Today in crypto: Digital possession funds tape-recorded a 3rd successive week of net inflows, driven by need in the United States. JPMorgan released its very first cash market fund through its $4 trillion possession management arm, and the UK is apparently preparing to extend monetary policies to crypto in 2027.

Digital possession ETPs publish 3rd straight week of net inflows, led by United States need

Crypto exchange-traded items (ETPs) tape-recorded about $864 million in inflows recently, according to a report on Monday by European digital possession supervisor CoinShares.

The United States led local inflows with about $796 million, followed by Germany with approximately $68.6 million and Canada with about $26.8 million. Together, the 3 nations represent around 98.6% of year-to-date (YTD) inflows into digital possession financial investment items.

Switzerland-listed crypto ETPs tape-recorded about $41.4 million in weekly outflows, while YTD net circulations had to do with $622.4 million, according to the information.

Bitcoin (BTC) financial investment items tape-recorded about $522 million in weekly inflows, while short-Bitcoin items published approximately $1.8 million in net outflows, “signalling a healing in belief,” according to the report.

Ether (ETH) saw around $338 million in inflows throughout the week, raising YTD to about $13.3 billion, up 148% from 2024.

Beyond Bitcoin and Ether, Solana (SOL) financial investment items tape-recorded about $65 million in weekly inflows, bringing YTD inflows to approximately $3.46 billion, a tenfold boost from in 2015.

XRP (XRP) items likewise drew in fresh capital, with around $46.9 million included throughout the week and about $3.18 billion in inflows collected YTD, according to the information.

Smaller-cap items saw more combined outcomes, with Aave (AAVE)- connected items taping about $ 5.9 million in weekly inflows and Chainlink (LINK) including approximately $4.1 million. Hyperliquid (BUZZ) items published net outflows of around $14.1 million throughout the duration.

This is the 3rd successive week of inflows for crypto ETPs, following about $716 million in inflows recently and approximately $1 billion the week previously.

Bitcoin has actually brought in around $27.7 billion YTD, still listed below the $41 billion it tape-recorded in 2024.

JPMorgan releases its very first tokenized cash market fund on Ethereum

JPMorgan, among the world’s greatest banks, is advancing its existence in tokenized financing by releasing its very first cash market fund through its $4 trillion possession management arm.

The fund, My OnChain Internet Yield Fund, will trade under the ticker MONY and is readily available on the general public Ethereum blockchain, JPMorgan stated in a statement shown Cointelegraph on Monday.

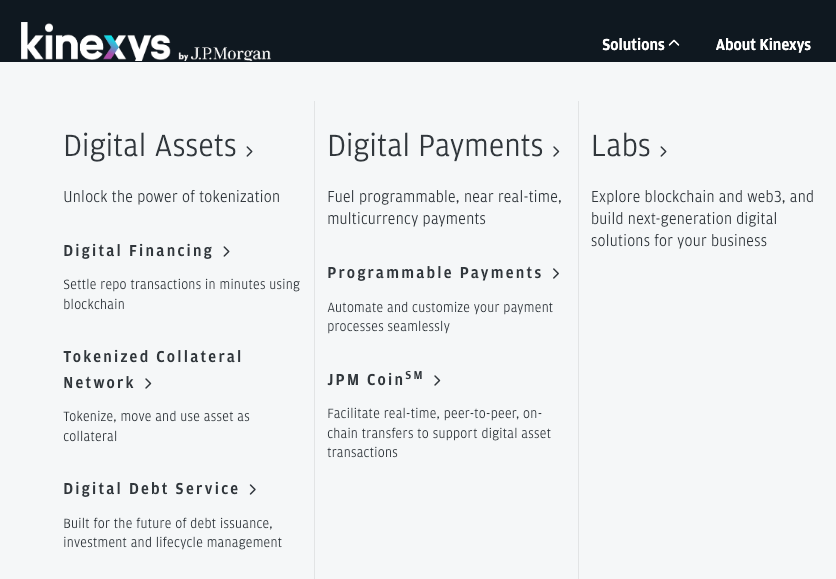

Released through Kinexys Digital Assets, JPMorgan’s exclusive tokenization platform, MONY is a 506( c) personal positioning fund offering certified financiers the chance to make United States dollar yields by subscribing through its institutional trading platform, Morgan Cash.

” With Morgan Cash, tokenization can essentially alter the speed and performance of deals, including brand-new abilities to standard items,” stated John Donohue, head of worldwide liquidity at J.P. Morgan Possession Management.

By releasing MONY, JPMorgan has actually ended up being the biggest worldwide systemically crucial bank to present a tokenized cash market fund (MMF) on a public blockchain, the bank stated in the statement.

The fund’s tokenization supplies increased openness, peer-to-peer transferability and the capacity for more comprehensive security use within the blockchain community, it stated.

” This marks a substantial advance in how properties will be sold the future,” Donohue stated, highlighting the function of Morgan Cash, where certified financiers can access the fund and get tokens at their blockchain addresses.

UK looks for to extend financing laws to crypto from 2027: Reports

The UK federal government will present legislation on Monday that will bring crypto business under existing financing laws by October 2027 under the oversight of the Financial Conduct Authority (FCA), the financing ministry has actually informed regional media.

The Treasury proposed draft crypto legislation in April, which has actually seen just small modifications. It would subject crypto to the exact same laws and customer securities as standard financing items.

” Bringing crypto into the regulative border is an essential action in protecting the UK’s position as a world-leading monetary center in the digital age,” stated the head of the Treasury, Rachel Reeves.

Reeves included that the expense provides “clear guidelines of the roadway” and strong customer securities while locking “dodgy stars out of the UK market.” On the other hand, financial secretary Lucy Rigby stated the UK’s objective “is to lead the world in digital possession adoption.”