The Institute for Supply Management’s (ISM) Production Buying Supervisors’ Index (PMI) has actually traditionally lined up with significant peaks in Bitcoin’s market cycles– a pattern that, if duplicated, might indicate a longer-than-usual cycle this time around.

The connection in between the ISM PMI and Bitcoin’s (BTC) rate was very first promoted by Genuine Vision’s Raoul Friend and has actually given that acquired traction amongst macro-focused crypto experts.

” All 3 previous Bitcoin cycle tops have actually broadly lined up with this month-to-month, oscillating index,” expert Colin Talks Crypto kept in mind, referencing the repeating overlap in between Bitcoin’s market highs and the PMI’s cyclical peaks.

If that relationship holds, Colin included, “it would suggest a substantially longer cycle than bitcoin cycles normally run for.”

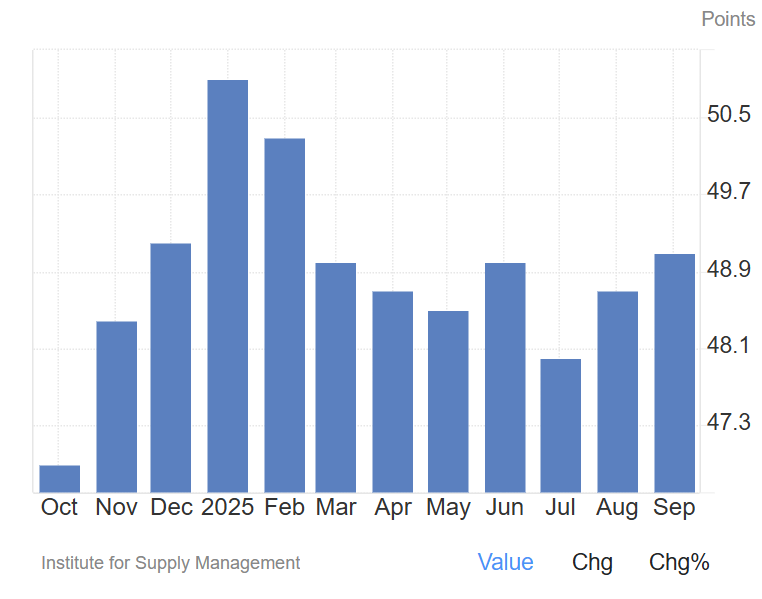

The ISM Production PMI, which determines United States commercial activity, has actually stayed listed below the neutral 50 mark for 7 successive months, signifying contraction. A continual relocation above 50 would recommend renewed financial growth, traditionally related to more powerful Bitcoin rate efficiency.

Previously this year, the PMI briefly climbed up above 50 before slipping back into contraction area, highlighting ongoing weak point in the producing economy.

Related: Bitcoin treasuries can make more Bitcoin, states Willem Schroé

United States production has a hard time to sustain momentum amidst tariffs, weak need

The production PMI signified a strong rebound in organization belief at the start of the year, partially credited to optimism surrounding the inbound Trump administration and expectations of business-friendly policy.

Nevertheless, the ongoing drag from high tariffs, unpredictable trade policy and soft international need has actually weighed on the sector, possibly extending business cycle instead of accelerating it.

ISM’s newest report revealed a modest uptick in September, with rates increasing while exports and imports contracted, recommending irregular conditions throughout producing subsectors.

In spite of the weak point, ISM kept in mind that production’s diminishing share of United States financial output indicates a contraction in the PMI does not always signify an economic downturn. ISM has actually formerly observed that a continual reading above 42.3 usually refers development in the more comprehensive economy.

One getting supervisor from the transport devices market informed ISM in September that “organization continues to be seriously depressed,” pointing out diminishing earnings and “severe taxes” in the kind of tariffs that have actually raised expenses throughout the supply chain.

” We have actually increased rate pressures both to our inputs and client outputs as business are beginning to hand down tariffs by means of additional charges, raising rates approximately 20 percent,” they included.

Related: Crypto Biz: Bitcoin whales trade secrets for convenience