As gold reached brand-new highs above $3,500, Peter Schiff– a popular gold supporter and Bitcoin critic– argued that the rare-earth element is cash, sustaining reaction from the crypto neighborhood.

” Gold is not simply any product, it’s cash,” Schiff composed in an X post on April 22 after gold costs quickly broke above $3,500.

While applauding gold, Schiff sounded the alarm about the state of the economy, highlighting that gold’s irregular rally in the previous couple of weeks holds unfavorable ramifications for the United States dollar.

” This is completion of the United States dollar’s supremacy. Life in America will alter in methods couple of can think of,” he mentioned.

Gold is up 31% YTD, USD is down 9%

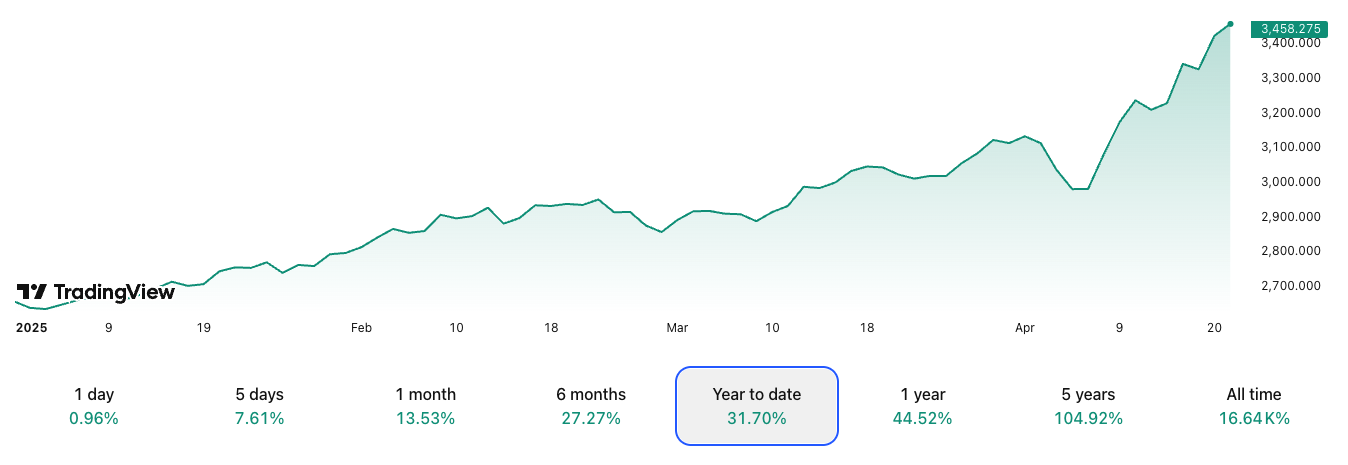

Schiff’s remarks came amidst gold futures rising to a record-breaking $3,500 on April 22, while area gold has yet to touch the turning point after reaching $3,498 on Tuesday, according to TradingView.

Because the start of 2025, area gold has actually acquired as much as 31.6% of worth, while its 1 year cost is up more than 44%.

The United States dollar has actually seen a noteworthy decrease year-to-date, with the United States Dollar Index (DXY) toppling more than 9% in 2025, based upon TradingView information.

Neighborhood concerns gold as “cash”

Schiff’s observations on the state of the United States dollar in the context of gold’s rally have actually gotten some traction on social networks, however lots of analysts have actually questioned whether the term “cash” represents gold.

Some crypto neighborhood members particularly highlighted that gold stops working to work as a feasible payment technique, among the 4 fundamental functions of cash.

” I shaved a bit off my gold bar at Starbucks today. They accepted it as payment. Very first time in a while,” cryptocurrency supporter Mike Alfred reacted in Schiff’s X thread, describing gold being seldom utilized as a technique of payment.

Related: Jack Dorsey presses Signal to embrace Bitcoin payments

Unlike gold, cryptocurrencies like Bitcoin (BTC) have the ability to serve the payment usage case, lots of posters worried.

” I spent for my hairstyle recently in Bitcoin,” one analyst stated, including:

” Merchants will not accept gold since how do they evaluate if it’s genuine?”

Amidst the continuous gold rally, the story of gold versus “digital gold” Bitcoin has actually been on the increase. According to Cathie Wood, a significant Bitcoin bull and ARK Invest creator, Bitcoin is a “much larger concept than gold,” and has a prospective to acquire from gold’s $23 trillion market.

Others think that gold and Bitcoin must not be viewed as rivals since the possessions are various in their nature and have various objectives.

Publication: Altcoin season to strike in Q2? Mantra’s strategy to win trust: Hodler’s Digest, April 13– 19