Crypto exchange-traded items (ETPs) tape-recorded about $864 million in inflows recently, according to a report on Monday by European digital property supervisor CoinShares.

The United States led local inflows with about $796 million, followed by Germany with approximately $68.6 million and Canada with about $26.8 million. Together, the 3 nations represent roughly 98.6% of year-to-date (YTD) inflows into digital property financial investment items.

Switzerland-listed crypto ETPs tape-recorded about $41.4 million in weekly outflows, while YTD net circulations had to do with $622.4 million, according to the information.

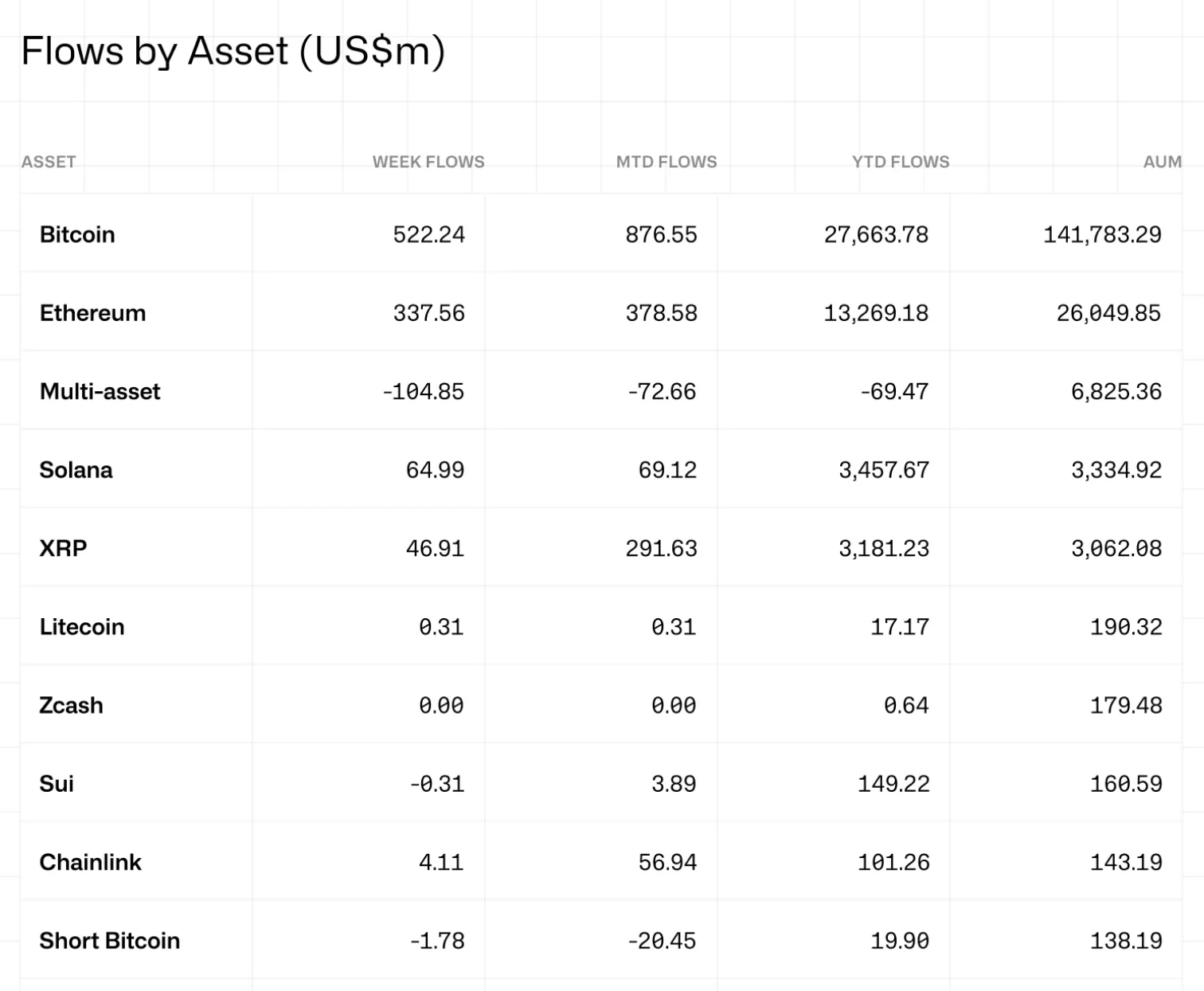

Bitcoin and Ether control inflows, followed by Solana and XRP

Bitcoin (BTC) financial investment items tape-recorded about $522 million in weekly inflows, while short-Bitcoin items published approximately $1.8 million in net outflows, “signalling a healing in belief,” according to the report.

Ether (ETH) saw roughly $338 million in inflows throughout the week, raising YTD to about $13.3 billion, up 148% from 2024.

Beyond Bitcoin and Ether, Solana (SOL) financial investment items tape-recorded about $65 million in weekly inflows, bringing YTD inflows to approximately $3.46 billion, a tenfold boost from in 2015.

XRP (XRP) items likewise drew in fresh capital, with roughly $46.9 million included throughout the week and about $3.18 billion in inflows built up YTD, according to the information.

Smaller-cap items saw more combined outcomes, with Aave (AAVE)- connected items tape-recording about $ 5.9 million in weekly inflows and Chainlink (LINK) including approximately $4.1 million. Hyperliquid (BUZZ) items published net outflows of around $14.1 million throughout the duration.

