On Wednesday, the United States Federal Reserve authorized a 25-basis-point rates of interest cut, marking the 3rd this year and lining up with market expectations. Common of its previous pre-FOMC cost action, Bitcoin rallied above $94,000 on Monday, however the media’s hawkish representation of the rate cut shows a Fed that is divided over the future of United States financial policy and the economy.

Provided the “hawkish” label connected with today’s rate cut, it’s possible that Bitcoin cost might offer on the news and stay range-bound up until a brand-new momentum chauffeur emerges.

CNBC reported that the Fed’s 9-3 vote is a signal that members stay worried about the durability of inflation, which the rate of financial development and rate of future rate cuts might slow in 2026.

According to Glassnode, Bitcoin (BTC) stays caught in a structurally delicate variety listed below $100,000, with the cost action constrained in between the short-term expense basis at $102,700 and the “Real Market Mean” at $81,300.

Glassnode information likewise revealed deteriorating onchain conditions, thinning futures need, and consistent sell pressure in an environment that continues to hold BTC listed below $100,000.

Secret takeaways:

-

Bitcoin’s structurally delicate variety kept the marketplace stuck listed below $100,000 with broadening latent losses.

-

Recognized losses have actually risen to $555 million/day, the greatest considering that the FTX collapse in 2022.

-

Heavy profit-taking from more than 1-year holders and the capitulation of leading purchasers are avoiding a recover of the STH-Cost Basis.

-

Fed rate cuts might stop working to considerably enhance Bitcoin cost in the short-term.

Time is going out for Bitcoin to recuperate $100,000

According to Glassnode, Bitcoin’s failure to break above $100,000 shown a growing structural stress: time is working versus the bulls. The longer the cost remained pinned within this delicate variety, the more latent losses built up, increasing the probability of required selling.

The relative latent loss (30-day-SMA) has actually increased to 4.4%, ending 2 years listed below 2% and indicating a shift into a higher-stress environment. Even with BTC’s bounce from the Nov. 22 low to approximately $92,700, the entity-adjusted understood loss continued climbing up, reaching $555 million/day, a level formerly seen throughout the FTX capitulation.

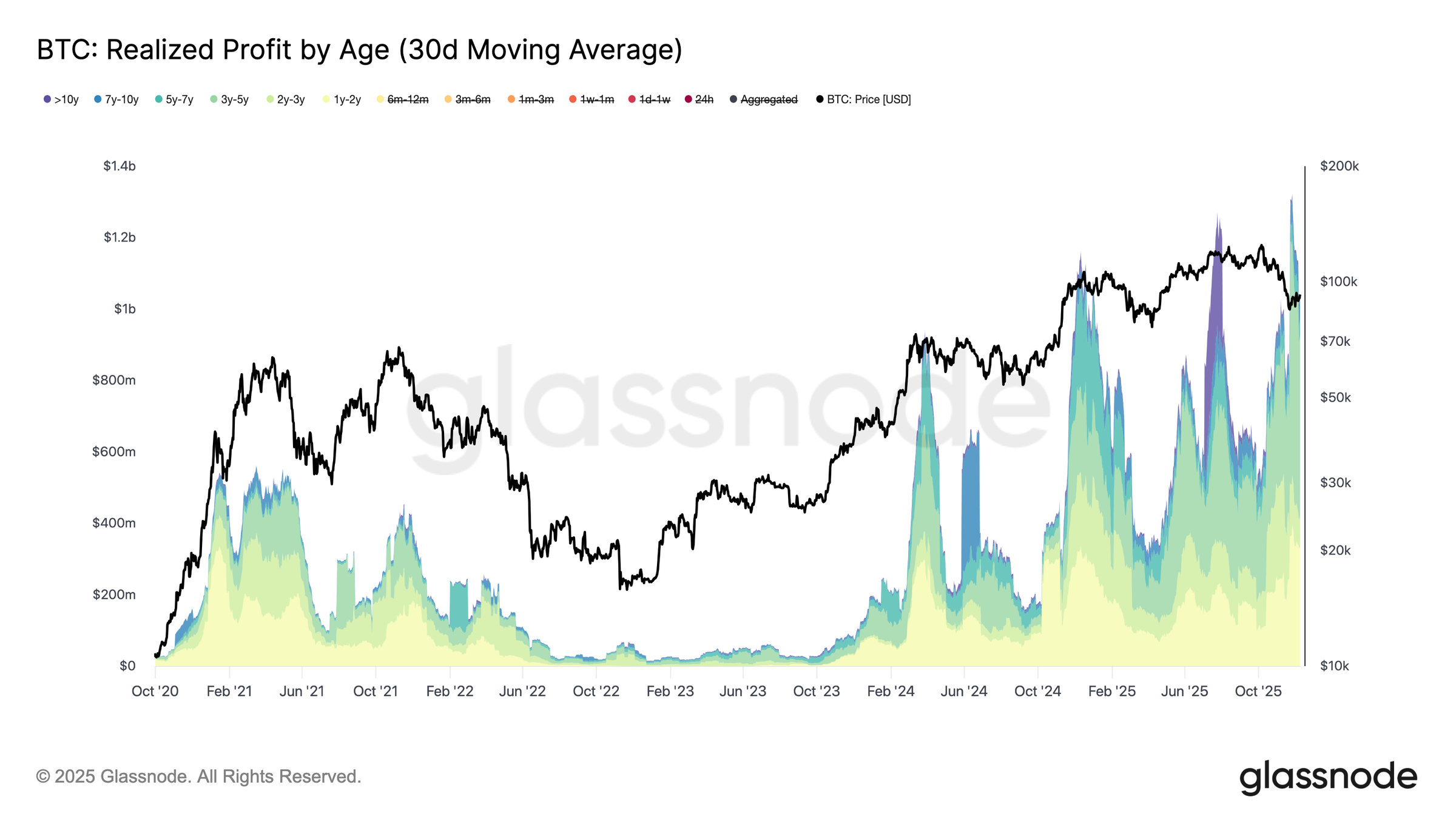

At the exact same time, long-lasting holders (above 1-year holding duration) understood more than $1 billion/day in revenues, peaking at a record $1.3 billion. This dynamic of capitulation from leading purchasers and heavy circulation from long-lasting holders, possibly kept BTC under the essential cost-basis limits, not able to retake the $95,000–$ 102,000 resistance band that topped the delicate variety.

