How Bitcoin increased amidst skyrocketing United States financial obligation

While Washington, DC printed trillions, Bitcoin mined block by block, silently progressing from digital experiment to international property class.

As policymakers increased federal government costs and executed stimulus procedures, the United States nationwide financial obligation rose to over $37 trillion, triggering fret about inflation, currency decline and long-lasting financial stability.

On the other hand, Bitcoin’s (BTC) restricted supply and decentralized structure have actually drawn growing interest from people, organizations and even sovereign wealth funds searching for options to standard currency dangers. Gradually, as the United States financial obligation continued to climb up, Bitcoin’s worth skyrocketed, driven by speculation and increasing hesitation towards traditional monetary systems.

Here is a summary of Bitcoin vs. the United States nationwide financial obligation:

Did you understand? In 2010, Bitcoin’s very first taped rate was simply $0.003. At that rate, $1 might purchase over 300 BTC, which deserves millions today.

Bitcoin’s parallel climb: From no to trillion-dollar property

Because its intro in January 2009, Bitcoin has actually changed from a small experiment into a trillion-dollar property, considerably affecting international financing and culture. A number of crucial aspects have actually added to this remarkable development.

Digital deficiency and credibility

- Bitcoin’s repaired supply of 21 million coins, protected by a decentralized proof-of-work (PoW) system, developed digital rarity.

- Bitcoin got a credibility as “digital gold” due to issues over inflation, currency weakening and decreasing rely on banks, driving financiers to options.

Institutional and international adoption

- Significant institutional turning points verified its reliability, consisting of approval of Bitcoin ETF applications by BlackRock and Fidelity in January 2024.

- Business like Metaplanet and GameStop went into the Bitcoin area, additional legitimizing it.

- El Salvador embraced Bitcoin as legal tender, and Latin American areas broadened Bitcoin mining operations.

Market price and monetary combination

- Bitcoin’s market cap ($ 2.1 trillion) competitors gold ($ 22.9 trillion), silver ($ 2 trillion) and significant stock exchange in spite of doing not have main management, monetary declarations or physical limits.

- Mainstream approval grows through ETFs and Bitcoin-backed monetary items. For example, Method (previously MicroStrategy) provided 2.5 million shares of 10% Continuous Stride chosen stock to raise $250 million to purchase Bitcoin.

- Efforts like the Strategic Bitcoin Reserve (SBR), moneyed with taken Bitcoin, are planned to function as long-lasting tactical possessions for the country.

- El Salvador has actually protected regulative approval for its Bitcoin-backed “Volcano Bonds,” which are created to assist handle sovereign financial obligation and fund the advancement of the prepared Bitcoin City. While preliminary preparations have actually been finished, the issuance has yet to emerge.

Cultural effect

- Bitcoin conversations have actually moved from online forum conversations to business conference rooms. It has actually redefined how individuals consider cash, trust and authority, sustaining an international shift towards decentralization. Accepted by activists, technologists and even artists, Bitcoin represents monetary flexibility and resistance to centralized control. From memes and mottos to political demonstrations and star recommendations, it has actually entered into international popular culture. Whether viewed as digital gold or a motion, Bitcoin’s genuine tradition might be its function in improving how society views power and ownership.

- Bitcoin Ordinals and Runes have actually included a lively cultural layer to Bitcoin, making it possible for NFTs and fungible tokens straight on its blockchain. This growth has actually brought in artists, collectors and meme neighborhoods, changing Bitcoin from a simply monetary property into a more comprehensive platform for digital imagination and cultural expression. Signs such as laser eyes and Bitcoin statues represent its function as a motion for financial flexibility and digital autonomy.

Timeline of crucial turning points in Bitcoin’s history

- 2009: Goes For $0

- 2010: Very first market value ($ 0.003)

- 2017: Crosses $20,000 for the very first time

- 2021: Strikes $1-trillion market cap

- 2024: Goes Back To ~$ 70,000 variety amidst institutional adoption and ETF approvals

- 2025: Rises previous $110,000 as sovereign adoption, ETF inflows and treasury methods drive record highs.

Did you understand? Bitcoin struck $1,000 for the very first time in late 2013, driven by increasing adoption in China and early enjoyment around crypto exchanges.

