Hive Digital Technologies (HIVE) is continuing its change from a pure-play crypto miner to a high-performance computing (HPC) providers.

What started with a fleet of 400 GPUs handled by 2 workers is now scaling towards a $100 million yearly earnings. The business is leveraging innovative AI chips, consisting of Nvidia’s H100s and the upcoming Blackwell GPUs, to drive this development.

Co-founder and Executive Chairman Frank Holmes and CEO Aydin Kilic elaborated on Hive’s method in an unique interview with Cointelegraph at the Nasdaq Stock market head office in New york city City, where the business sounded the closing bell on Thursday.

The executives detailed Hive’s continuous diversity into AI. Like other miners, Hive recognized AI as a possibly more successful usage of energy than Bitcoin (BTC) when determined in kilowatt-hours. This insight has actually led numerous crypto mining business to include AI processing into their facilities, specifically to counter decreasing success following the 2024 halving.

According to Holmes, Hive was the very first openly traded miner to pivot into HPC in 2022. By the 2nd quarter of 2023, HPC earnings appeared on the business’s earnings declaration for the very first time, and it has actually because grown to a $20 million yearly run rate, with an objective of reaching $100 million by 2026.

Still, scaling HPC capability should be approached thoroughly, offered the continuous “scramble for electrical energy and land,” stated Kilic.

In reaction, Hive just recently obtained a website near Pearson International Airport in Toronto, Canada, protecting a tactical area efficient in scaling approximately 7.2 megawatts of HPC power.

The option of Toronto was deliberate as it puts Hive at the heart of a robust pipeline of AI skill, consisting of connections to the University of Toronto and Canada’s AI environment.

In spite of the capital shift, Hive has actually preserved favorable gross mining margins every quarter, even throughout Bitcoin’s high slump in 2022. Kilic credits this to Hive’s tight functional structure and continued financial investment in hardware, attaining worldwide energy performance as low as 17.5 joules per terahash (J/TH).

Publication: AI might currently utilize more power than Bitcoin– and it threatens Bitcoin mining

Hive stock is still carrying out as a Bitcoin proxy

In spite of Hive’s pivot into higher-margin markets like high-performance computing, its stock continues to act like a Bitcoin proxy, restricting its appraisal upside, according to Kilic and Holmes.

Following the business’s closing bell event at Nasdaq, Hive shares published a modest gain and have actually rebounded 31% over the previous month. Nevertheless, year-to-date, the stock stays down 27%, trading around $2.23 with a market capitalization of roughly $475 million.

Even with this volatility, experts have actually mainly released favorable protection on Hive, indicating that the stock is underestimated at present levels. In February, H.C. Wainwright released a “Buy” ranking with a $10 rate target. Just Recently, Canaccord Genuity restated its “Purchase” ranking, appointing a $9 target.

Rosenblatt Securities expert Chris Brendler likewise sees upside, mentioning Hive’s broadening HPC footprint and growing operations in Paraguay.

As Cointelegraph reported, Hive obtained its Paraguay center from Bitfarms in January for $85 million. Kilic later on informed Cointelegraph that Hive sees Paraguay as a long-lasting financial investment, promoting the nation’s affordable hydro power, geopolitical stability and federal government assistance.

Bitcoin mining M&A activity rising

Although Hive has actually broadened beyond its initial required as a Bitcoin miner, it still sees BTC as a core long-lasting tactical possession.

Previously this month, Hive revealed it had actually doubled its everyday Bitcoin production to over 6 BTC. According to Holmes, that figure is anticipated to double once again to 12 BTC by Thanksgiving, representing approximately 3% of the worldwide Bitcoin network.

Related: Hive doubles down on BTC hodl method amidst miner equity dilution, financial obligation dependence

In January, Cointelegraph reported that numerous miners were embracing a Bitcoin treasury method to take advantage of awaited rate gratitude, enhance their balance sheets and hedge versus currency danger. This pattern emerged together with a more comprehensive wave of market debt consolidation that started in mid-2024, driven in part by post-halving economics and the pivot towards AI.

