Retail financiers are inspecting the crypto market for indications that it might have bottomed out to determine when to purchase more crypto possessions, according to crypto belief platform Santiment.

” Retail traders are attempting to meta-analyze the marketplace, searching for indications of others stopping to time their own entries, which typically occurs near bottoms,” Santiment stated in a report on Saturday.

Santiment has actually connected this to the word “capitulation,” which has actually ended up being a top-trending crypto term on social networks, according to the platform’s information.

The term explains financiers offering their holdings out of worry that the marketplace will not recuperate, a situation that experts generally keep track of when examining whether the marketplace has actually reached a bottom.

” Capitulation” might have currently taken place, states Santiment

” If everybody is waiting on ‘capitulation,’ the bottom may have currently taken place while they were waiting on a clearer indication,” Santiment stated.

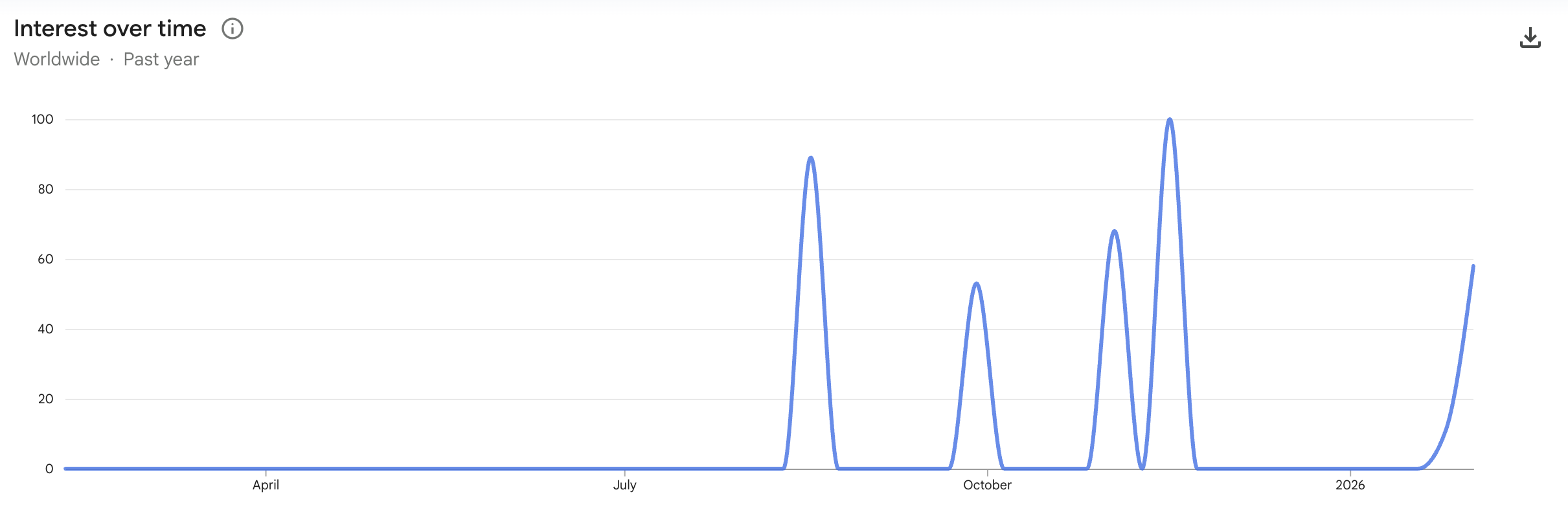

On The Other Hand, Google Trends information programs look for “crypto capitulation” increasing from a rating of 11 to 58 in between the weeks ending Feb. 1 and Feb. 8.

Crypto financiers are generally careful about calling a market bottom prematurely. History reveals costs can keep falling even when many people believe the worst is over.

Market expert Caleb Franzen stated in an X post on Saturday that while capitulation is the “word of the week,” numerous financiers do not comprehend that “bearishness generally experience numerous capitulation occasions.”

It comes as Bitcoin’s (BTC) rate dropped as low as $60,000 on Thursday, a level it hasn’t seen given that October 2024, amidst its continuous drop.

Some experts are doubtful of the “cycle bottom”

Crypto expert Ted stated in an X post on Friday that “the other day’s dump appears like capitulation, however it’s not the cycle bottom.”

Echoing a comparable belief, crypto expert CryptoGoos stated, “We have not seen real Bitcoin capitulation up until now.”

Related: Over 23% of traders now anticipate rates of interest cut at next FOMC conference

Over the previous 1 month, Bitcoin has actually fallen 24.27%, trading at $68,970 since publication, according to CoinMarketCap.

The Crypto Worry & & Greed Index, which determines general crypto market belief, fell even more into the “Extreme Worry” area on Sunday, with a rating of 7, signifying severe care amongst financiers.

Publication: Bitcoin’s ‘greatest bull driver’ would be Saylor’s liquidation: Santiment creator