungible property which will save my financial energy for an indefinite amount of time.”

Bitcoin financial investments start

” I’m viewing the world burn while all the Wall Street guys get abundant,” he stated before asking his long-lasting buddy and creator of Blockchain Financial investment Group, Eric Weiss, about Bitcoin and crypto– which he initially believed was a “rip-off coin” throughout the 2018 bearish market.

Saylor began studying crypto utilizing YouTube videos, podcasts, and books and concerned the viewpoint that the option was a “non-sovereign shop of worth bearer instrument of which gold had actually been the very best of those.”

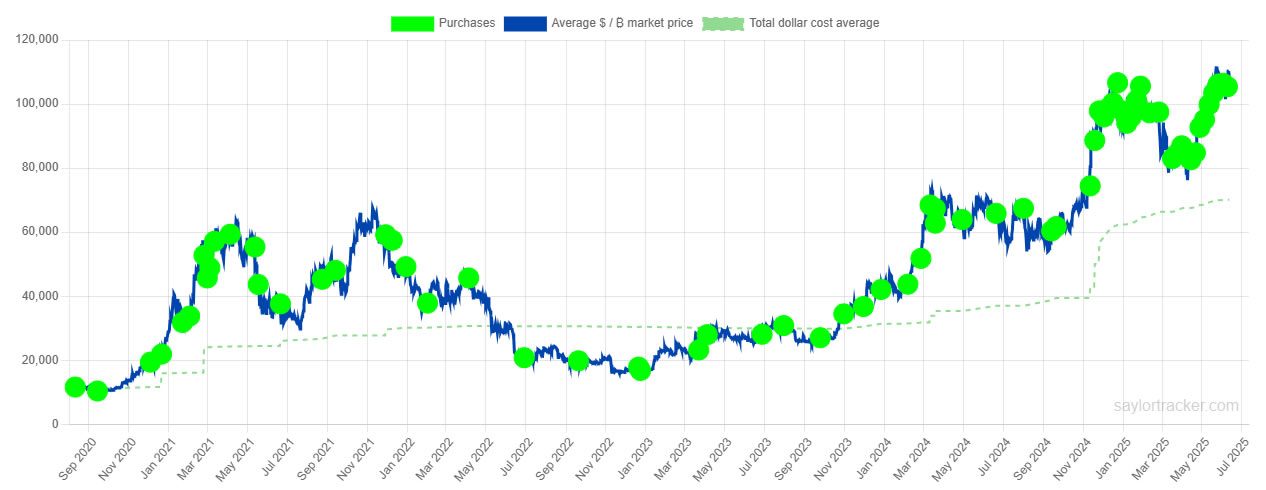

MicroStrategy made its very first BTC purchase in August 2020, scooping up 21,454 coins for $250 million at the time.

The business is now the world’s biggest business holder of the property with 582,000 BTC worth around $63 billion, according to the Saylor Tracker.

Publication: Elon Musk Dogecoin pump inbound? SOL tipped to strike $300 in 2025: Trade Tricks