210k Capital, a hedge fund established by business owner David Bailey, has actually supposedly published huge gains from its digital possession holdings after assisting convince United States President Donald Trump to embrace a pro-crypto policy position, highlighting the possible effect of beneficial policy on the digital possession sector.

The fund provided a net return of 640% in the 12 months through June, mostly driven by financial investments in openly traded business that included Bitcoin (BTC) to their balance sheets, Bloomberg reported.

As a personal entity, 210k Capital is not needed to divulge financials, however Bloomberg got the figures from a confidential source, who likewise stated the fund’s wealth originates from Bitcoin treasury financial investments in numerous nations, consisting of the United States, UK, Canada, Australia and Sweden.

The hedge fund’s moms and dad business, UTXO Management, reports that 210k Capital has financial investments in numerous Bitcoin-linked business, consisting of Technique (MSTR), Metaplanet (3350 ), Moon Inc. (1723 ), The Smarter Web Business (SWC), The Blockchain Group (ALTBG), Liquid Technologies (LQWD), H100 (H100), Matador (MATA) and DV8 (DV8).

Handling partner Tyler Evans informed Bloomberg the company is assessing an extra 30 financial investments in so-called Bitcoin proxies– business running within the Bitcoin community.

Bailey, a serial business owner and creator of Bitcoin Publication and BTC Inc., worked as a crucial crypto consultant to then-candidate Trump’s governmental project. Bloomberg explains him as the chief designer behind Trump’s pivot towards Bitcoin.

While little is openly understood about 210k Capital, Bailey’s impact is extensively felt throughout the digital possession community. In Might, Cointelegraph reported that his Bitcoin financial investment company, Nakamoto Holdings, raised $300 million and is checking out a possible public offering.

The business later on raised an extra $51.5 million as part of its merger with doctor KindlyMD, intending to even more scale its Bitcoin treasury technique.

Related: How one Nasdaq company raised $51.5 M in 72 Hours, simply to purchase Bitcoin

Following in Technique’s steps: Bitcoin treasury business are acquiring traction

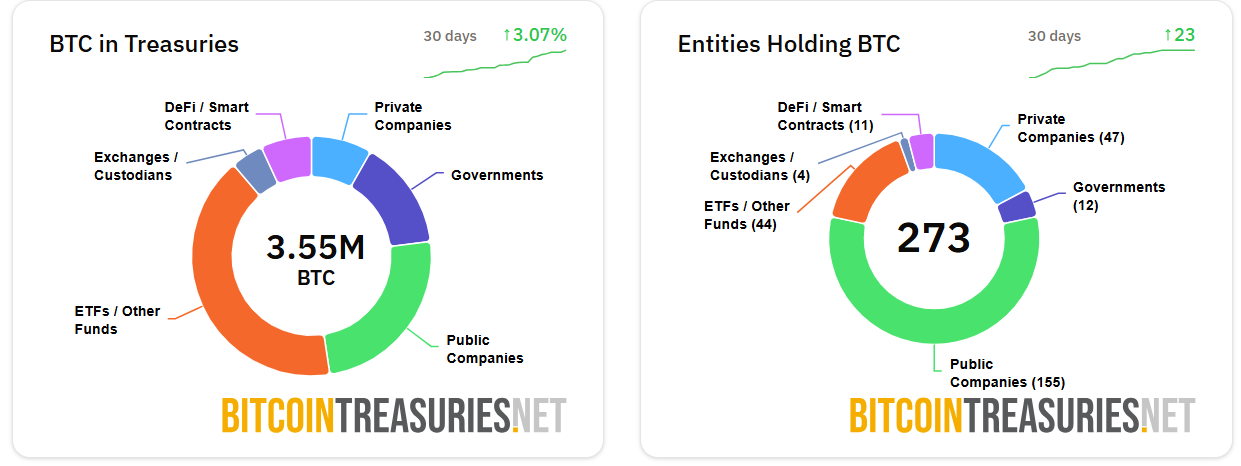

Because Michael Saylor’s Technique, previously MicroStrategy, embraced Bitcoin as a treasury possession in August 2020, more than 150 business have actually done the same, according to market information. A minimum of 47 personal companies have actually likewise divulged holding Bitcoin on their balance sheets.

The technique is settling in 2025, as Bitcoin continues to strike record highs, most just recently climbing up above $123,000. Nevertheless, experts stay divided on the long-lasting outlook for Bitcoin treasury companies.

Equity capital business Type just recently warned that the success of Bitcoin treasury business depends greatly on keeping a market price well above their several on net possession worth, or MNAV. For Type, MNAV represents a business’s capitalization relative to the worth of its digital possessions.

A continual drop in the cost of Bitcoin, for instance, might result in a decrease in the business’s MNAV, more deteriorating its capability to raise more financial obligation to money its BTC purchases.

Others, such as Glassnode expert James Examine, argue that corporations getting on the Bitcoin bandwagon without a clear specific niche or long-lasting technique will have a hard time to acquire enduring traction.

” I believe we’re currently near to the ‘reveal me’ stage, where it will be progressively tough for random business X to sustain a premium and get off the ground without a major specific niche,” Examine composed on X.

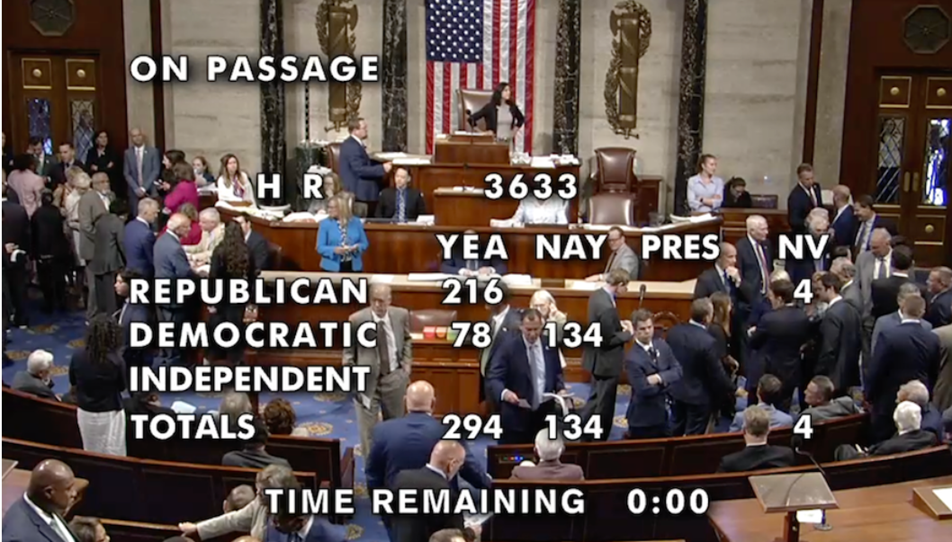

Nonetheless, the Bitcoin adoption bandwagon is taking place at a turning point in the market’s advancement. Recently, the Republican-controlled Legislature passed 3 crypto costs attending to stablecoins, market structure and a restriction on developing a reserve bank digital currency.

Publication: Bitcoin’s undetectable tug-of-war in between matches and cypherpunks