Gold, among the earliest and most relied on shops of worth, suffered a ruthless sell-off in simply 24 hr, erasing trillions of dollars in market price, more than the whole worth of Bitcoin.

The gold market extended Tuesday’s huge correction, with $2.5 trillion being removed from its market cap on Wednesday, according to the monetary analysis publication, The Kobeissi Letter.

Putting gold on track for its biggest two-day decrease because 2013, the 8% drop has actually triggered panic amongst financiers who had actually turned to the metal as a hedge versus inflation and market volatility after its 60% rise previously in 2022.

Although Bitcoin (BTC)– frequently called “digital gold” for its capped supply– is understood for far sharper everyday corrections with double-digit percent decreases, gold’s newest crash highlights that even “safe-haven” possessions aren’t unsusceptible to high sell-offs.

Gold’s 7% drop is unusual: Here’s why it crashed

The scale of the correction is extremely uncommon and in theory would just take place “as soon as every 240,000 trading days,” Alexander Stahel, a resources financier in Switzerland, observed in a post on X on Tuesday.

” Gold is offering us a lesson in data,” he stated, including that the property has actually dealt with even larger drawdowns because 1971, with such corrections counting 21 times.

Resolving the factors behind the dip, Stahel indicated the growing worry of losing out (FOMO), as “gold craze” momentum developed amidst financiers significantly looking for direct exposure to gold equity, physical gold bars and tokenized gold.

” FOMO triggered the current upper hand. Now, earnings taking and weak hands got cleaned,” Stahel stated, including that statistically there are possibilities that “calmer days are ahead.”

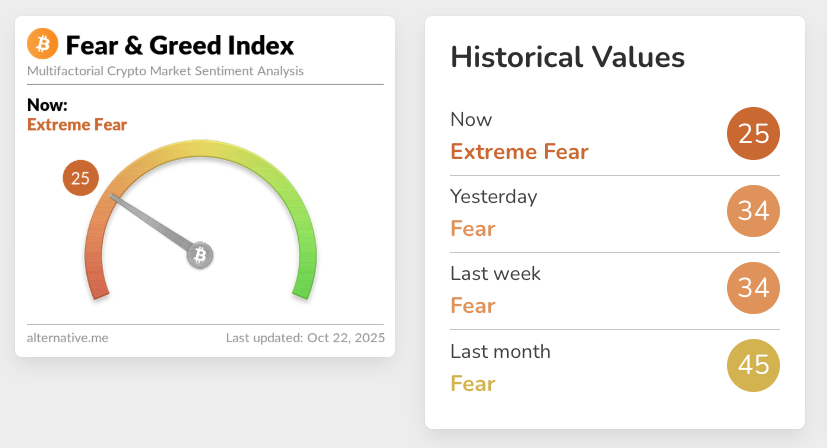

Crypto Worry & & Greed Index at least expensive levels because 2022

As gold’s $2.5 trillion dip exceeds Bitcoin’s whole market cap of $2.2 trillion, some analysts highlighted the magnitude of the correction in contrast to the crypto market.

” In regards to market cap, this decrease in gold today amounts to 55% of the worth of every crypto currency out there,” experienced trader Peter Brandt composed in an X post on Tuesday.

Bitcoin, which has actually long been slammed for volatility as one of the essential arguments versus being a genuine shop of worth, has likewise slipped 5.2% from its intra-day high of $114,000, though everyday losses had to do with 0.8% at the time of composing, according to Coinbase information.

While Bitcoin area exchange-traded funds (ETFs) likewise saw $142 million inflows the other day, the more comprehensive crypto market momentum plunged into “Extreme Worry,” with the Crypto Worry & & Greed Index plunging to levels not seen because December 2022.

Related: Bitcoin-gold connection increases as BTC follows gold’s course to shop of worth

Gold’s continuous volatility came weeks after Deutsche Bank’s macro strategist Marion Laboure observed a set of parallels in between gold and Bitcoin, which might possibly make the crypto property an enticing shop of worth.

Deutsche Bank’s experts likewise worried that regardless of parabolically breaking brand-new highs in dollar terms, gold just exceeded its real-adjusted all-time highs in early October.

Publication: Bitcoin to suffer if it can’t capture gold, XRP bulls back in the battle: Trade Tricks