A tweet, a hack and Bitcoin cost rise: What occurred?

At around 00:53 GMT on June 10, 2025, the validated X account of Paraguayan President Santiago Peña published something that set the crypto world buzzing.

The now-deleted tweet specified that Paraguay had actually formally authorized Bitcoin as legal tender. It included that President Peña had actually signed into law a $5 million Bitcoin (BTC) reserve and bond gain access to for crypto-enabled people. It likewise consisted of a wallet address triggering users to stake BTC.

The tweet was composed in English, an odd option for a Spanish-speaking president, however it didn’t stop speculation from racing ahead. Consisted of in the post was a wallet address and a call to action, which lots of crypto users instantly flagged as suspicious.

Within minutes, the main Paraguayan federal government account (@PresidenciaPy) released a correction: The president’s account had actually been jeopardized and the info was incorrect. The post was quickly erased, however the damage, a minimum of to market belief, was currently done.

Did you understand? Paraguay’s crypto boom has a criminal undercurrent; prohibited mining farms have actually been busted taking as much as $60,000 in electrical power monthly, with countless makers taken in cops raids across the country in 2024.

The cost response: BTC spikes above $110K

In the extremely speculative crypto world, even a tip of favorable news can send out costs flying. The concept of another nation embracing Bitcoin as legal tender, following El Salvador’s 2021 relocation, suffices to stir significant market interest.

In spite of being a scam, the tweet triggered BTC to increase over 4%, reaching a regional high of $110,450, according to aggregated trading information from significant exchanges. At the time, it was among the greatest intraday cost dives of the quarter.

Numerous other leading tokens likewise saw momentary increases:

- Ether (ETH): 7%

- Solana (SOL): 5%

- XRP (XRP): 6%

- Cardano (ADA): 6%

Notably, this upward motion wasn’t just since of the Paraguay news. There was a confluence of bullish signals, consisting of continuous trade talks in between the United States and China, which offered a macroeconomic tailwind to run the risk of properties.

In addition, other synchronised advancements like the clearness Act, a bipartisan United States expense clarifying regulative authority over digital properties, offering main oversight of crypto markets to the CFTC, passed both your house Farming and Financial Providers committees around the time of the phony tweet. Additionally, significant exchanges like Gemini and Coinbase are set to protect MiCA licenses, enhancing institutional self-confidence in Europe’s regulative structure.

Did you understand? The Effective Market Hypothesis (EMH) states property costs quickly show all readily available info. Nevertheless, crypto markets frequently defy this, as seen when a phony tweet from Paraguay moved Bitcoin costs before the reality was validated.

A history of hacked tweets in crypto

This isn’t the very first time a prominent figure’s account has actually been hacked to affect crypto markets.

Significant previous hacks:

