The phenomenon of monetary bubbles is fiercely discussed amongst market operators, and there are numerous scholastic documents on the topic, beginning with Teacher Didier Sornette’s 2014 research study of monetary bubbles. In truth, the paper specifies a “bubble” as a duration of unsustainable development with costs increasing much faster and much faster, i.e., growing more than significantly. Undoubtedly, bubbles by meaning are predestined to rupture and bring costs back to their beginning worth or even worse.

In the current past, Bitcoin (BTC) has actually experienced durations of more than rapid development, followed by extremely sharp decreases, called “crypto winter season,” a duration when nobody spoke about Bitcoin and other possessions any longer, suggesting there was a freeze around the sector, and costs collapsed. Previous decreases following the Bitcoin cost bubble were -91%, -82%, -81%, and -75% in the last crypto winter season, respectively.

Up until now, the cost pattern of Bitcoin has actually followed an unique cycle marked by cutting in half every 210,000 blocks, equivalent to about 4 years, which has actually rhythmically figured out durations of decrease, healing, and after that rapid development.

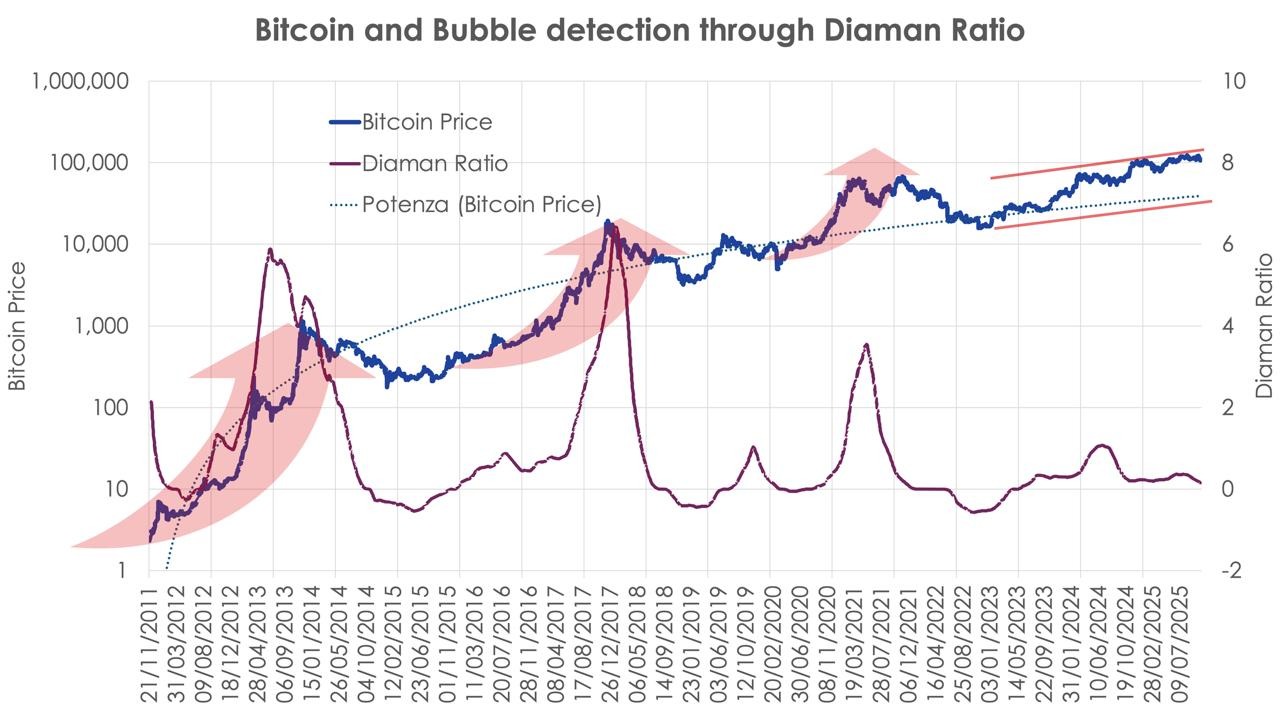

In 2011, together with Teacher Ruggero Bertelli, Diaman Partners released a paper on a deterministic analytical sign called the Diaman Ratio. This sign produces a direct regression in between costs on a logarithmic scale (as revealed above for the cost of Bitcoin) and time.

