Bitcoin (BTC) rebounded by as much as 14% after plunging to a four-month low near $76,600 on March 11. However BTC rate is down around 25% from its record high of around $110,000, which is typical for a “booming market correction.”

Still, some experts prepare for the Bitcoin rate decreases to continue in the future.

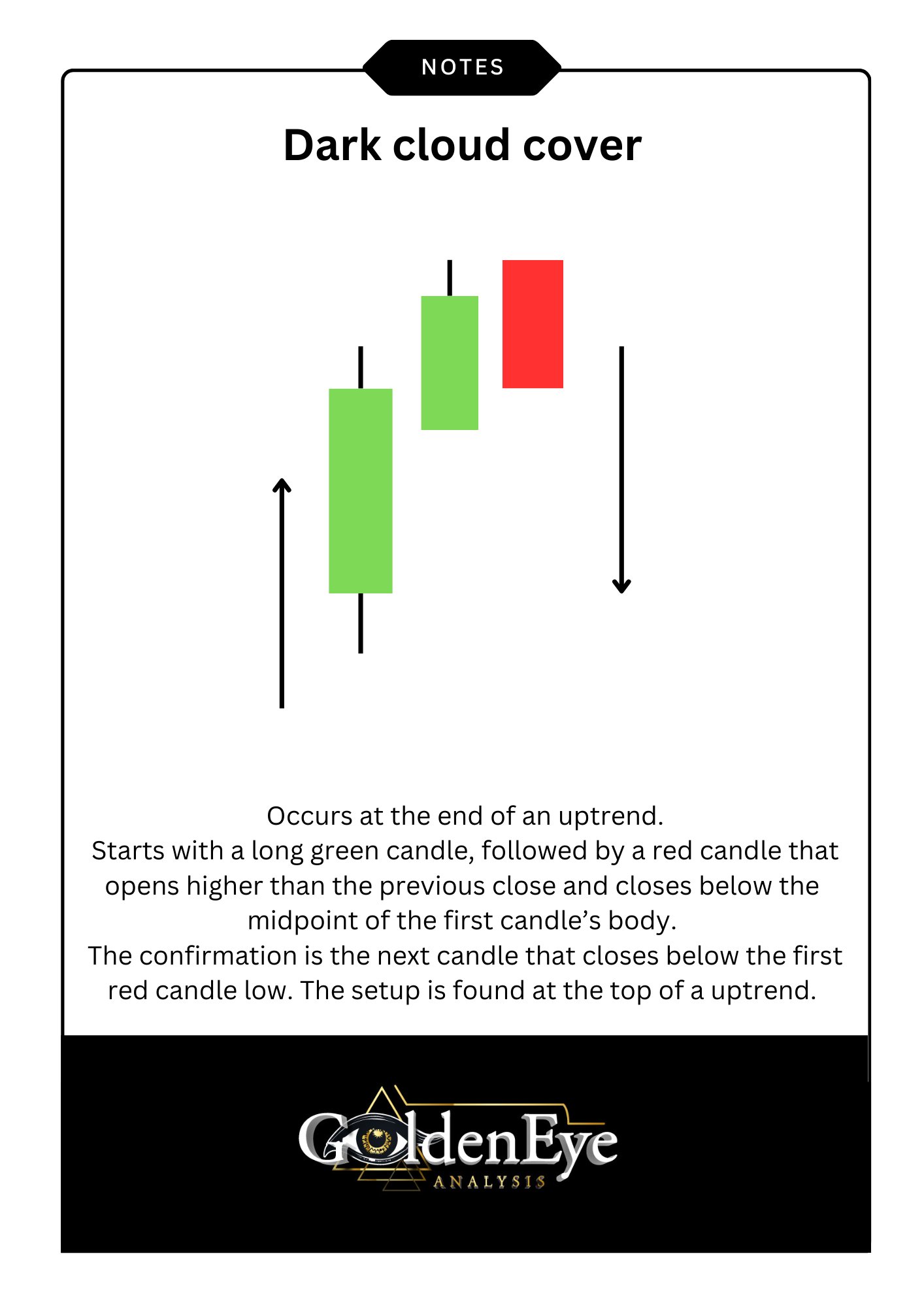

” Dark cloud” hints Bitcoin is peaking

Bitcoin deals with restored bearish pressure after declining at $87,470, the coming down channel resistance, with a “dark cloud cover” pattern enhancing the sag, according to an analysis shared by GDXTrader on X.

BTC/USD everyday rate chart. Source: TradingView/@GDXTrader

The dark cloud cover pattern happens when a strong green candle light is followed by a red candle light that opens above the previous close however closes listed below the midpoint of the very first candle light’s body.

Illustration of a dark cloud cover. Source: GoldenEye Analysis

Such a shift in belief shows that purchasers tried to press greater however were subdued by sellers, frequently resulting in additional disadvantage.

Bitcoin’s failure to close within the $90,000-$ 93,000 resistance zone recommends an absence of purchasing conviction, GDXTrader kept in mind, stating the cryptocurrency will stay under bearish pressure unless it decisively breaks above the stated variety.

BTC rate “ideal rejection” threats $65,000

Bitcoin’s possible to decrease additional develops from its “ideal rejection” after evaluating the $86,000-88,000 zone as resistance, according to analysis from popular trader CrediBULL Crypto.

Related: Here’s why Bitcoin rate can’t go greater than $87.5 K

Especially, Bitcoin tried to break towards the regional supply zone marked in red however stopped working to sustain above the stated resistance zone, shown by the orange circle in the chart below.

