Bitcoin exchange-traded funds (ETFs) saw less than $1 billion in outflows following the historical crypto market crash in October that triggered a 20% decrease in BTC’s cost, according to senior Bloomberg ETF expert Eric Balchunas.

The ETFs broke a six-day outflow streak on Thursday, taping about $240 million in capital inflows, Balchunas stated, sharing a chart that revealed net outflows of about $722 million over the previous month.

” Told y’ all the ETF-using boomers are no joke. So who’s been offering? To price quote that scary motion picture, ‘Ma’am, the call is originating from inside your house,'” Balchunas stated.

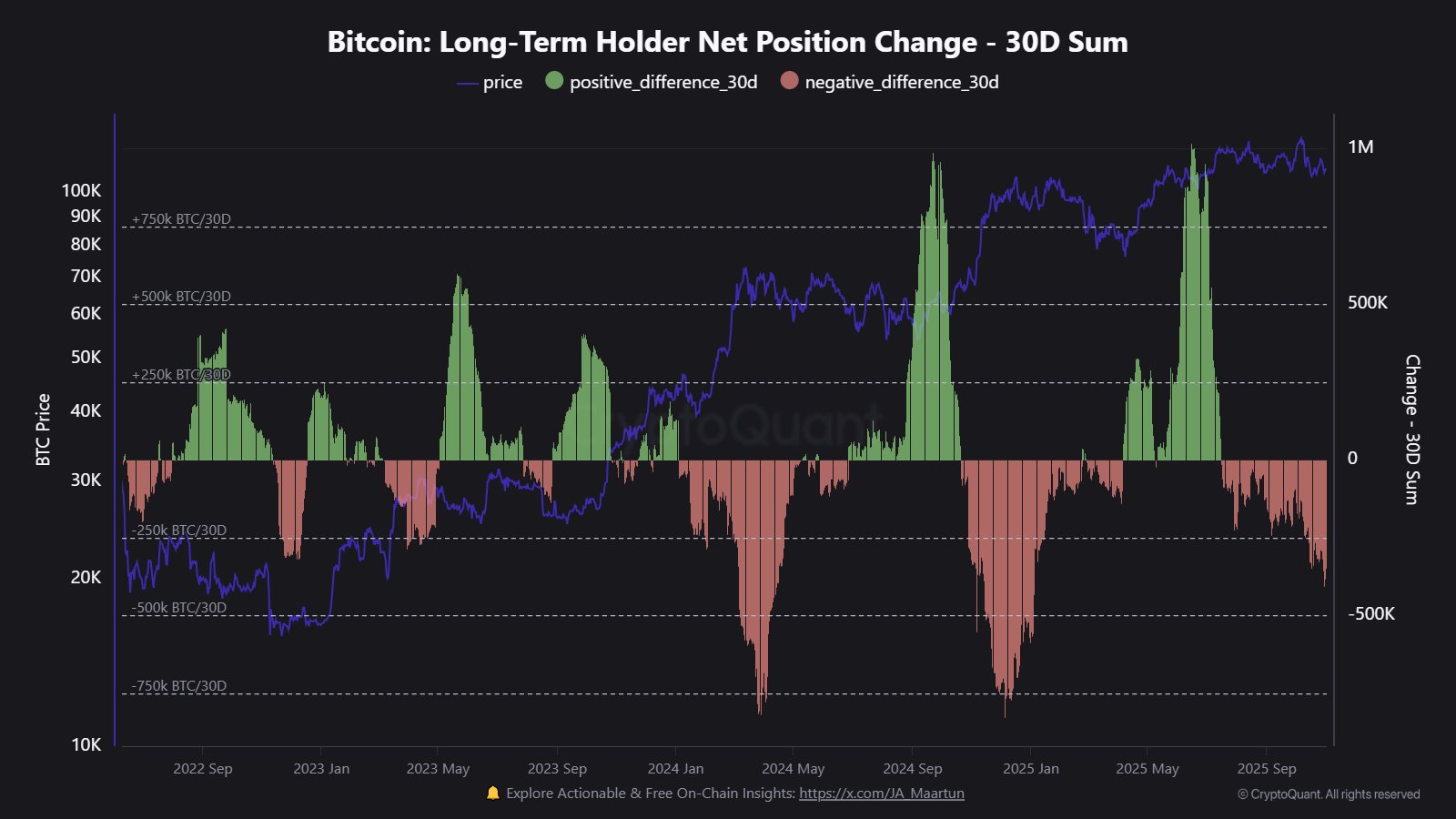

The remarks describe the 400,000 BTC offered by Bitcoin whales and long-lasting BTC holders, who moneyed in around the $100,000 cost level throughout October.

October’s historical market crash cleaned away about $20 billion in leveraged crypto bets within 24 hr, marking the worst crypto liquidation occasion in history and denting crypto rates to the point of requiring down modifications of cost projections from numerous investment firm.

Related: Bitcoin bulls pull back as area BTC ETF outflows deepen and macro worries grow

Long-lasting HODLers are offering while ETF financiers reveal interest in crypto

Long-lasting Bitcoin holders, those who have actually held BTC for 155 days or more, disposed 405,000 BTC, valued at over $41.3 billion at the time of this writing, according to CryptoQuant expert Maartunn.

Almost half of all ETF financiers surveyed by brokerage and monetary services business Charles Schwab in July and August stated they prepare to buy crypto ETFs, vanquishing emerging market equities, products and genuine possessions.

” ETFs are sluggish cash. RIAs, pensions, and 401( k) s purchase guidelines, not reports. They rebalance, they balance in. Traders barf, basis traders relax, perps waterfall,” author Shanaka Anslem Perera composed on X.

Capital inflows into ETFs have actually damped Bitcoin’s cost volatility, assisting to develop a flooring that supports rates by drawing in funds from conventional financiers, experts state.

These passive financial investment streams into BTC ETFs signal market maturation and growing conviction amongst Bitcoin ETF holders in Bitcoin’s long-lasting cost gratitude and its usage cases as a shop of worth or a macroeconomic property.

Publication: Bitcoin OG Kyle Chassé is one strike far from a YouTube permaban