A “3rd required” from the United States Federal Reserve might alter long-lasting financial policy if actioned, which might be problem for the dollar however great news for crypto.

The Fed has actually long been thought about to have a double required– rate stability and optimum work– however President Donald Trump’s choice for Fed guv, Stephen Miran, mentioned a “3rd required” previously this month, triggering speculation on the future of reserve bank financial policy.

The 3rd required is a statutory requirement buried in the Fed’s starting files, which specifies that the reserve bank in fact needs 3 goals: optimum work, rate stability and moderate long-lasting rates of interest.

The Trump administration appears prepared to utilize this forgotten statutory requirement as reason for more aggressive intervention in bond markets, possibly through yield curve control or broadened quantitative easing and cash printing, Bloomberg reported on Tuesday.

Decreasing long-lasting rates of interest

This 3rd objective has actually been mainly neglected for years, with the majority of considering it a natural by-product of attaining the very first 2, however Trump authorities are now mentioning it as legal cover for possible yield curve control policies, where the Fed purchases federal government bonds to target a wanted rate of interest.

Trump has actually long promoted for lower rates, calling Fed guv Jerome Powell “too sluggish” or “far too late” in minimizing them.

Related: Crypto markets get ready for Fed rate cut amidst guv shakeup

The administration wishes to actively reduce long-lasting rates of interest, and possible tools consist of increased Treasury costs issuance, bond buybacks, quantitative relieving or direct yield curve control.

Lower long-lasting rates would minimize federal government loaning expenses as nationwide financial obligation strikes a record $37.5 trillion. The administration likewise wishes to promote real estate markets by reducing home loan rates.

Favorable effect on crypto

Christian Pusateri, creator of file encryption procedure Mind Network, stated on Wednesday that the 3rd required is “monetary repression by another name,” including that it “looks a lot like” yield curve control.

” The rate of cash is coming under tighter control due to the fact that the olden balance in between capital and labor, in between financial obligation and GDP, has actually ended up being unsteady,” he stated.

” Bitcoin stands to take in enormous capital as the favored hedge versus the international monetary system.”

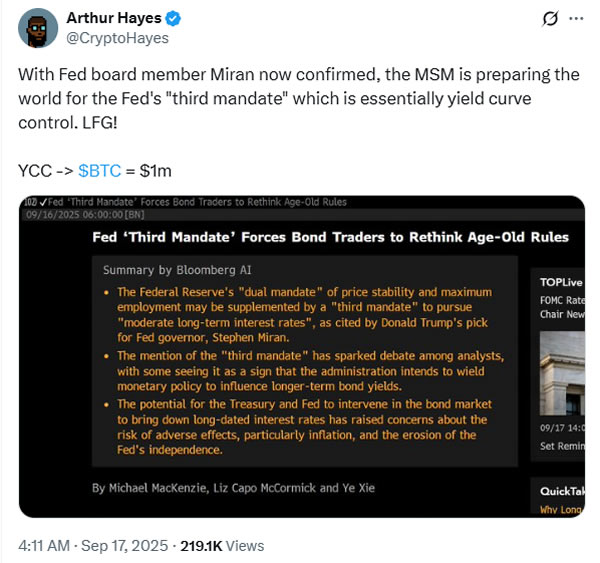

Outspoken BitMEX creator Arthur Hayes likewise stated it was bullish for crypto, recommending that yield curve control might send out Bitcoin to $1 million.

Publication: XRP to retest highs? Bitcoin will not go sideways for long: Hodler’s Digest