BTC/USD per hour rate chart. Source: TradingView/CrediBULL Crypto

Failure to recover the supply zone has actually increased the possibility of a drop towards lower assistance levels around $77,000-79,000 (highlighted in green) by March. Checking this location as assistance has actually resulted in sharp rate rebounds in March.

Nevertheless, if this assistance zone breaks, a much deeper relocation listed below the $77,000-79,000 area might extend towards the $65,000-74,000 location– the bigger green liquidity zone in the chart above– by April.

Expert George shared a comparable outlook, as revealed listed below.

Source: George1Trader/X

” Difficult to remain bullish” with a bear flag pattern

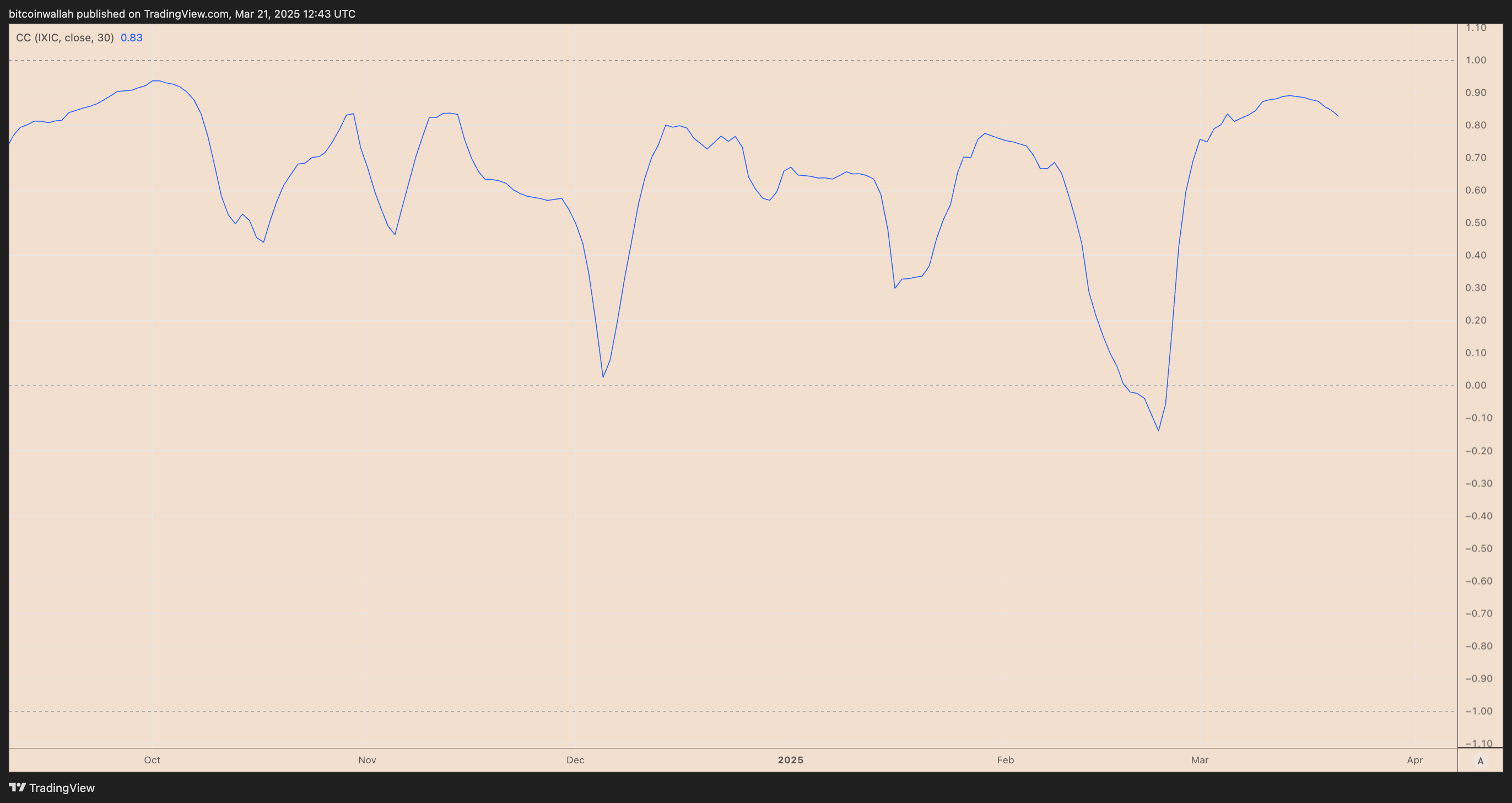

According to expert CryptOpus, Bitcoin stays securely associated with conventional equity markets, especially the S&P 500 (SPX) and Nasdaq 100 (NDX), both of which are showing bear flag patterns on the charts.

A bear flag kinds when the rate combines greater inside a rising parallel channel. It solves if the rate breaks listed below the lower trendline and come by as much as the previous sag’s height.

Source: CryptOpus

BTC is following a comparable bear flag structure, with $84,000 serving as the lower trendline assistance. A break listed below this limit might set off a much deeper sell-off towards $72,000 per the technical guideline discussed above.

Furthermore, Bitcoin’s connection with equities has actually grown due to a more comprehensive decrease in risk-on belief, led by the United States President Donald Trump’s worldwide trade war.

BTC/USD and Nasdaq Composite 30-day connection. Source: TradingView

Arthur Breitman, the co-founder of Tezos, has actually called United States economic downturn among the crypto market’s most significant external threats.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.