This is the 3rd successive week of inflows for crypto ETPs, following about $716 million in inflows recently and approximately $1 billion the week in the past.

Bitcoin has actually drawn in around $27.7 billion YTD, still listed below the $41 billion it tape-recorded in 2024.

Related: XRP sinks listed below $2 in spite of $1B in ETF inflows: How low can price go?

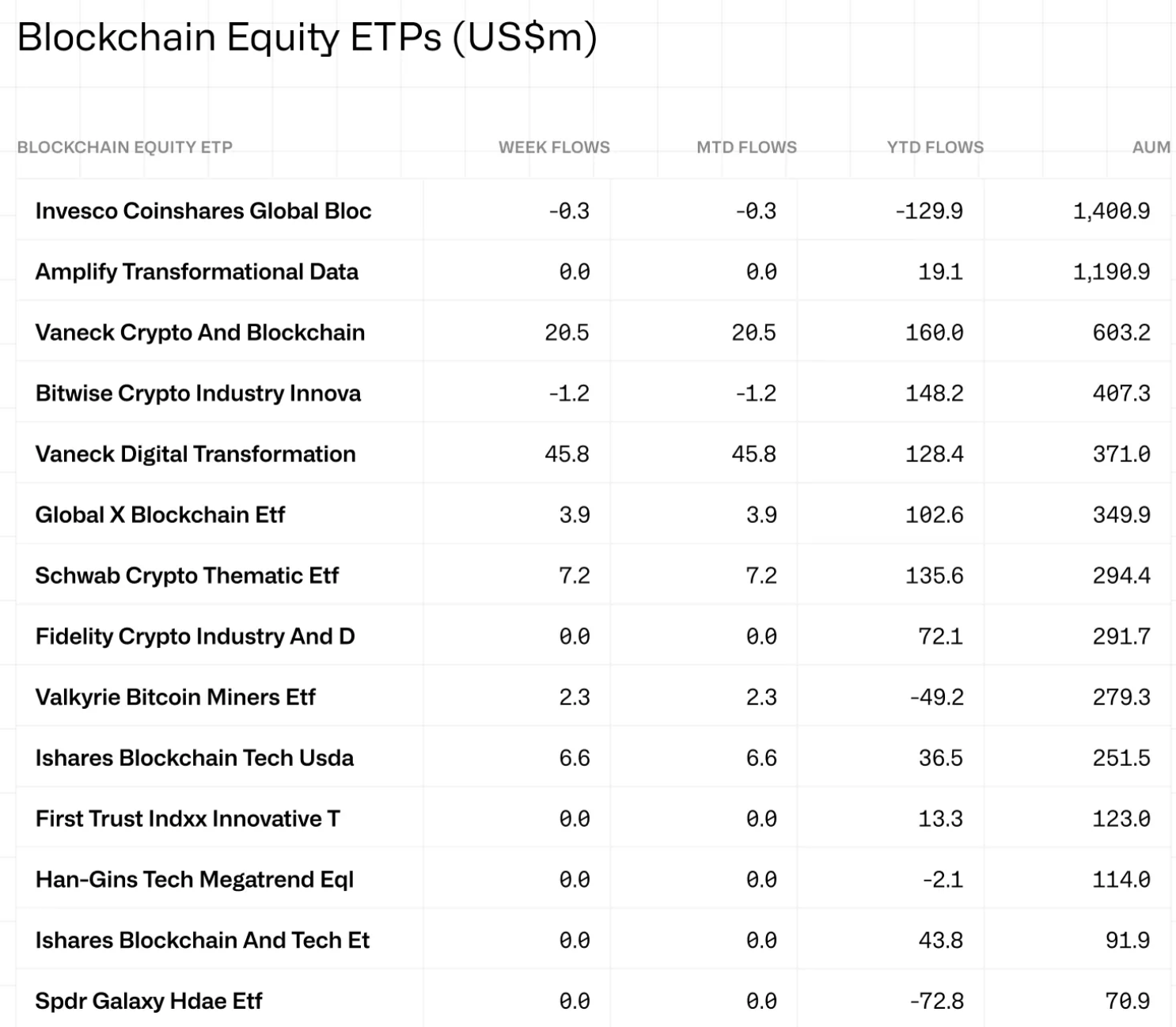

Possessions under management and equity ETP streams

By possessions under management, Bitcoin financial investment items hold about $141.8 billion, while Ether-linked items represent approximately $26 billion.

Beyond single-asset items, multi-asset crypto ETPs tape-recorded about $ 104.9 million in weekly outflows, extending net redemptions to approximately $ 69.5 million YTD, in spite of holding roughly $ 6.8 billion in possessions under management, according to the information.

Funds that buy openly traded blockchain-related business saw combined financier streams throughout the week. VanEck’s Digital Change fund published the biggest weekly inflow at about $45.8 million, followed by VanEck Crypto and Blockchain at approximately $20.5 million and Schwab’s Crypto Thematic ETF at about $7.2 million.

Invesco CoinShares’ Worldwide Blockchain and Bitwise Crypto Market Innovators ETPs tape-recorded modest net outflows throughout the week.

Publication: Huge concerns: Would Bitcoin endure a 10-year power interruption?