Dutch cryptocurrency provider Amdax is preparing to introduce a Bitcoin treasury business on Amsterdam’s Euronext stock market, as more European business follow United States equivalents in embracing Bitcoin techniques.

Amdax stated Monday it is developing AMBTS B.V., an independently held business with independent governance that will run as a stand-alone company. AMBTS intends to end up being a “1% Bitcoin treasury business,” with the objective of ultimately collecting 1% of all Bitcoin (BTC) in flow.

The business stated it prepares to raise capital in phases through the marketplaces to broaden its Bitcoin holdings, grow equity worth and boost Bitcoin-per-share metrics for financiers. Collecting 1% of Bitcoin’s overall supply would need more than $24 billion at existing costs, with Bitcoin trading above $115,800 today.

Amdax was the very first crypto provider to sign up with the Dutch Reserve Bank in 2020. The platform was amongst the very first Dutch crypto company to get a Markets in Crypto-Assets Policy (MiCA) license from the Dutch Authority for the Financial Markets (AFM) on June 26.

Amdax and AMBTS strategy to raise capital from personal financiers in a preliminary funding round, with the net profits anticipated to be utilized to “make a running start with the Bitcoin build-up method,” the statement stated.

Amdax stated its platform provides 33 cryptocurrencies for trading, automated investing and expert-managed portfolio techniques for users.

Cointelegraph gotten in touch with Amdax for discuss the timeline of the company’s approaching capital raise and future Bitcoin financial investments, however had actually not gotten an action by publication.

Related: Spar presents across the country stablecoin and crypto payments in Switzerland

Business Bitcoin adoption grows in Europe

More European business are embracing Bitcoin as a main treasury reserve possession. Nevertheless, Bitcoin direct exposure is still “reasonably little in financial investment portfolios,” according to Lucas Wensing, CEO of Amdax. He included:

” With now over 10% of bitcoin supply held by corporations, federal governments and organizations, we believe the time is best to develop a Bitcoin treasury business with the objective to get a listing on Euronext Amsterdam, as one of the leading exchanges in Europe.”

A minimum of 15 European business have actually openly revealed embracing Bitcoin as part of their business balance sheet. These consist of Germany-based Bitcoin Group with 3,605 BTC, the United Kingdom-based Smarter Web Business with 2,395 BTC, France-based The Blockchain Group with 1,653 BTC and the UK’s Satsuma Innovation with 1,126 BTC.

Other European business with less than 1,000 BTC consist of Sweden’s H100 Group, Samara Property Group, CoinShares International Limited, 3U Holding, Advanced Bitcoin Technologies, Phoenix Digital Assets, Baultz Capital, Vanadi Coffee, Aker ASA, K33 and Refined Group.

Bitcoin continues to outshine

Related: Bitcoin’s business boom raises ‘Fort Knox’ nationalization issues

Bitcoin has actually exceeded all significant possession classes over the previous years, increasing more than 26,900%, compared to gains of 193% for the S&P 500, 125% for gold and 4.3% for petroleum, according to CoinGecko.

Beyond Europe and the United States, business Bitcoin adoption is likewise gradually growing in Asia, led by Japanese financial investment company Metaplanet.

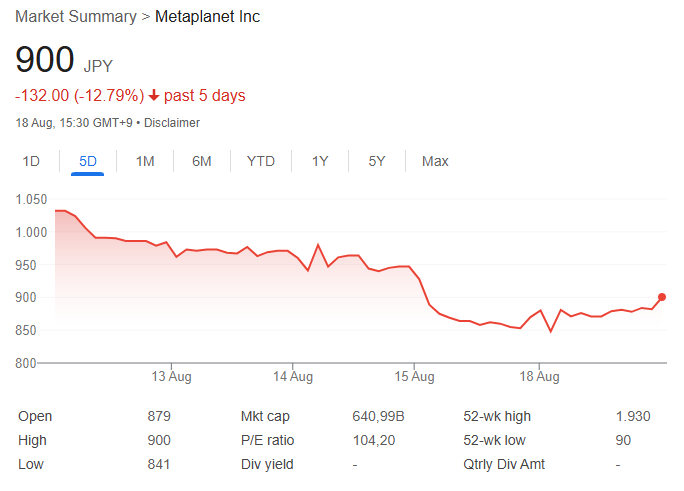

Metaplanet obtained an extra 775 BTC worth over $89 million, to go beyond 18,888 BTC or $2.1 billion in overall holdings, the business stated on Monday.

Metaplanet stock has actually risen nearly 190% year-to-date, outshining the 7.2% increase of Japan’s leading and most liquid blue-chip business tracked by the Tokyo Stock Cost Index (TOPIX) Core 30, Cointelegraph reported on Wednesday.

Regardless of a positive revenues report launched recently, Google Financing information reveals that Metaplanet’s stock rate fell by over 12.7% throughout the previous 5 trading days, to trade at 900 Japanese yen, or $6.11 per share.

Publication: Scottie Pippen states Michael Saylor alerted him about Satoshi chatter