The rate of gold struck an all-time high after United States President Donald Trump discussed inflation on his social networks platform, however Bitcoin was relocating the opposite instructions on Monday, in what might be viewed as an example of Bitcoin’s “split character.”

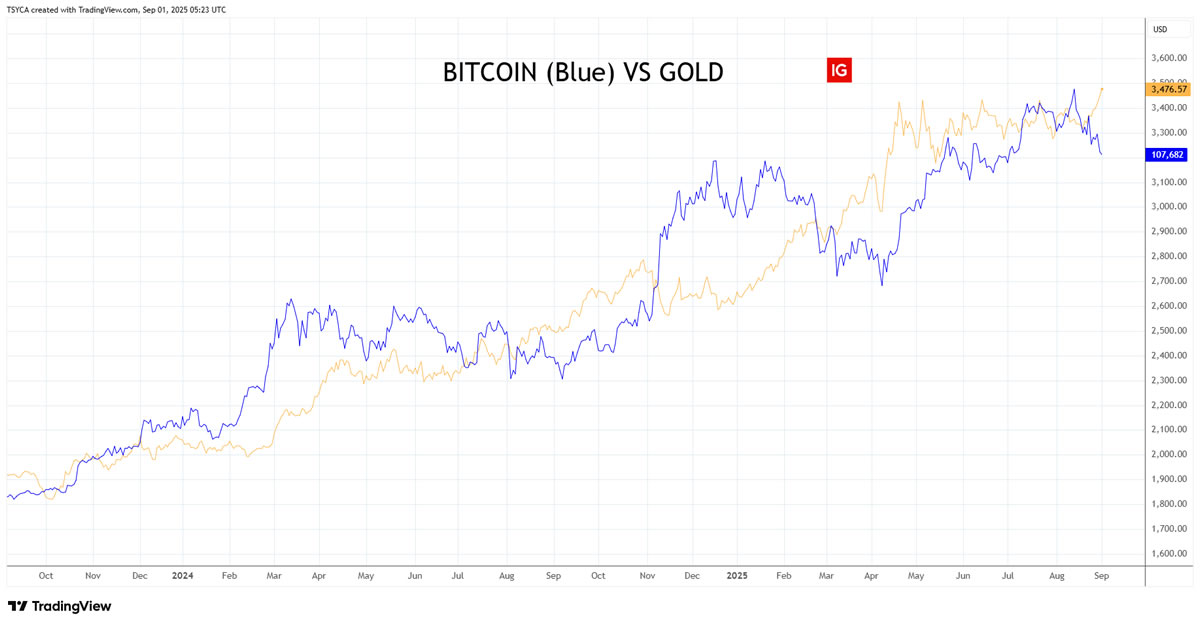

Over the previous 2 and a half years, there has actually been a strong connection in between gold, Bitcoin, and the Nasdaq, with all of them ripping greater, IG market expert Tony Sycamore informed Cointelegraph.

” Nevertheless, there has actually been a breakdown in the connection in between gold and Bitcoin in current weeks, which isn’t unusual for short durations and comes due to Bitcoin’s split character.”

” Sometimes, Bitcoin is deemed a shop of worth or a safe house, and at other times it’s deemed a threat possession,” he included.

The rate of gold reached its greatest ever level on Monday, reaching $3,485 per ounce after a 1% spike, according to GoldPrice. It followed Trump published to his social networks platform Fact Social on Sunday, mentioning, “rates are ‘METHOD DOWN’ in the U.S.A., with essentially no inflation.”

On The Other Hand, Bitcoin (BTC) has actually been up to its most affordable level given that early July in a divergent relocation.

It was up to a two-month low of $107,290 on Coinbase on Monday early morning, according to TradingView. This has actually led to its inmost correction from the mid-August all-time high, as the pullback surpassed 13%.

Bitcoin-gold connection questioned

” Nowadays, Bitcoin and gold aren’t actually moving together,” Vince Yang, co-founder of Ethereum layer-2 platform zkLink, informed Cointelegraph.

” The connection’s been quite low, even unfavorable sometimes this year. Gold’s still the traditional ‘safe-haven’ play, while Bitcoin is more connected to liquidity and market danger,” he stated. “Essentially, they stabilize each other out instead of run side by side.”

Nevertheless, Sycamore thinks the connection in between Bitcoin and gold might ultimately straighten, as it has actually done previously.

Related: Bitcoin threats brand-new 2025 correction as BTC rate uptrend begins 7th week

” Zooming out, I presume if Trump is going to run the economy red hot and the Fed cuts rates into consistent inflation, Bitcoin’s connection with gold will reassert itself and both will go higher,” he stated.

” It’s simply a concern from what level Bitcoin discovers its toehold,” he included.

Bitcoin might simply be lagging gold

On the other hand, historic information reveals Bitcoin’s rate rallies within 150 days of gold striking brand-new all-time highs.

Gold rates reached a brand-new peak above $2,000 in 2020 throughout the pandemic, which preceded Bitcoin’s rise to an all-time high the list below year.

Joe Consorti, head of development at Theya, stated previously this year that Bitcoin follows gold’s directional predisposition with a lag of 100-150 days at a time.

Publication: XRP ‘cycle target’ is $20, Technique Bitcoin claim dismissed: Hodler’s Digest, Aug. 24– 30