Without explaining about this sign, which is really extremely beneficial for those who utilize quantitative tools to make financial investment choices, the function of this very first part of the analysis is to validate just how much and how Bitcoin has actually gotten in a bubble in the past. To do this, if DR 1, it indicates that development is more than rapid, which represents Prof. Sornette’s meaning of bubbles.

Diaman Partners took the day-to-day historic series of Bitcoin, computed the 1 year DR, and inspected when it was higher than 1.

The chart plainly reveals that in previous cycles there were durations of more than rapid development, while in the current cycle, apart from an effort when ETFs were authorized in the United States and the cost of Bitcoin went beyond the 2021 high before the 2024 halving, a phenomenon that had actually never ever occurred before, the Diaman Ratio was never ever much greater than 0.

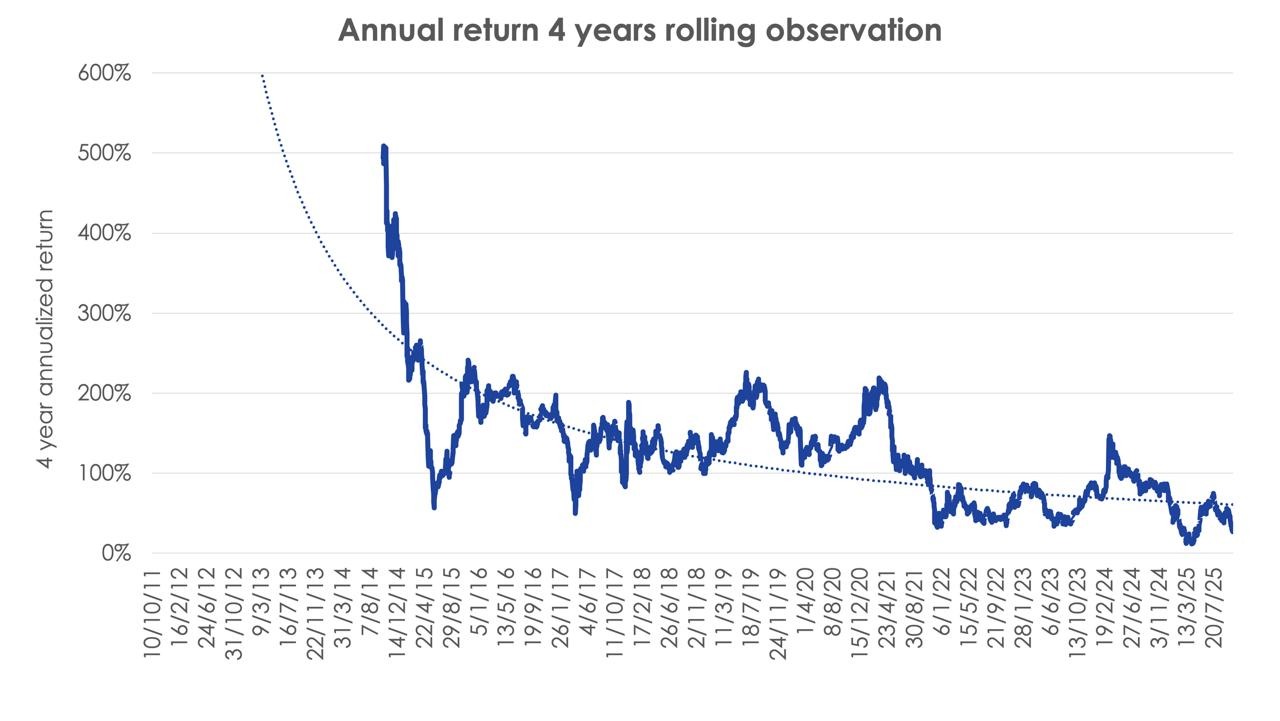

Does this mean that Bitcoin cycles will no longer follow the four-year guideline, with crypto winter season beginning towards completion of the 2nd year of the cycle? It is prematurely to state, however probably the development structure of Bitcoin has actually altered. To evaluate this hypothesis, we took the volatility of the Bitcoin cost with a 4-year observation window, equivalent to the halving cycle, and moved this volatility estimation window gradually to see if it stays consistent or reduces gradually.

The chart reveals a sharp decrease in volatility, which in the early years of advancement was over 140% on a yearly basis, then slowly decreased to an existing worth of around 50% or less. While lower volatility likewise indicates lower predicted returns, it likewise indicates higher cost stability for the future and less surprises.