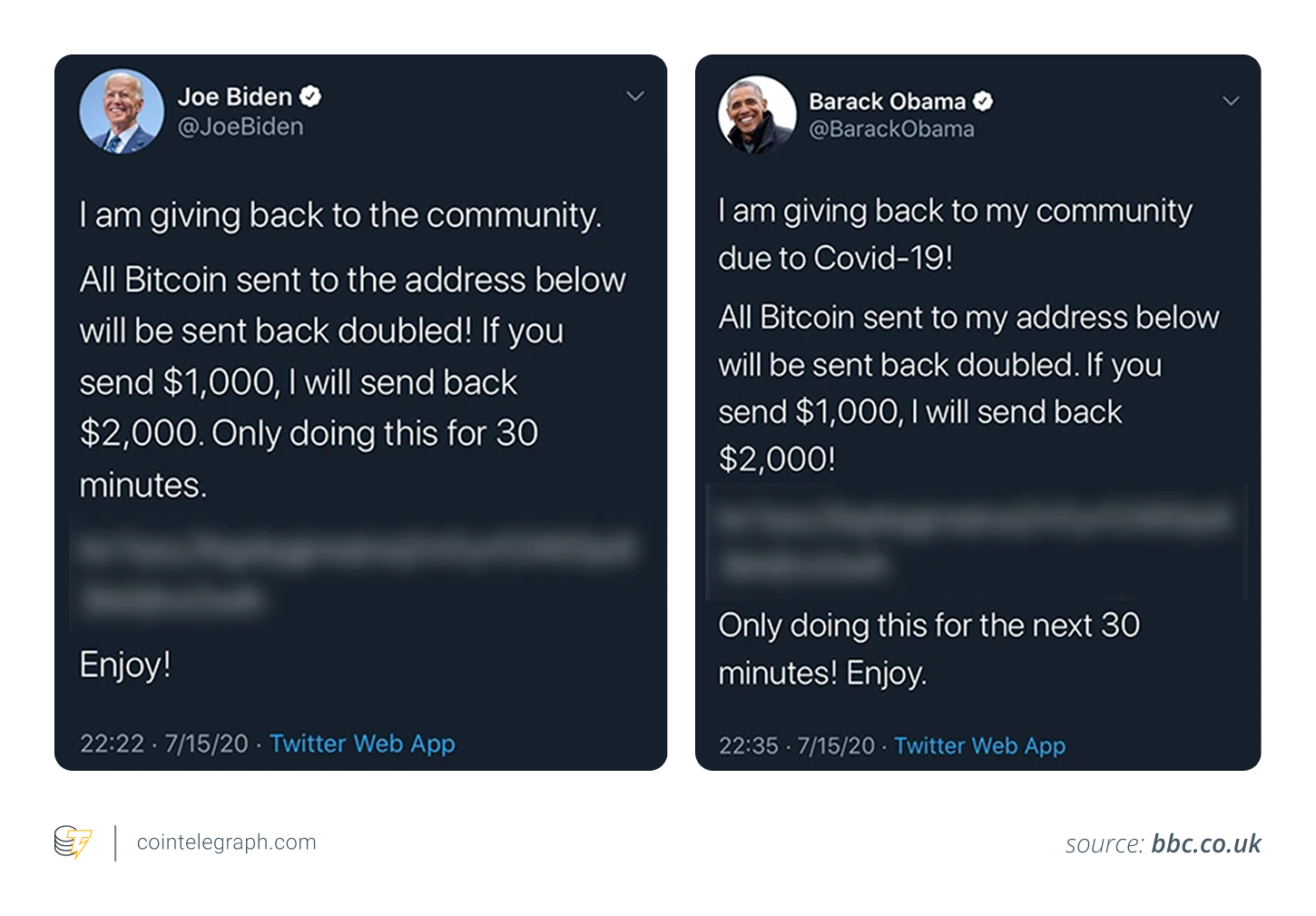

- 2020: Accounts of Barack Obama, Joe Biden, Elon Musk and others were pirated in a huge collaborated rip-off requesting for Bitcoin contributions. The plan gathered over $100,000 before being closed down.

- 2021: Indian Prime Minister Narendra Modi’s X account was hacked, wrongly declaring Bitcoin had actually ended up being legal tender in India.

- 2024: The SEC’s authorities X account was jeopardized, wrongly revealing the approval of a long-awaited area Bitcoin ETF. The tweet set off a fast BTC cost rise before being unmasked, showcasing as soon as again how delicate crypto markets are to false information.

The objective for the most part? Pump-and-dump plans or direct rip-offs that tempt unwary users into sending out Bitcoin or tokens to deceptive addresses.

In the Paraguay occurrence, the wallet address published in the hacked tweet apparently held just $4, showing this was likely more about market impact than theft.

Why does the marketplace respond to crypto news?

Crypto markets are quick, worldwide and psychological. Numerous traders count on heading momentum, scanning social networks and news feeds for tips of what to purchase or offer.

In such a setting:

- News = Fuel.

- Unpredictability = Volatility.

When the tweet hit, algorithmic trading bots most likely chose it up before human beings had time to fact-check. These bots are trained to respond to keywords like “legal tender,” “Bitcoin” and “reserve,” setting off automated buy orders that enhance cost action.

Paraguay has actually long been reported to be friendly towards Bitcoin mining, thanks to its inexpensive hydroelectric power. That provided some surface-level plausibility to the statement, offering it simply enough reliability to move markets, even if just for a brief while.

Why does this matter?

- Rely on social networks stays delicate: Even in 2025, when deepfake detection and platform security have actually apparently enhanced, top-level social networks hacks can still shake worldwide markets. This highlights how central interaction channels can end up being attack vectors in decentralized financing.

- Legal tender = significant driver: Bitcoin’s main adoption as legal tender in El Salvador (2021) and later on the Main African Republic (2022) worked as historic pointers of just how much symbolic weight such relocations bring. Traders are still primed to respond highly to comparable headings, real or not.

- Market maturity? Not rather: While institutional adoption has actually grown, occasions like these emphasize that crypto stays extremely reactive and in some methods immature. A phony tweet must not have the ability to move billions in market cap, however it still can.

Could a genuine legal tender law originated from Paraguay?

Since mid-June 2025, there’s no main relocation by Paraguay to embrace Bitcoin as legal tender.

Nevertheless, the nation stays pertinent in crypto circles due to its inexpensive hydroelectric power from the Itaipu Dam, which supports a growing variety of mining operations.

While Paraguay’s energy profile makes it a natural suitable for mining, the leap from mining center to legal tender adoption is considerable. El Salvador stays the only nation in Latin America to have actually taken that action. The Main African Republic did the same in 2022, however both relocations were consulted with uncertainty from worldwide banks like the IMF and World Bank.

Other Latin American countries, consisting of Argentina, Brazil, Colombia and Mexico, have actually checked out crypto adoption in more mindful, regulatory-focused methods. Argentina has actually gone over utilizing Bitcoin for agreements in particular provinces, while Brazil’s reserve bank has actually released a pilot CBDC called Drex. Yet none have actually pressed legislation to acknowledge Bitcoin as a main currency.

Embracing BTC formally needs more than beneficial conditions; it requires legal support, reserve bank positioning and geopolitical preparation. In the meantime, Paraguay does not seem on that course.

How to recognize phony tweets and secure yourself

To recognize and secure versus phony crypto tweets, constantly confirm the source, expect rip-offs and utilize relied on tools before acting.

In the fast-moving world of crypto, one phony tweet can send out costs skyrocketing or crashing. It is vital to understand how to find false information before it impacts your trades or wallet. Here’s how to remain safe:

- Inspect the deal with thoroughly: Constantly analyze the username for subtle misspellings, additional characters or missing out on confirmation badges. Impersonation accounts frequently look almost similar to genuine ones in the beginning look.

- Confirm the language utilized: If a tweet from a non-English-speaking federal government is composed in English, it might be a warning. Authorities statements are typically made in the nation’s main language.

- Cross-check with relied on sources: Before responding, verify the news through main sites, news release, or dependable media like Reuters or Bloomberg. If it’s genuine, numerous reliable outlets will report it.

- Expect seriousness hints: Expressions like “Act now” or “Minimal time just” are traditional trademarks of rip-offs. They’re created to press you into fast, psychological choices.

- Avoid wallet links and QR codes: No genuine federal government or public figure would consist of a wallet address in a tweet. If you see one, it’s likely a fraud.

- Usage internet browser security tools: Install tools like Wallet Guard and Revoke.cash or phishing filters to obstruct destructive links and discover suspicious activity. These tools can include an additional layer of defense.

- Time out before responding: In crypto, speed isn’t constantly safe. Take a minute to confirm info before making any trades or deals.