Cryptocurrency financial investment items published record-breaking inflows recently as they tape-recorded gains for a 14th successive week.

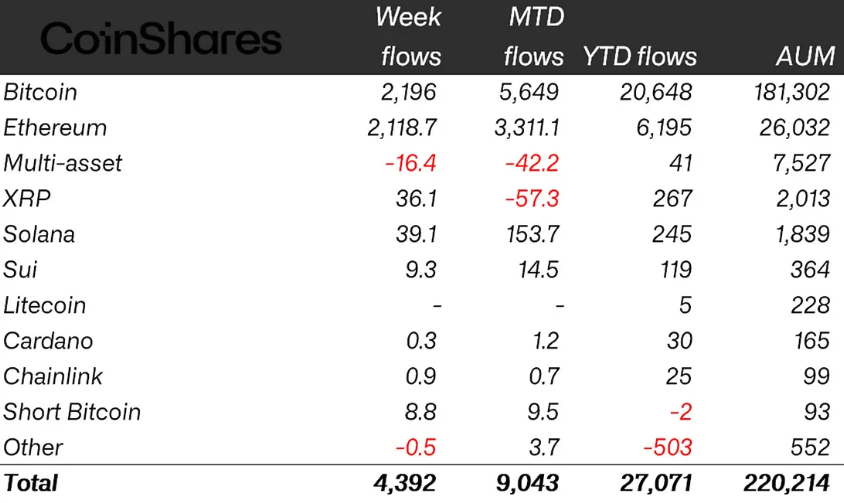

Worldwide crypto exchange-traded items (ETPs) tape-recorded $4.4 billion of inflows for the trading week that ended Friday, CoinShares reported on Monday.

The inflows came amidst Bitcoin (BTC) rising previous $122,000 for the very first time on July 14, then dropping to an intraweek low of about $116,000 before ending up the trading week at around $120,000, according to CoinGecko information.

With the fresh gains, the year-to-date (YTD) inflows in crypto ETPs reached a brand-new high of $27 billion, while overall possessions under management (AUM) for the very first time broke $220 billion.

Ether ETP inflows exceed 2024 overalls

Ether (ETH) ETPs set several records recently, with 2025 inflows going beyond 2024 overalls at $6.2 billion, while weekly inflows struck double the previous record at $2.12 billion, CoinShares’ head of research study James Butterfill composed in the report.

The most recent inflows came as ETH rose previous $3,500 for the very first time given that early January. The highs followed numerous months of down pressure that pressed ETH listed below $1,500 in April, according to CoinGecko.

” The previous 13 weeks of inflows now represent 23% of Ethereum AUM,” Butterfill kept in mind.

New Bitcoin highs do not interfere with ETP inflows

Bitcoin ETP inflows stayed resistant as BTC reached brand-new all-time highs, contrasting with the downturn seen in early July, a dip Butterfill credited to growing care as Bitcoin neared record levels.

According to the most recent upgrade, Bitcoin funds published $2.2 billion of inflows recently, representing 50% of overall crypto ETP inflows.

Solana (SOL), XRP (XRP) and Sui (SUI) were significant for their inflows amounting to $39 million, $36 million and $9.3 million, respectively.

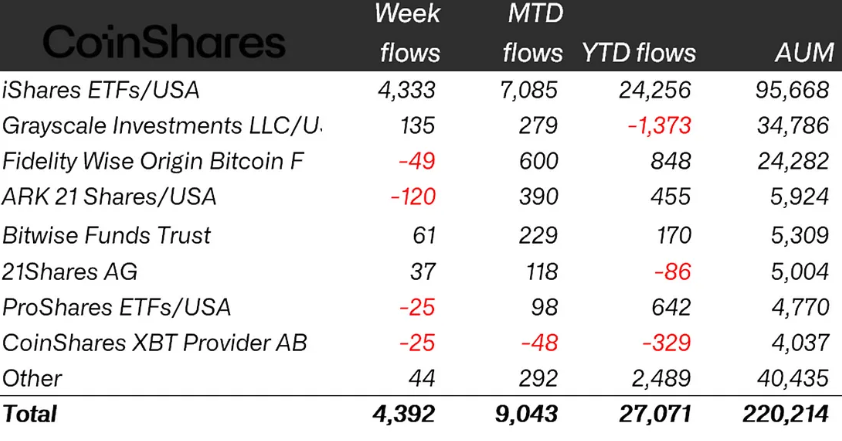

United States providers see $200 countless outflows integrated

Regardless of crypto ETPs seeing record-breaking inflows recently, some providers tape-recorded some small outflows.

Cathie Wood’s ARK Invest tape-recorded the biggest losses amongst providers, with overall outflows reaching $120 million, CoinShares reported.

Related: Crypto area trading down 22% in Q2 in spite of Bitcoin rally: Report

The ARK Next Generation Web ETF added to the sell-off, unloading $8.7 million worth of its ARK 21Shares Bitcoin ETF (ARKB) last Tuesday.

Other United States providers, consisting of Fidelity Investments and ProShares, experienced modest outflows of $49 million and $25 million, respectively.

European company CoinShares likewise saw small outflows of $25 million, contributing to recently’s $18 million in outflows.

Publication: Bitcoin OG Willy Woo has actually offered the majority of his Bitcoin: Here’s why