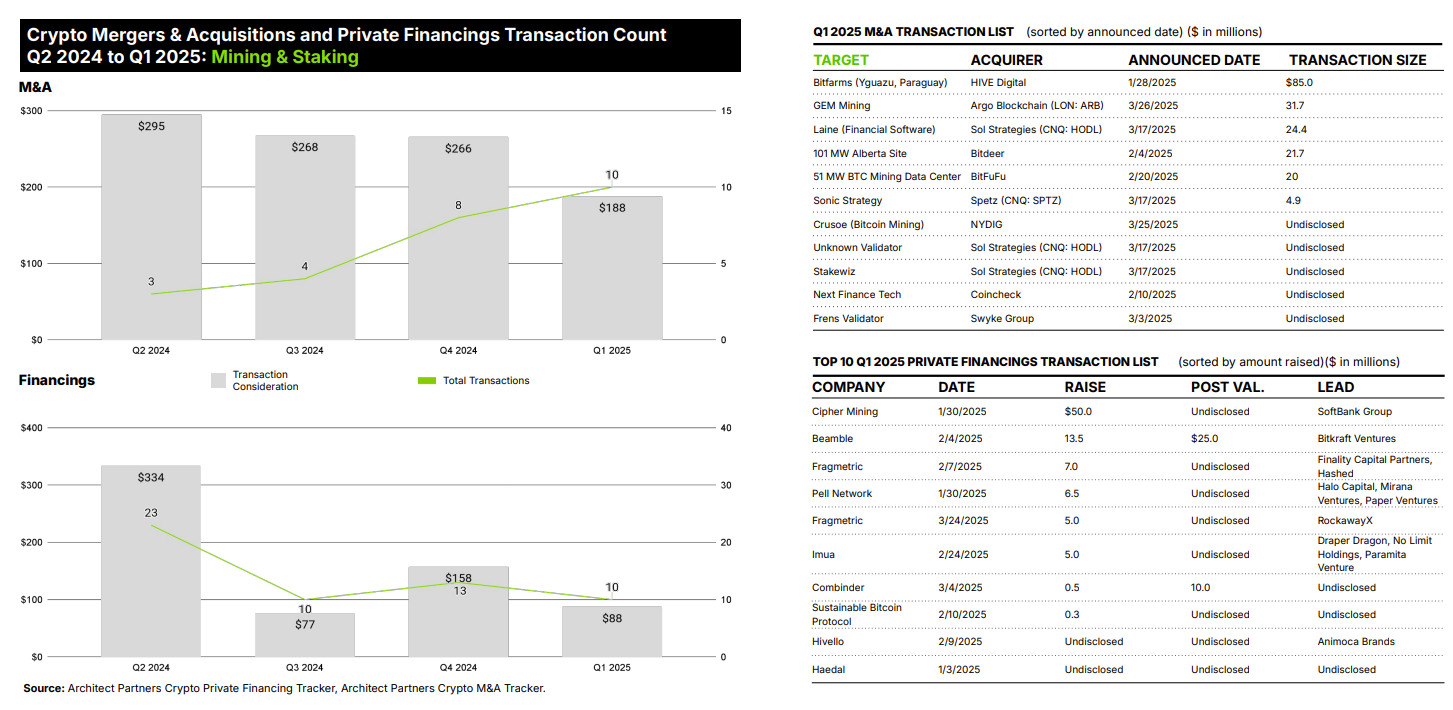

Considering that the 2nd quarter of 2024, M&A deals have actually increased gradually, according to information from Architecture Partners.

Amongst mining and staking companies, there were 10 deals in the very first quarter of 2025 valued at $188 million. In the quarter before that, 8 deals valued at $266 million were finished.

The most significant merger was settled this month, with CoreWeave getting Core Scientific in an all-stock offer valued at $9 billion. The acquisition came more than a year after CoreWeave initially revealed interest in the Bitcoin miner, whose board at first turned down the deal as underestimated.

Although CoreWeave was at first a crypto miner before transitioning to an AI facilities supplier, its acquisition of Core Scientific does not always suggest it’s going back to the mining market.

In revealing the Core Scientific acquisition, CoreWeave signified its intent to repurpose the miner’s properties for HPC or divest its crypto mining company totally.

Other significant M&A handle the mining market consist of Marathon Digital’s acquisition of Generate Capital mining websites, Hut 8’s acquisition of Validus Power properties, CleanSpark’s takeover of GRIID Facilities and Bitfarms’ buyout of Fortress Digital Mining.

Publication: Bitcoin’s undetectable tug-of-war in between fits and cypherpunks