Bitcoin (BTC) has 4 brand-new crucial assistance levels to enjoy as a fresh wave of bearish BTC cost action intends to press the marketplace cost listed below $50,000.

Bottom line:

-

Bitcoin’s understood rates stay essential turning points as the marketplace forms a long-lasting flooring.

-

Binance users’ deposit expense basis is successive as a safeguard, states analysis.

-

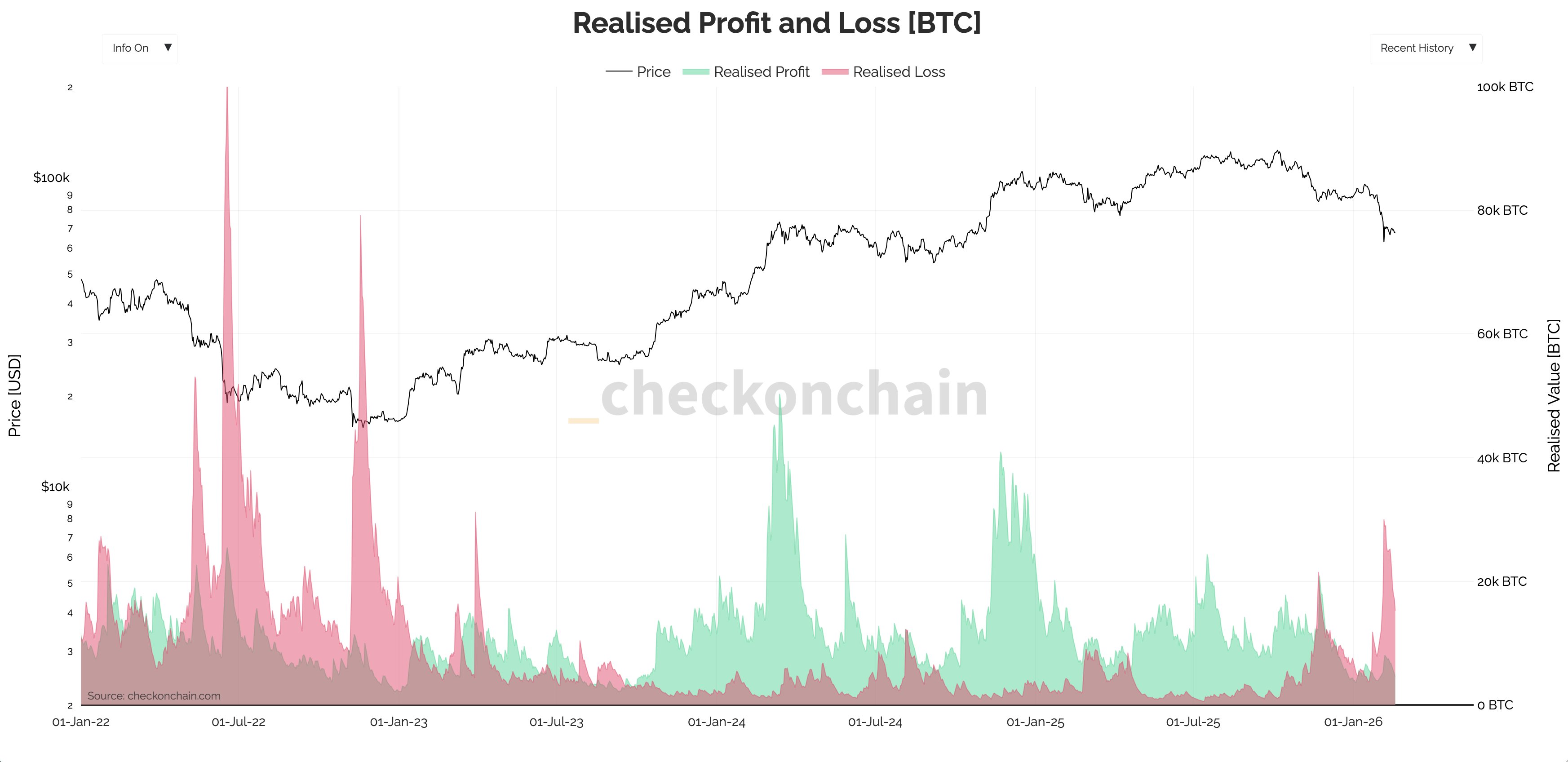

Understood losses reach levels hidden because completion of the 2022 bearishness.

BTC cost analysis puts concentrate on Binance traders

Brand-new analysis from Burak Kesmeci, a factor to onchain analytics platform CryptoQuant, sees $58,700 as Bitcoin bulls’ next line in the sand.

” Which 4 levels am I enjoying in Bitcoin? 4 crucial understood cost levels– important for tracking the long-lasting pattern in my view,” he composed in among CryptoQuant’s Quicktake article on Wednesday, entitled “Bitcoin’s Roadmap to the Bottom.”

Understood cost describes the aggregate expense basis of the BTC supply or a subset of it. When BTC moves onchain, its understood cost ends up being that at which it was last associated with a deal.

Understood rates that include bigger groups of coins can frequently operate as market assistance or resistance zones.

” Bitcoin has actually been dropping since it lost the New Whales’ expense basis– a traditional bear cycle signal,” Kesmeci kept in mind.

Newer Bitcoin whales’ aggregate buy-in cost stands at $88,700, however with the cost now far listed below, 3 others are on the radar. Older whales’ understood cost is the most affordable of the choice at $41,600, while Bitcoin’s total expense basis now sits at $54,700.

In between the existing area cost and those 2 levels, nevertheless, lies the understood cost for deposit addresses (UDA RP) on significant international crypto exchange Binance.

” From here, the 2 crucial assistances I’ll be enjoying in order are Binance UDA RP and Bitcoin RP (58.7 K and 54.7 K),” Kesmeci included.

” The factor: when Bitcoin falls listed below New Whales’ expense basis, it traditionally tends to a minimum of test the Understood Cost. And the only assistance standing in between here and there is 58.7 K.”

Bitcoin losses echo 2022 bearishness bottom

While panic offering from exchange users has actually cooled because BTC/USD rebounded from 15-month lows near $59,000 at the start of February, CryptoQuant information highlights the threat of additional capitulation.

Related: Bitcoin 2024 purchasers consistent BTC cost as trader sees $52K ‘next week approximately’

The percentage of the BTC supply presently held at a latent loss has actually reached 46%, its greatest reading because completion of Bitcoin’s 2022 bearishness.

” It deserves keeping in mind that the correction has actually been so serious that the boost in supply held at a loss has actually taken place extremely quickly,” CryptoQuant factor Darkfost talked about X throughout the $60,000 swing lows.

Recently, on the other hand, Darkfost reported likewise obvious levels of understood losses from Bitcoin financiers– coins moving at a lower cost than in their previous deal.

” At its peak, on February 5, understood losses went beyond 30,000 BTC,” he verified.

” This stays well listed below the severe levels observed throughout the last bearishness, when understood losses reached 92000 BTC and 80000 BTC on different celebrations. However, it is still a clear indication that a capitulation stage has actually happened.”

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.