Secret takeaways:

-

United States Treasury funds saw $19 billion inflows, the greatest given that March 2023, as the 30-year yield fell 30 basis points.

-

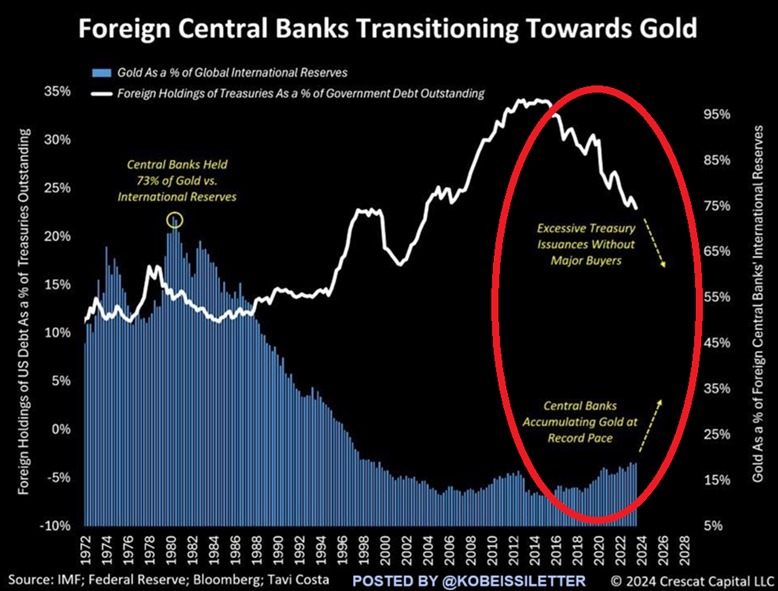

Foreign reserve banks cut United States Treasury holdings to 23%, a 22-year low, as gold reserves struck 18%.

-

Bitcoin skyrocketed in 2020 from $9,000 to $60,000 amidst comparable patterns, meaning a comparable result in 2025.

The worldwide monetary tides are moving substantially, and Bitcoin (BTC) rate might significantly take advantage of it. Current information suggests that United States Treasury funds saw $19 billion in net inflows recently, going beyond the 2020 pandemic peak of $14 billion, with the 4-week moving typical increasing to $7 billion– the greatest given that March 2023.

The 30-year United States Treasury yield fell by 30 basis points from its April peak, suggesting an increase in bond costs as financiers want to accept lower returns in exchange for the security of these bonds. This rise in need for Treasurys as a safe-haven possession increases market liquidity and stability while reducing United States loaning expenses.

Nevertheless, foreign reserve banks have actually rotated, cutting Treasury holdings to 23% of United States federal government financial obligation, a 22-year low. This recommends that while personal financiers were potentially driving inflows, foreign reserve banks are going back, potentially due to the continuous tariff conflict with the United States.

At the exact same time, gold’s share of worldwide reserves has actually risen to 18%, a 26-year high, up 8% given that 2015, with China doubling its gold reserves to 7.1% given that 2023.

This worldwide de-dollarization pattern mirrors a pattern that prefers Bitcoin. Throughout the 2020 pandemic, when United States Treasury inflows surged amidst COVID-19 unpredictability, Bitcoin skyrocketed from $9,000 to almost $60,000 by early 2021, with gold’s share of worldwide reserves increasing by 14.5% in 18 months.

