The European Union’s newest vindictive tariffs have actually deepened macroeconomic unpredictability, triggering crypto experts to anticipate increased volatility for Bitcoin rates, which might drop listed below the important $75,000 assistance level.

The EU will enforce counter-tariffs on 26 billion euros ($ 28 billion) worth of United States items beginning in April, the European Commission revealed on March 12, reacting to United States President Donald Trump’s current transfer to enforce 25% tariffs on steel and aluminum imports.

This relocation is the current vindictive tariff statement in reaction to United States import tariffs, which might activate restored trade war issues and market volatility in the near term.

Source: European Commission

” Counter tariffs aren’t a favorable signal as they recommend a possible recuperate from the opposite once again,” according to Marcin Kazmierczak, co-founder and chief running officer of blockchain oracle service company, RedStone.

This might see Bitcoin (BTC) review $75,000, he informed Cointelegraph, including that “provided stablecoins and RWAs [real world assets] stay at all-time-highs, it has the prospective to rebound.”

” I do not think that news will have a strong effect in the meantime, however we’ll observe the reaction on the United States end,” he included.

Related: Bitcoin reserve reaction signals impractical market expectations

Other experts still eye a short-term Bitcoin retracement listed below $72,000 as part of a “macro correction” throughout the present booming market cycle before Bitcoin’s next upper hand.

Still, import tariffs are not the only aspect affecting Bitcoin’s rate, Ryan Lee, primary expert at Bitget Research study, informed Cointelegraph, including:

” The rates are associated with larger financial conditions however are likewise affected by aspects beyond trade policies. Worldwide institutional adoption, regulative updates and high energy make it more durable than conventional monetary instruments.”

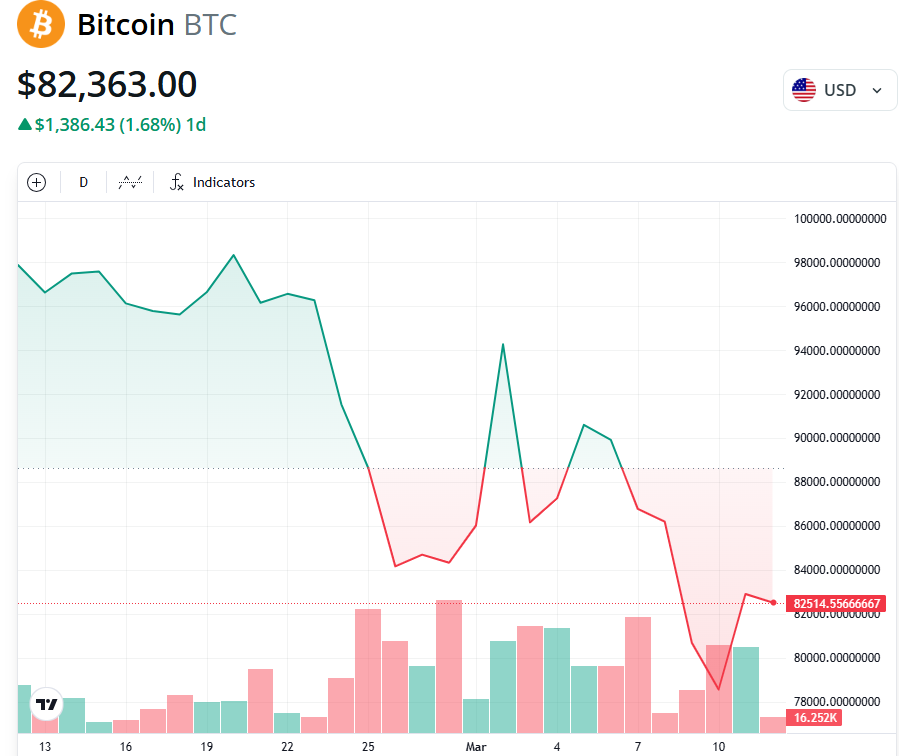

BTC/USD, 1-month chart. Source: Cointelegraph

Europe revealed its vindictive tariffs the very same day Trump’s increased 25% tariffs on all steel and aluminum imports worked. Europe’s present suspension of tariffs on United States items will end on April 1, and its brand-new tariffs will take complete result by April 13.

Related: Bitcoin might gain from United States stablecoin supremacy push

Worldwide trade tariff unpredictability might restrict markets till April 2

Standard and cryptocurrency markets might be restricted by tariff-related issues till April 2, according to Aurelie Barthere, primary research study expert at Nansen.”

” Tariff sound is most likely to continue till after April 2, and the mutual tariff statements, and after that settlements, and put a cover on threat cravings.”

” That stated, we observed tentative stabilization in the significant United States equity indexes and BTC the other day, at the low of their particular RSI, which we are keeping an eye on,” she included.

Trump threatened to “significantly increase” responsibilities on vehicles getting in the United States from Canada, set to work on April 2, unless Canada chooses to drop a few of its trade tariffs.

Publication: SCB suggestions $500K BTC, SEC hold-ups Ether ETF choices, and more: Hodler’s Digest, Feb. 23– March 1