Related: Bitcoin treks volatility into ‘challenging’ FOMC as $93.5 K annual open stops working

Spot-led rally satisfies decreasing BTC futures market

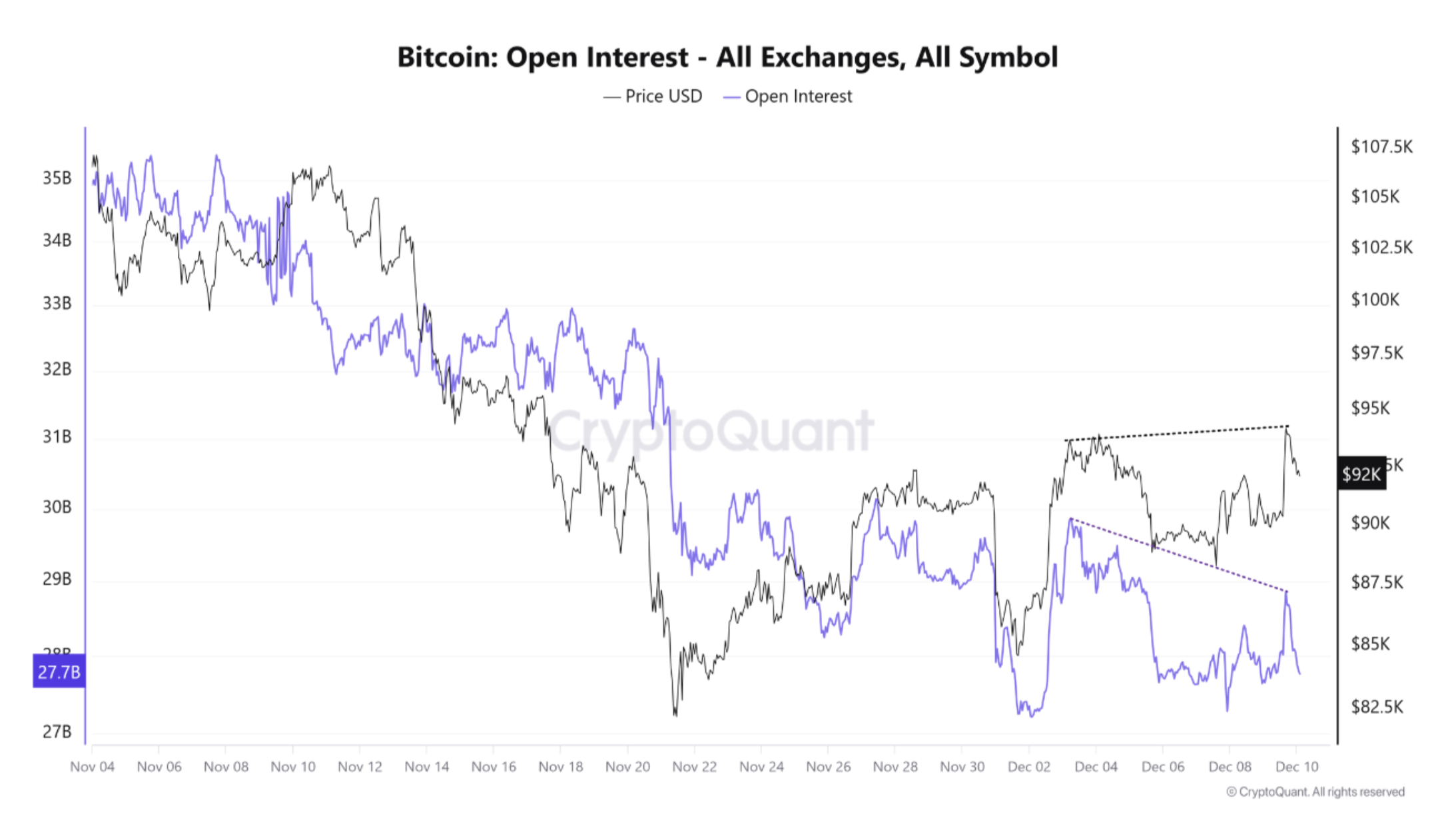

Information from CryptoQuant discovered that the crypto market has rallies ahead of FOMC conferences, however a significant divergence has actually appeared where Bitcoin’s cost has actually increased while open interest (OI) has actually been on a decrease.

OI decreased throughout the restorative stage considering that October, however even after BTC bottomed on Nov. 21, it continued to fall in spite of the cost relocating to greater highs. This marked a rally driven mostly by area need, instead of leverage-driven speculation.

CryptoQuant included that while spot-led uptrends are normally healthy, continual bullish momentum traditionally needs increasing leveraged positioning. Considered that derivatives volumes are structurally dominant, area volume represented just 10% of derivatives activity, which the marketplace might have a hard time to keep if rate-cut expectations compromise heading into the conference.

Related: Brief the dip and purchase the rip? What FOMC results expose about Bitcoin cost action

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.