As the United States Federal Reserve prepares to change rate of interest on Wednesday, a wider shake-up at the reserve bank might have major ramifications for crypto markets.

The Fed is anticipated to cut rate of interest tomorrow, in a relocation that generally indicates a rally in crypto markets: Lower yields on possessions like bonds suggest riskier possessions like crypto are more appealing.

The anticipated rate cuts come in the middle of a political fight and a brand-new consultation to the Federal Reserve. United States President Donald Trump’s administration has actually charged Fed guv Lisa Cook with home loan scams as it seeks her elimination. On the other hand, the Senate has actually verified White Home financial consultant Stephen Miran to the board of guvs.

The charges versus Cook and the effort to choose a specific with ties to the administration might suggest a less independent Federal Reserve, which plays a crucial function in setting crypto policy.

What a political Federal Reserve indicates for crypto policy

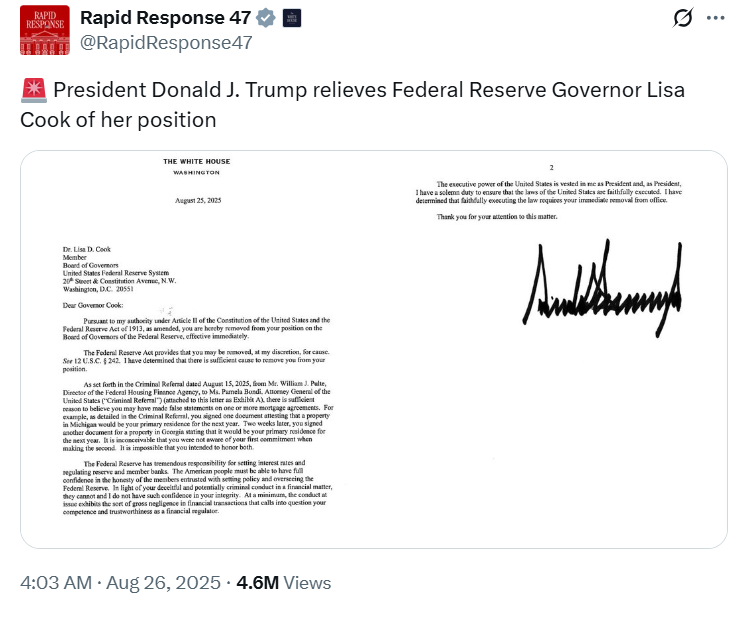

The Trump administration is looking for to eliminate Cook– a Biden-era appointee– as it intends to put in more control over the Federal Reserve. On Aug. 25, the White Home X page published a letter in which Trump fired Cook, implicating her of making incorrect declarations on several home loan contracts.

Prepare rejected the allegations and declined to step down. Her legal group stated the charges were inspired by politics which the White Home is “rushing to create brand-new reasons for its overreach.” Prepare herself stated that it is “unmatched and prohibited.”

On Monday, the appeals court in Washington obstructed the White Home from eliminating Cook from her position at the Federal Reserve. This will permit her to keep her post while the case is pending.

Today, Miran, an economic expert and chairman of the Council of Economic Advisors, who has actually likewise made some pro-crypto remarks in the past, was verified by the Senate.

His position is momentary– the term ends in January 2026– however Miran has actually decreased to devote to stepping down as a White Home consultant must his term extend beyond Jan. 31.

This has Democratic lawmakers fretted that the Fed and its financial policy program will be more beholden to Trump’s political objectives.

Related: Trump restores push to oust Fed’s Cook ahead of anticipated rate cut

Aaron Brogan, creator of crypto-focused law practice Brogan Law, informed Cointelegraph, “The Fed has fantastic authority over banks, and eventually, banks are quasi-regulators of the crypto market by identifying who can and can not access monetary services.”

” That impact is not likely to reduce with a less independent Fed, however the policy might. I would bet it would be more adjustable and vulnerable to public impulses.”

A politicized Fed is fairly uncharted area. When asked what a less independent Fed indicates for United States financial policy, Brogan stated, “No one understands.”

” There is a presumption that a reliant Fed would have more liberal, profligate financial policy just due to the fact that it is more responsive to popular opinion, which is unpredictable. However considering that we have not seen it, it is pure speculation. In this administration, a minimum of, Trump would cut rates.”

Crypto market prepares for Federal Reserve rate cut

As legislators in Washington battle over the fate of the reserve bank, crypto markets are preparing for the Fed’s conference tomorrow, where it’s anticipated that they will cut rates.

Kevin Rush, creator of real-world possession (RWA) loaning and loaning environment RAAC, informed Cointelegraph that “markets are on edge.”

” Resuming the cutting cycle starts to open the $7.2 trillion being in cash market funds, along with the trillions bound in impressive home loan financial obligation.”

He forecasted that liquidity would stream into alternative yield-generating financial investments like those in decentralized financing (DeFi) and RWAs.

Alice Liu, research study lead at CoinMarketCap, informed Cointelegraph that “high-beta layer ones” like Ether (ETH) and Solana (SOL) are especially impacted by Fed rates of interest modifications.

” These trade like development tech– more conscious liquidity and danger hunger than BTC. Particularly as rates of interest cuts might possibly set off extra capital injected in risk-on possessions, financiers might be taking a look at releasing extra capital into ETH’s ‘digital oil’ narrative or SOL’s adoption development,” she stated.

She stated that DeFi tokens are “fairly more appealing” when rate of interest fall, improving tokens connected to lending/DEX activity.” Bitcoin is “still the quality crypto” and less rate-sensitive to rates of interest modifications however can still move “around huge policy surprises and liquidity turns.”

The Kobeissi Letter composed, “When the Fed cuts rates within 2% of perpetuity highs, the S&P 500 usually enjoys it.” While immediate-term outcomes were blended, “in 20 of the last 20 times this has actually occurred, the S&P 500 has actually ended greater 1 year later on.”

They anticipate the very same result this time too. “There will be more immediate-term volatility, however long-lasting possession owners will celebration.”

” Gold and Bitcoin have actually understood this. The straight-line greater cost action we have actually seen in these possession classes is pricing-in what’s coming. Gold and Bitcoin understand lower rates into a currently HOT background will just press possessions greater. It’s a fun time to own long-lasting possessions.”

The political defend the Fed is still uncertain, however no matter who is pulling the levers, low rate of interest are a welcome sight for traders.

Publication: Satisfy the Ethereum and Polkadot co-founder who wasn’t in Time Publication