Related: Approximating Bitcoin’s assistance levels for the next cycle bottom

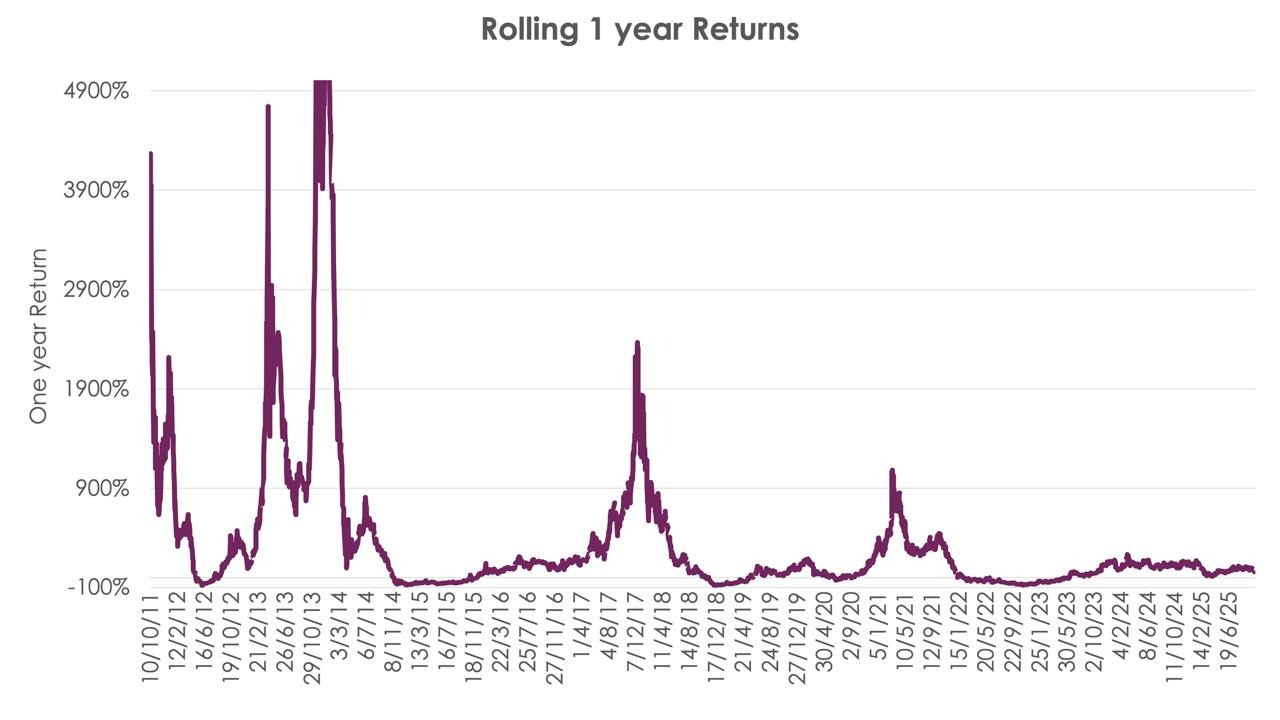

In truth, if we take the rolling yearly return chart, i.e., take the efficiency of one year in 2011 and after that determine the return for one year on a day-by-day basis, it is clear that in the previous there were returns that have actually reduced gradually and in the last 3 years have in truth stayed flat, verifying that the theory of the Bitcoin cycle, with great years followed by a devastating year, has actually been rather broken.

The chart above programs that balance yearly returns have actually slowly decreased, without any peaks at all in the last cycle, verifying the hypothesis that Bitcoin’s risk-return structure has actually altered. Yet the cost of Bitcoin has actually increased from $15,000 in December 2022 to $126,000 at current highs, so a really appealing return has actually still been accomplished in this cycle, however with less excitement than in previous cycles.

The chart of typical yearly returns over a four-year observation duration reveals a clear pattern towards decreasing Bitcoin returns gradually, which is easy to understand when thinking about the overall market cap of Bitcoin, as it is something to double a property worth $20 billion, however rather another to double a property worth $2 trillion.