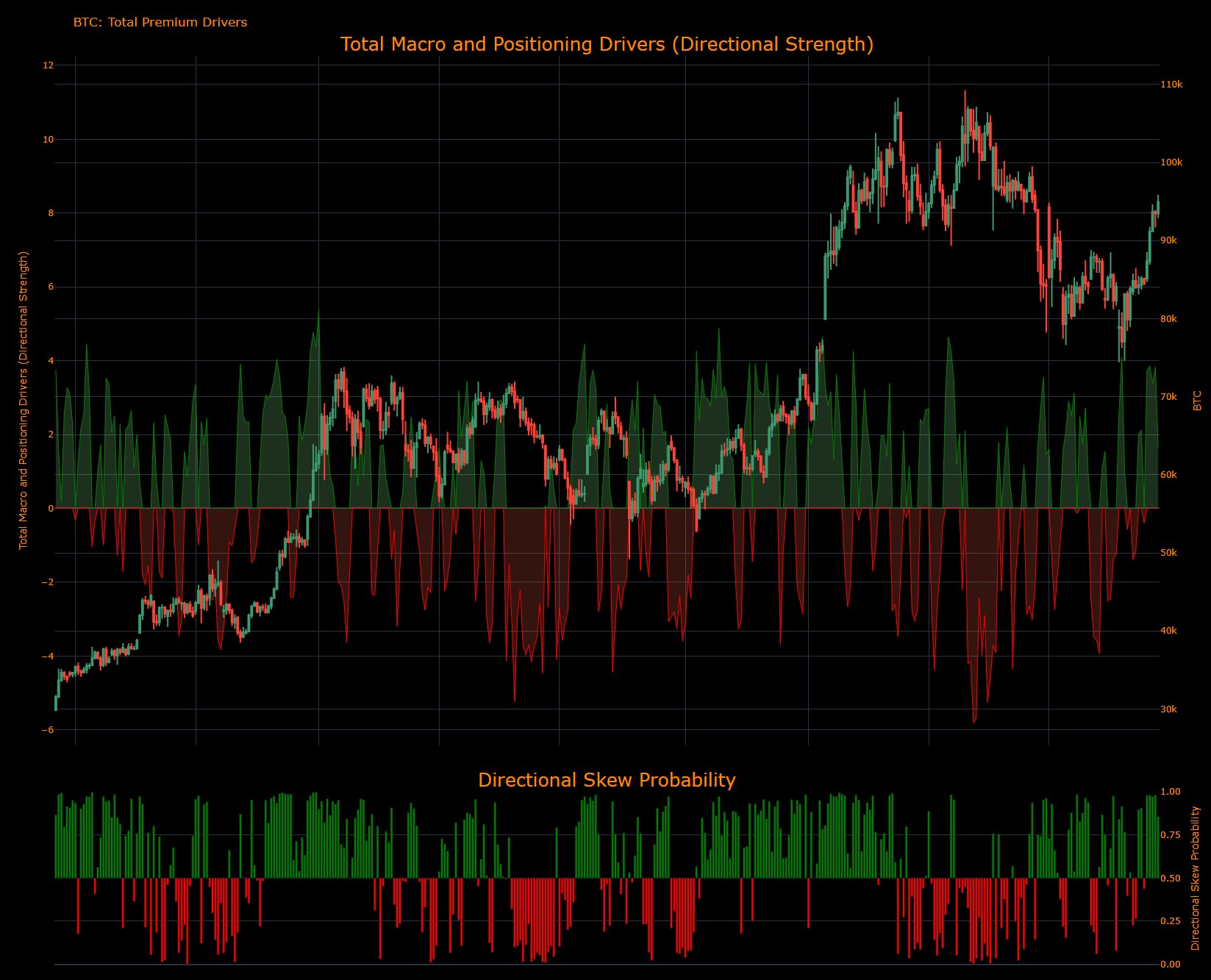

The present environment, marked by a supporting bond market and a reserve bank’s gold rush, indicates a comparable trigger for Bitcoin’s next bullish relocation. In 2023, when United States Treasury yields increased amidst economic crisis worries, Bitcoin acquired 47% in a month while the Nasdaq dropped 8.7%. With yields reducing and reserve banks signifying an absence of faith in the United States dollar, Bitcoin’s appeal as a worldwide shop of worth enhances.

Nevertheless, Bitcoin’s bullish story might fail if worldwide markets go into an economic downturn in 2025. This is because of financiers’ choice to focus on liquidity and conventional safe-haven properties like money or United States Treasurys throughout financial declines, as kept in mind recently, over speculative properties like Bitcoin.

Related: Bitcoin advantage might stop at $100K regardless of $3B in ETF inflows

Google look for “Bitcoin” at long-lasting lows, states Bitwise CEO

Confidential worldwide markets scientist Capital Streams kept in mind that macroeconomic liquidity and positioning aspects drive Bitcoin’s bullish rate trajectory. The expert highlighted BTC’s impulse strength in a directional possibility alter chart, recommending that it is poised for an upward motion.

This lined up with Bitwise CEO Hunter Horsley’s observation that Google look for “Bitcoin” are near long-lasting lows, recommending the rally is sustained by organizations, advisors, corporations, and countries instead of retail financiers.

The absence of retail-driven search interest contrasts with historic patterns where Bitcoin search volume highly associated with its rate in the previous cycle (r= 91%, per SEMrush information), suggesting a shift in market characteristics where institutional adoption is sustaining need.

Related: Bitcoin ‘power law’ design projections $200K BTC rate in 2025

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.