The once-scrappy world of digital possessions has actually turned into a sector specified by structured governance, audited financials, and scalable income designs.

Exchanges that started as weekend experiments now look like standard banks, total with compliance groups, financier relations departments, and long-lasting capital techniques. “We are now IPO-ready,” MEXC chief running officer (COO) Tracy Jin informed Cointelegraph.

On June 5, Circle, the company of the USDC ( USDC) stablecoin, raised $1.1 billion in its public launching, surpassing expectations and marking a record-setting 167% gain on its very first day of trading.

On June 6, Gemini, the exchange established by Cameron and Tyler Winklevoss, likewise submitted in complete confidence for a United States listing, followed by a comparable filing from Bullish, the digital property exchange backed by billionaire financier Peter Thiel, on June 10.

” Better market belief is the essential of an effective launch,” Jin stated, indicating the rise of capital streaming into area Bitcoin (BTC) and Ether (ETH) ETFs in the United States as a driver. The booming market environment has actually pressed evaluations greater and produced a wealth result for early financiers, opening the IPO window.

Related: Tether CEO snubs IPO, states $515B assessment is ‘a bit bearish’

Regulator clearness increases IPO buzz

Nevertheless, belief alone isn’t driving the pattern. According to Jin, long-awaited regulative clearness is playing a main function. Structures like Markets in Crypto-Assets Policy (MiCA) in Europe and United States ETF approvals have actually assisted de-risk crypto for institutional financiers.

” For several years, the obscurity in jurisdictions like the United States revealed market financiers cautious,” she kept in mind. The brand-new guidelines might not be detailed, however they supply adequate structure to legitimize listings in the eyes of Wall Street.

MEXC’s COO thinks the market itself has actually developed considerably. “Crypto is no longer a nascent market run from garages,” Jin stated. With audited financials, developed governance, and sustainable income from custody, staking, and trading, crypto companies are now “IPO-ready.”

When it comes to what type of companies will control this brand-new IPO stage, Jin sees facilities and fintech-adjacent business blazing a trail. Blockchain analytics, staking services and safe custody companies will be amongst the leading competitors, together with stablecoin companies.

” The momentum is sustainable, however it will be selective,” she stated. “Business with clear, defensible organization designs that look more like tech or fintech than a pure bet on token costs will be the most effective.”

Related: Circle’s NYSE launching marks start of crypto IPO season: Are Kraken, Gemini and Bullish next?

Asia beside see crypto rise

Asia might become a hotbed of activity. Jin pointed out Metaplanet’s Bitcoin treasury method as an indication of growing local adoption. “It’s not simply a MicroStrategy story any longer,” she stated, keeping in mind that issues over currency devaluation in Japan have actually made BTC an appealing hedge.

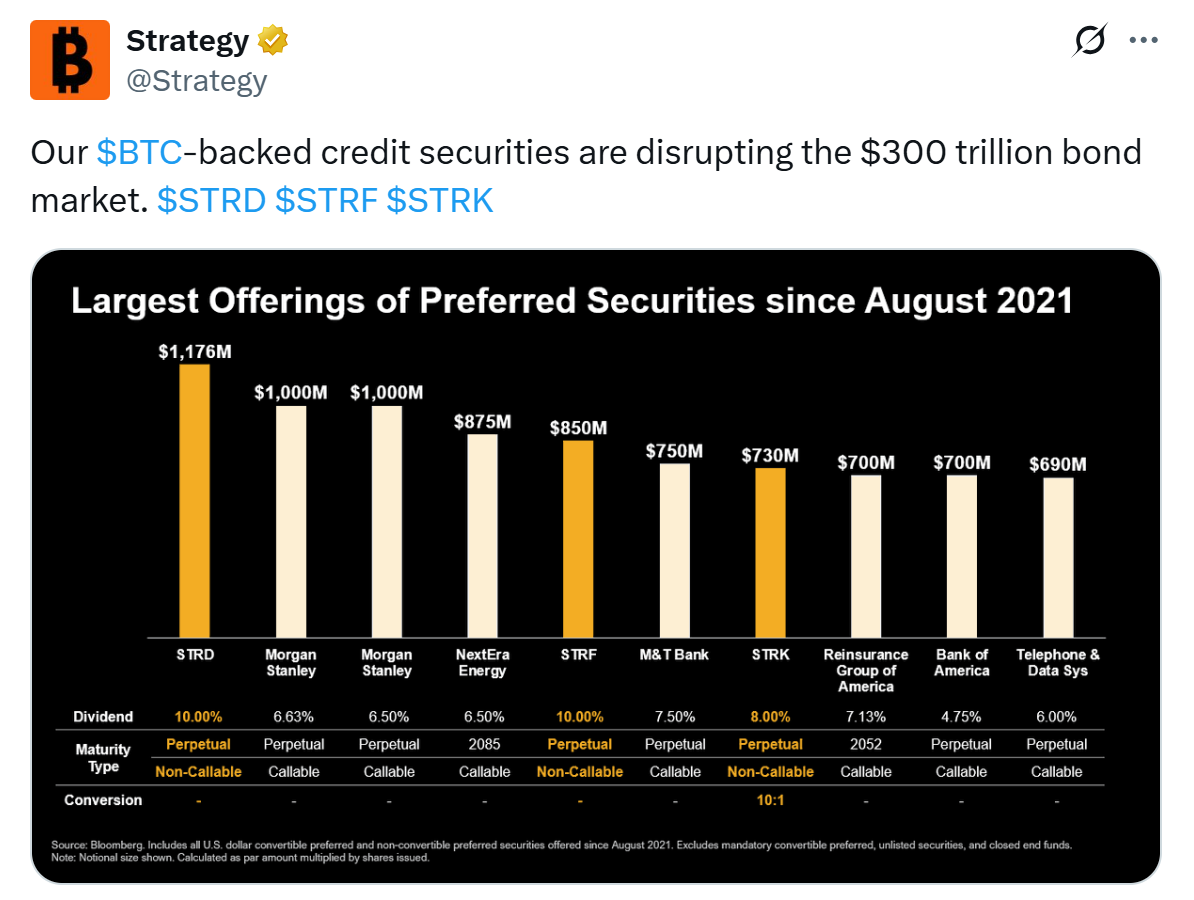

She likewise sees a future for crypto-linked monetary engineering. Method’s usage of convertible notes to supply yield with upside direct exposure has actually set a precedent. “I completely anticipate to see a wave of structured items from significant banks like Goldman Sachs and JP Morgan,” Jin stated.

That does not imply organizations are prepared to hold crypto on their balance sheets en masse, however it’s an action in that instructions. Jin views these instruments as “a plan for mainstream adoption” that begins as a specific niche play and slowly constructs institutional convenience with the property class.

Publication: China threatened by United States stablecoins, G7 advised to deal with Lazarus Group: Asia Express