Bitcoin vs. fiat: 2 clashing financial designs

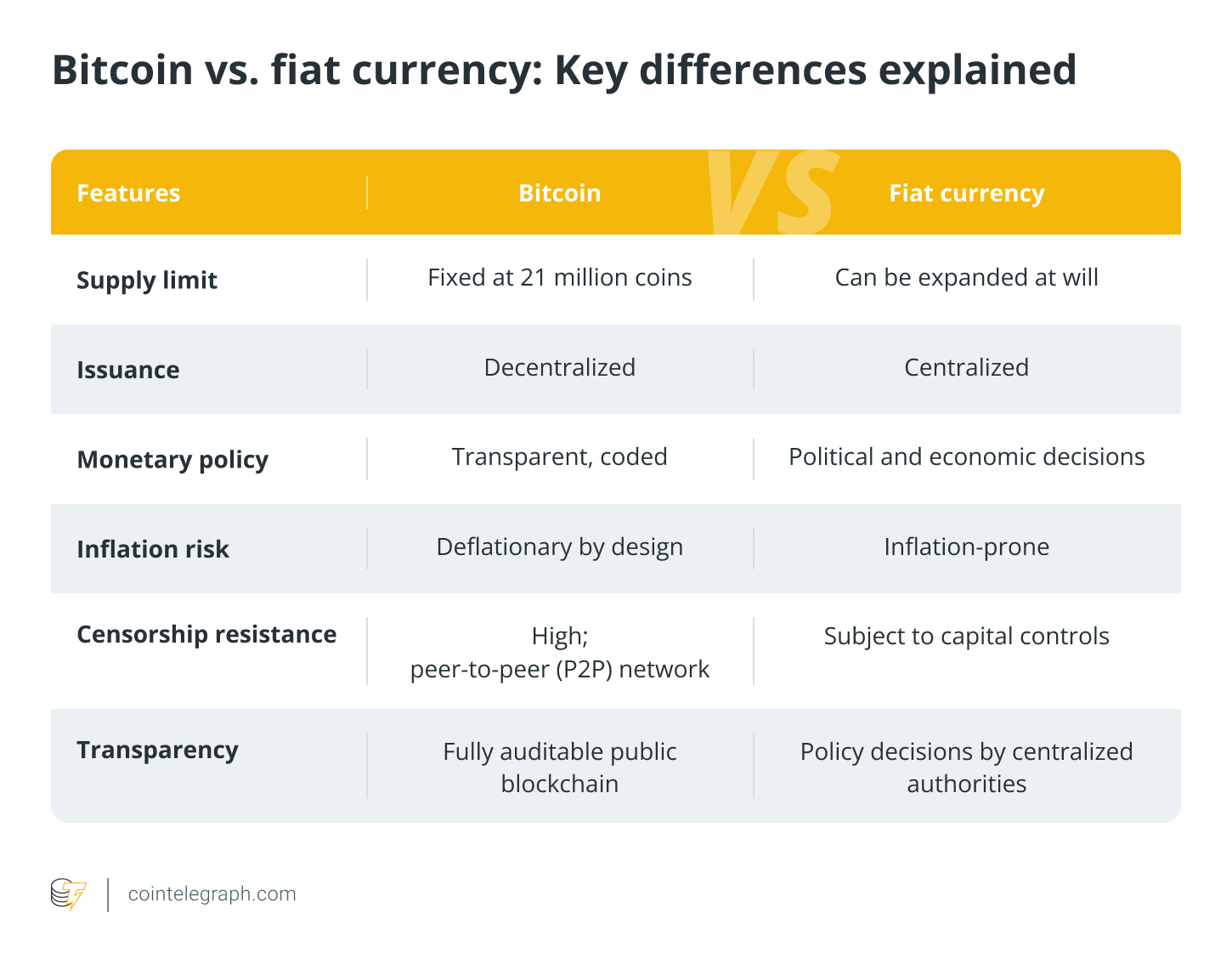

Bitcoin and fiat currencies embody 2 essentially various financial systems. While fiat systems, like the United States dollar, depend on centralized control and versatile cash supply, Bitcoin provides a decentralized, fixed-supply option.

Federal governments and reserve banks, which provide fiat currencies, can increase the cash supply at will by printing currency notes, loaning and financial stimulus. While this method permits versatility in resolving financial difficulties, it likewise leads to inflation. Currency gets deteriorated and nationwide financial obligation increases, as evidenced by the United States’s $37-trillion financial obligation.

In 2025, Bitcoin’s market price is around $2.1 trillion, contrasting dramatically with increasing nationwide financial obligations. The UK’s financial obligation has actually exceeded 2.8 trillion British pounds ($ 3.4 trillion), while the EU’s cumulative public financial obligation surpasses $16 trillion. China’s public financial obligation stands even greater at over $16.6 trillion.

On the other hand, Bitcoin runs on a decentralized design with a repaired supply of 21 million coins. It is created to be unsusceptible to centralized control or financial growth. Bitcoin is launched in flow through a foreseeable, transparent mining procedure, making sure deficiency. Unlike fiat currencies, which can decline due to policy choices, Bitcoin’s strength depends on its resistance to decline, censorship and control.

As federal governments continue to depend on debt-driven costs, Bitcoin provides an alternative as a deflationary property independent of standard monetary systems. This contrast fuels continuous conversations about financial self-reliance, long-lasting wealth security and the future of cash.

A contrast of Bitcoin and fiat currencies as financial designs

What Bitcoin attained while the United States invested

Bitcoin silently established as an unique monetary system as the United States federal government increased its financial obligation. While fiat financial obligation grew by trillions, Bitcoin advanced technically, got institutional assistance and broadened internationally.