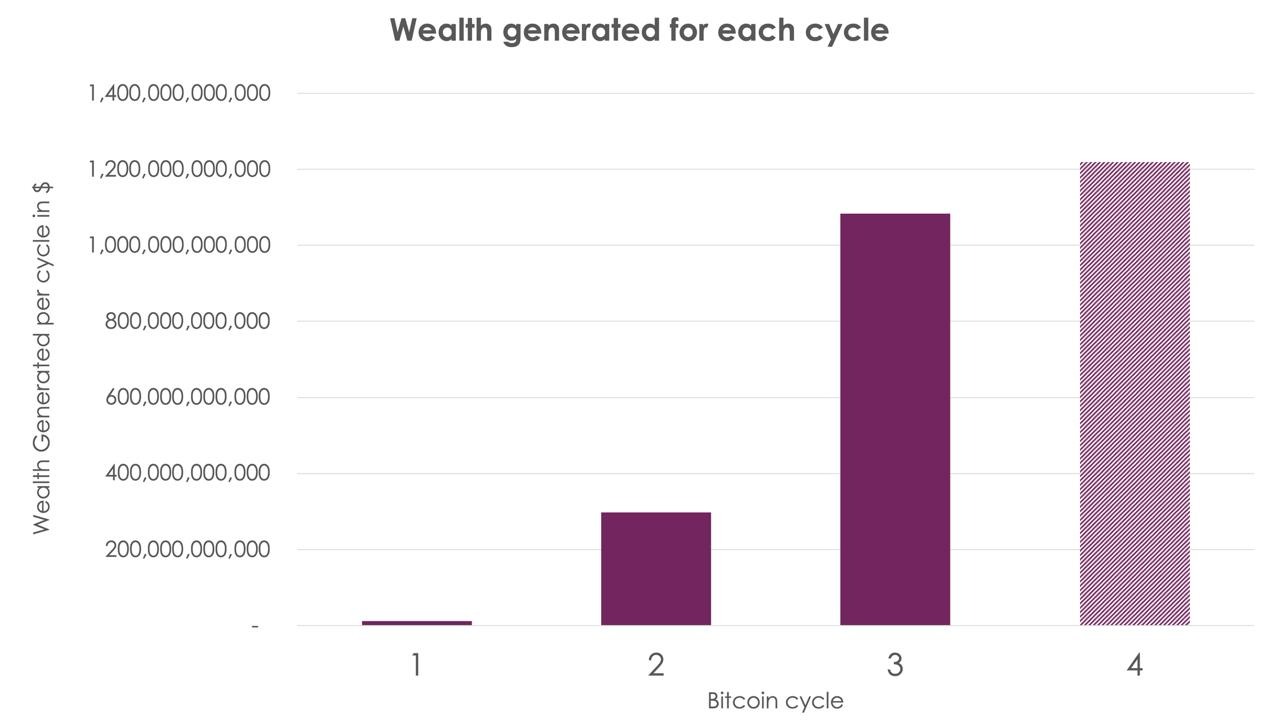

On the other hand, presuming that we can think about the increase of the 4th halving cycle to be over, which nobody can reject or verify with certainty, the overall wealth produced up until now is higher than in other cycles, verifying, if verification were required, that Bitcoin, comprehended both as a network and as a property in itself, has actually produced more wealth than any other kind of financial investment in simply 15 years of history.

Reasoning from this analysis, from an analytical viewpoint:

-

On 4 celebrations, Bitcoin can be thought about to be in a ‘bubble’ stage, i.e., with more than rapid returns, however unlike standard bubbles that then rupture in a couple of months, Bitcoin has actually revealed strength in its development, which typically has a Diaman Ratio of less than 1 with high however not rapid development. In truth, a power law can explain the development of Bitcoin’s cost effectively.

-

It can likewise be plainly seen that these “bubble” phenomena have actually reduced in strength and period gradually, a lot so that in the last cycle that started in 2024, there has actually been (a minimum of in the meantime) no greater than rapid cost development.

-

Both returns and volatility are reducing, recommending that reaching worths above one million (if ever) will most likely take 15 years, and for that reason, lots of forecasts of Bitcoin reaching $13 million in 2040 are statistically extremely not likely.

-

The approval of ETFs in the United States, with BlackRock’s IBIT area Bitcoin ETF reaching $100 billion in possessions under management in less than 3 years, ending up being without a doubt the fastest-growing monetary item in history, has actually broken the Bitcoin cycle that forecasted durations of development, hypergrowth, and crypto winter season, with brand-new highs being reached after the next halving.

-

Greater stability in returns and lower volatility recommend that the crypto winter season will not be “extremely cold” with losses going beyond 50-60% as in previous cycles, however might alternate durations of decrease with brand-new highs without the rapid dives seen in the past.

This short article is for basic info functions and is not meant to be and must not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.