Secret takeaways:

-

Bitcoin onchain information reveals no indications of getting too hot, regardless of reaching an all-time high of $126,000.

-

Bitcoin cup-and-handle pattern targets $300,000, backed by several aspects.

Bitcoin (BTC) traded 4% listed below its brand-new all-time high of $126,000 reached on Monday. As BTC rate combines around $122,000, a number of market experts are encouraged that the bull cycle is not over.

Bitcoin market is not overheated yet

For crypto expert Mark Moss, Bitcoin has actually not yet reached its peak variety.

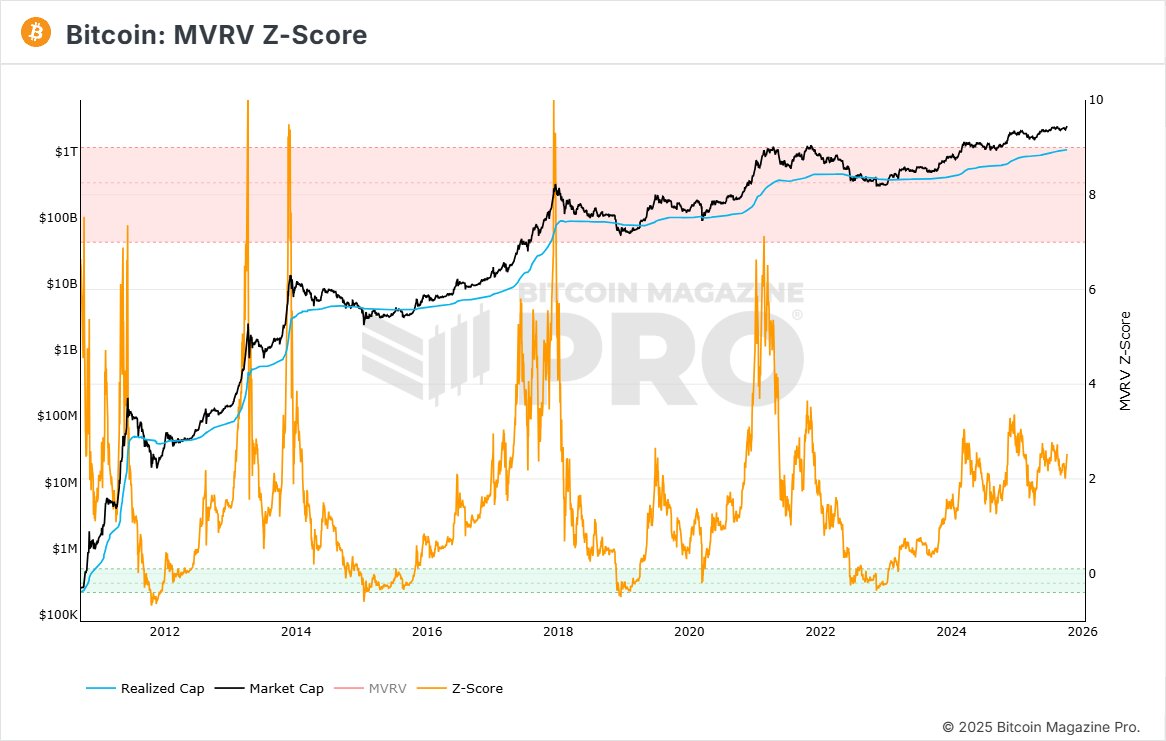

While Bitcoin trades near all-time highs, its MVRV Z-Score stays far listed below levels traditionally connected with market tops. This divergence recommends the present rally might still have space to run.

Related: ‘ Numerous simulations’ pin Bitcoin at 50% chances of $140K this month

The MVRV Z-Score determines how far Bitcoin’s market price differs its understood worth, a proxy for the capital in fact invested into the network.

” Bitcoin is breaking out to brand-new ATHs, and yet it’s not looking anywhere near cycle peaks,” Mark Moss stated in an X post on Tuesday.

He included that favorable principles, consisting of quantitative easing (QE) by the United States Federal Reserve, record area BTC inflows, consistent purchasing by Bitcoin treasury business, and market shift to “debasement trade,” might press Bitcoin rate greater in Q4 2025.

Likewise, CoinGlass’ booming market peak signals, a choice of 30 prospective selling activates focused on capturing long-lasting BTC rate tops, are revealing no indications of getting too hot. In reality, none of the indications are flashing a leading signal.

YouTuber Jesus Martinez, in specific, highlighted the Pi Cycle Top indication to show that “Bitcoin still has a great deal of space for development.”

” The dollar is crashing, the world’s financial system is falling apart, and thinking about markets have no place near the retail interest seen in 2021, we are still in a development stage,” Martinez stated, including:

” The Pi Cycle Top Indication is targeting a $200K Bitcoin today.”

Cointelegraph likewise reported that Bitcoin’s short-term holder MVRV rates bands are well listed below overheated levels, signifying that BTC still has space for growth.

Bitcoin rate might rally to $300,000

The weekly candle light chart reveals that the rate broke above the cup-and-handle neck line at $69,000 in November 2024. The BTC/USD set is still confirming the breakout and might increase to finish the optimum range in between the cup’s trough and the neck line.

That puts Bitcoin’s cup-and-handle breakout target for 2025– 2026 at around $303,000, according to chartist Gert van Lagen.

Such a relocation would represent a 147% rally from the present levels.

” Bitcoin’s brand-new all-time high is simply the start,” stated a technical expert, Jonathan Carter, while highlighting a comparable setup on the two-day chart.

An effective breakout might see the BTC/USD set “rise towards targets at $135,000, $145,000, and $160,000,” Carter stated, including:

” The long-lasting bullish target for this cycle is anticipated to reach in between $200,000 and $250,000.”

As Cointelegraph reported, extreme profit-taking at greater levels might see Bitcoin bull back towards $114,000, in the short-term, possibly offering an entry point for late longs, before the uptrend resumes.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.