The crypto whale that made $200 million from the US-China tariff-led crypto crash last month is now wagering $55 million that Bitcoin and Ethereum will increase once again.

Crypto analytics platform Arkham was among the very first to recognize the whale’s brand-new long positions in an X post on Monday, which consists of a $37 million Bitcoin long position and an $18 million Ether long position on the decentralized derivatives exchange Hyperliquid.

Described as the “Hyperunit whale,” the trader just recently ended up being well-known for making $200 million by effectively anticipating the US-China tariff market crash on Oct. 10.

HyperUnit has likewise carried out 2 more successful shorts ever since, which has triggered Arkham to ask whether they will “Get it right for the FOURTH time in a row?”

The whale has actually remained in the marketplace for a minimum of 7 years, acquiring $850 countless Bitcoin (BTC) throughout the 2018 bearishness and keeping it up until its worth reached $10 billion. And they might be onto something.

Bitcoin is presently trading at $106,598, while Ether is trading at $3,602. Bitcoin is down 15.5% from its all-time high, while Ether is down 27.3% from its record high.

The Crypto Worry & & Greed Index is presently in the “Worry” zone with a rating of 42 out of 100.

Bitcoin OGs can’t hodl permanently; they have a “life to live”

Crypto property supervisor Bitwise CEO Hunter Horsley stated OG whales have actually mainly added to the current market correction, discussing on Saturday that it can be “mentally taxing” for these financiers to remain in the marketplace after making a 100x or 1000x return.

” They have actually got life to live/ it can be mentally taxing to see $100M or 1/3 of their wealth entered a bearishness, even if momentary. They prepare to keep holding much/ many.”

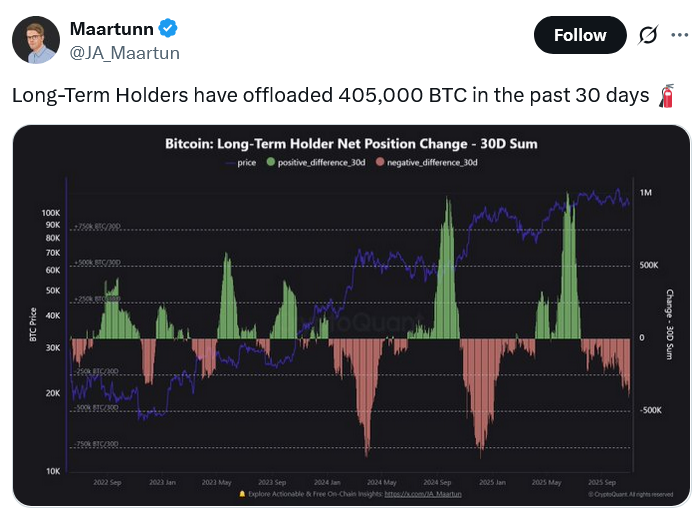

Information from CryptoQuant likewise reveals that long-lasting holders unloaded 405,000 Bitcoin from about Oct. 2 to Nov. 2.

That stated, Horsley is determined that much of the greatest holders aren’t preparing to offer their holdings.

The bottom might be near: Santiment

Nevertheless, the majority of the marketplace discomfort might have currently been felt, according to blockchain analytics platform Santiment, which kept in mind that there are presently 208,980 BTC less on crypto exchanges compared to 6 months earlier.

Related: Retail financiers ‘pull away’ to $98.5 K: 5 things to understand in Bitcoin today

” Regardless of Bitcoin’s market price dropping 14% given that its all-time high back on October sixth, a motivating indication is the truth that BTC is normally remaining off of exchanges.”

” Total, when a coin’s supply is stagnating to exchanges, the threat of additional sell-offs are restricted.”

Publication: Grokipedia: ‘Far best talking points’ or much-needed remedy to Wikipedia?