Here are numerous methods Bitcoin has actually grown:

- Institutional adoption: Significant monetary companies, consisting of BlackRock, Fidelity, Metaplanet, Method and Tesla, included Bitcoin to their financial investment portfolios as a reserve property. GameStop upgraded its treasury policy in March to hold Bitcoin, obtaining approximately 4,710 BTC (roughly $513 million) in Might 2025. As soon as understood for selling and leasing computer game, GameStop is following Method, which makes use of Bitcoin as a treasury reserve property.

- Regulative approval: In January 2024, area Bitcoin ETFs got regulative approval, making it simpler and more certified for standard financiers to gain access to Bitcoin. This turning point highlighted Bitcoin’s increasing approval by regulators and monetary markets. By January 2025, area Bitcoin ETFs saw $129 billion in inflows. In 2025 alone, inflows have actually reached about $45 billion, consisting of a single-day boost of $408 million on June 16, 2025, mostly driven by iShares Bitcoin Trust ETF (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC).

- Adoption of Bitcoin as legal tender: El Salvador ended up being the very first nation to embrace Bitcoin as legal tender in 2021, leading the way for other countries to think about cryptocurrency. This action showed Bitcoin’s possible as an option to standard currency systems, specifically for nations seeking to minimize dependence on fiat.

- Network upgrades: The innovation behind Bitcoin has actually enhanced considerably considering that its creation in 2009. Lightning Network (2016) allowed quick microtransactions, Taproot (2021) increased personal privacy and deal effectiveness, Ordinals (2023) permitted embedding digital material on the blockchain, and Runes (2024) broadened token development, improving Bitcoin’s performance.

- International liquidity and market habits: Bitcoin’s trading patterns started to look like those of significant macro possessions, frequently compared to the “Spectacular 7” tech stocks like Apple and Nvidia. Its rate now reacts not simply to crypto-specific news however likewise to wider risk-on and risk-off shifts in international markets. This positioning with high-growth equities shows Bitcoin’s progressing function as a speculative yet tactical property, drawing both chance and systemic danger along with the wider market.

Did you understand? In December 2017, Bitcoin escalated to almost $20,000 before crashing 80% in 2018, highlighting its severe rate volatility.

What if simply 1% of every significant federal stimulus plan had actually entered into BTC

Because 2020, the United States has actually passed numerous enormous stimulus plans amounting to around $7.6 trillion. If simply 1% of that had actually been assigned to Bitcoin, the overall financial investment would be: $7.6 trillion x 1% = $76 billion.

Let’s comprehend how.

Significant stimulus plans

- CARES Act, formally the Coronavirus Help, Relief, and Economic Security Act (March 2020): $2.2 trillion, implying $22 billion into Bitcoin ($ 2.2 trillion x 1% = $22 billion).

- Consolidated Appropriations Act (December 2020): $2.3 trillion, implying $23 billion into Bitcoin ($ 2.3 trillion x 1% = $23 billion).

- American Rescue Strategy (March 2021): $1.9 trillion, implying $19 billion into Bitcoin ($ 1.9 trillion x 1% = $19 billion).

- Other COVID-era and facilities programs (2021-2023): ~$ 1.2 trillion, implying $12 billion into Bitcoin ($ 1.2 trillion x 1% = $12 billion).

- Overall possible BTC financial investment: $76 billion (based upon the quantity assigned towards financial stimulus).

Market effect

Bitcoin’s market cap (June 2025) is $2.1 trillion.

Now, $76 billion ÷ $2.1 trillion = 3.62% of existing market cap.

A capital injection of this size, specifically focused, might result in a 5% -15% rate gratitude, enhanced by Bitcoin’s low float and high level of sensitivity to big buys.

What would it alter?

- Cost impact: $76 billion might have included $100 billion-$ 300 billion in market cap through multiplier impacts.

- Federal government recognition: Crypto’s understanding as a speculative fringe property may have moved to “sovereign-worthy.”

- Volatility: More comprehensive ownership minimizes retail-driven cycles.

- Policy ramifications: A strong relocation like this would have challenged international financial orthodoxy.

Therefore, even a 1% allowance would have changed Bitcoin into a federally backed reserve-like property, developing causal sequences throughout financial policy, international financing and digital property adoption.

Compromises and dangers

Nevertheless, funneling public funds into Bitcoin has its disadvantages. Bitcoin is still an extremely unstable property, susceptible to sharp drawdowns (e.g., ~ 70% in 2022). Designating taxpayer-backed stimulus into such a property might provoke political reaction, specifically throughout declines. There is likewise the concern of control; unlike bonds or facilities jobs, Bitcoin provides no ensured yield, governance take advantage of or domestic task development. While the benefit might be enormous, so would the examination and systemic danger direct exposure.