Secret takeaways:

-

Institutional need and ETF inflows have actually so far taken in the redistributed BTC from Mt. Gox.

-

Rate cuts, trade optimism, and increasing worldwide liquidity reinforce Bitcoin’s course towards $150,000–$ 500,000.

Mt. Gox, a defunct crypto exchange, has actually delayed payments to its financial institutions by a year and stays in control of around $4 billion in Bitcoin (BTC) since Wednesday.

Is this newest hold-up in payments bearish or bullish for the Bitcoin cost progressing?

Bitcoin up in spite of earlier Mt. Gox redistributions

The Mt. Gox trust has actually rearranged roughly 75% of its Bitcoin reserves to financial institutions considering that mid-2024, minimizing its BTC holdings to 34,690 from 142,000, according to information resource Arkham Intelligence.

That indicates over $12 billion worth of Bitcoin in today’s worth has actually currently been dispatched, however it has actually not assisted the bears keep rates down.

Considering that the payments started, BTC has actually gotten 85%, and, according to numerous experts, might climb up towards $150,000 by year’s end.

That recommends purchasers quickly taken in any selling pressure from the Mt. Gox payments, an indication of strong market depth amidst unrelenting need from United States area Bitcoin ETFs and public business gradually including BTC to their balance sheets.

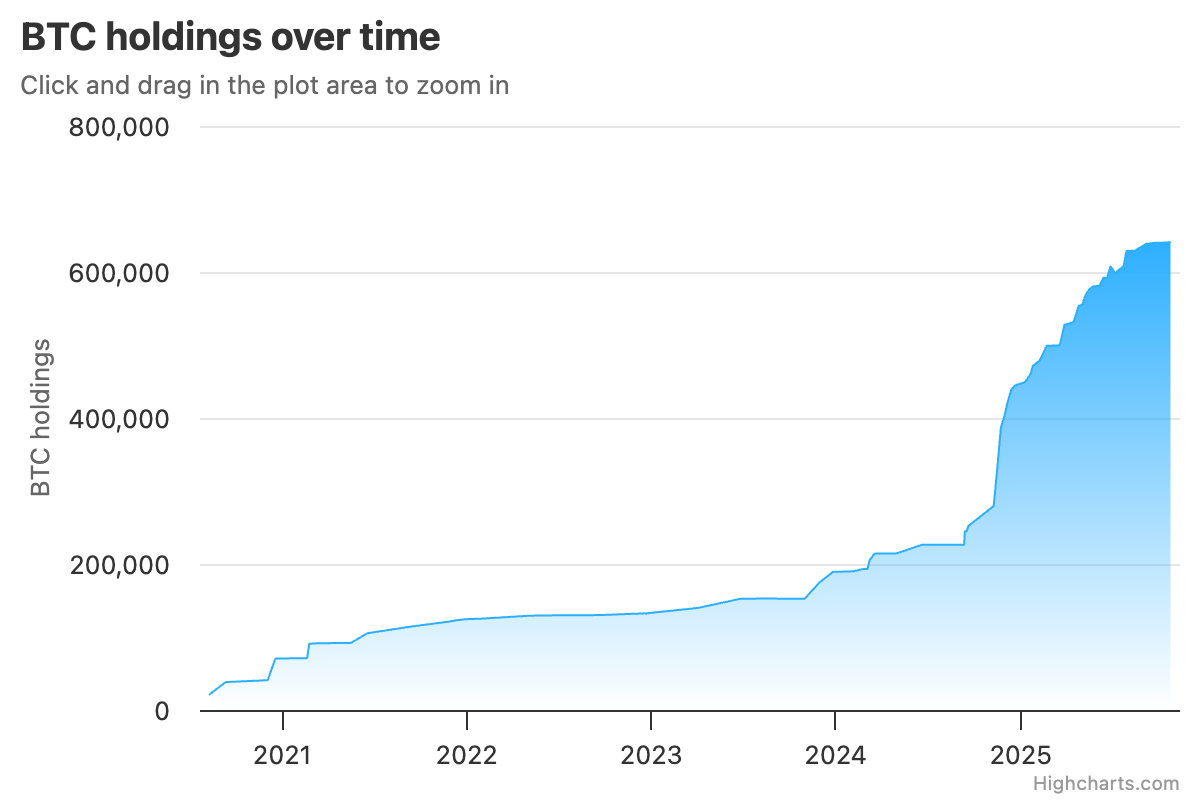

For example, Nasdaq-listed Method (MSTR) has actually solitarily built up 414,477 BTC (~$ 47 billion) considering that mid-July, according to information resource Bitbo.IO. That is approximately 3.9 times more Bitcoin than what Mt. Gox rearranged to date.

For that reason, today’s Bitcoin market, supported by ETFs, sovereign interest, and business treasuries, can take in numerous billion dollars of BTC more quickly than throughout the 2017 or 2021 cycles.

Pressing Mt. Gox payments to October 2026 indicates that approximately $4 billion in Bitcoin will be deflected the marketplace, minimizing the possibility of an unexpected market dump.

Macro conditions prefer BTC cost increasing

Bitcoin bulls have actually predicted the cost to grow in the long term, mentioning macroeconomic drivers that might reduce any drawback effect originating from Mt. Gox’s BTC circulation.

Initially, markets are practically completely pricing numerous Federal Reserve rate cuts, signifying the start of a reducing cycle. Lower loaning expenses lower pressure on speculative possessions, providing Bitcoin space to broaden towards $150,000 in the coming months.

Development towards a United States– China trade offer has actually even more enhanced worldwide threat belief, eliminating among the most significant overhangs on equities and crypto alike.

International M2 cash supply is speeding up at its fastest speed considering that 2020.

Experts keep in mind that if Bitcoin follows the exact same liquidity-driven course as throughout the post-COVID growth, it might climb up towards $500,000 by 2026, possibly echoing its greatest historic uptrend.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.