While many cryptocurrency financiers invited the marketplace healing following the possible end of the United States federal government shutdown, some brief sellers were captured off guard by the rebound.

The crypto market healing saw popular high-leverage trader James Wynn’s primary Hyperliquid account liquidated several times throughout the previous 24 hr, with his wallet’s worth sinking to simply $5,422, according to Hyperdash information.

The unanticipated healing liquidated Wynn 12 times in the last 12 hours, leading to 45 liquidations over the previous 2 months, according to blockchain information platform Lookonchain.

Before the crypto market healing, Wynn was running several Bitcoin (BTC) leveraged brief positions, which are de facto bets on the cost of Bitcoin decreasing.

Related: China’s spending plan AI bots smash ChatGPT in crypto trading face-off

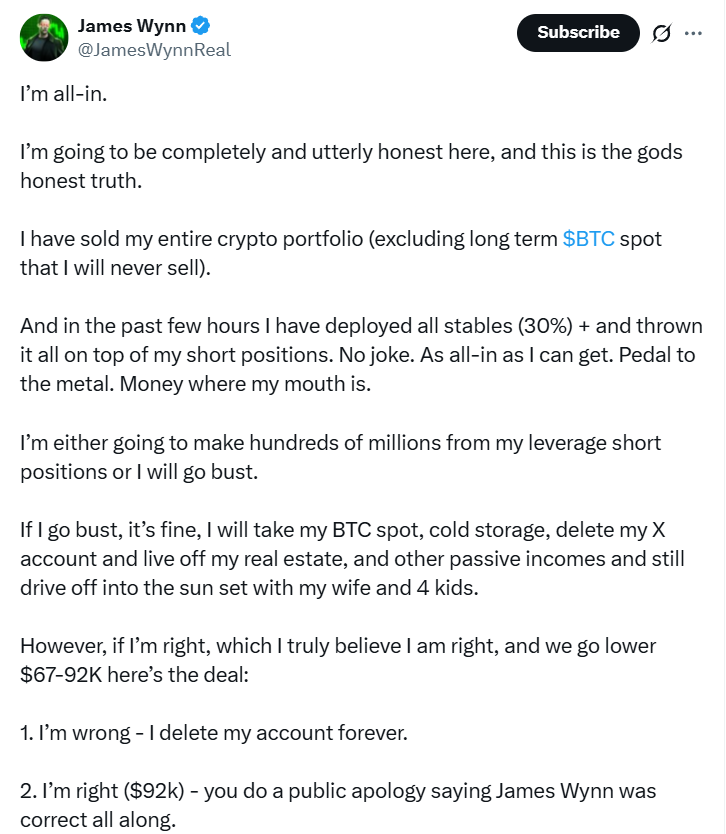

Wynn goes “all-in” in spite of liquidation, bets on Bitcoin decrease to $92,000

In spite of the installing losses, Wynn continued doubling down on his brief positions.

Wynn stated he has actually moved all his stablecoin funds into his brief positions, anticipating a decrease in Bitcoin listed below $92,000 in spite of optimism over the possible end of the United States federal government shutdown.

” In the previous couple of hours, I have actually released all stables (30%) + and tossed everything on top of my brief positions. No joke. As all-in as I can get,” stated Wynn in a Monday X post, including:

” I’m either going to make numerous millions from my utilize brief positions or I will fold,” included the pseudonymous trader.

Related: Michael Saylor’s Technique kickstarts November with $45M Bitcoin buy

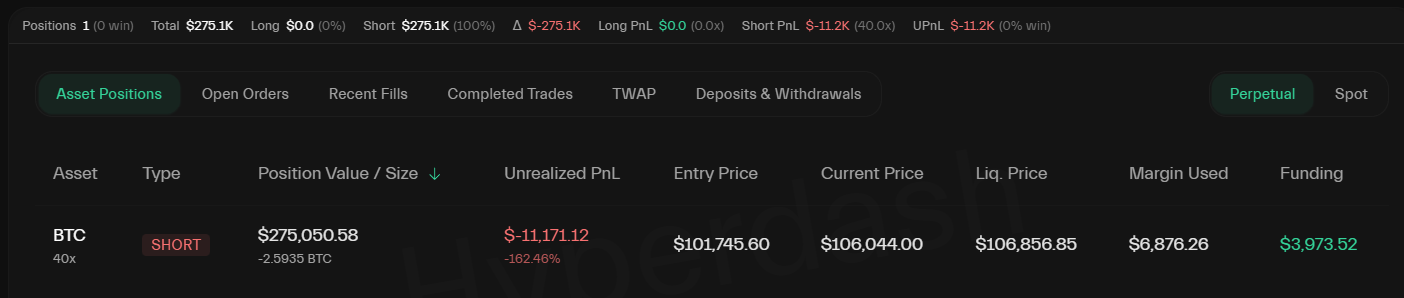

At the time of composing, Wynn’s primary account had a 40x leveraged brief position worth $275,000 in Bitcoin, which would deal with liquidation if Bitcoin’s cost recuperates above $6,856.

Wynn opened the brief position when Bitcoin was trading listed below $101,800 and dealt with a latent loss of $11,147 since 11:20 am UTC on Monday, according to Hyperdash information.

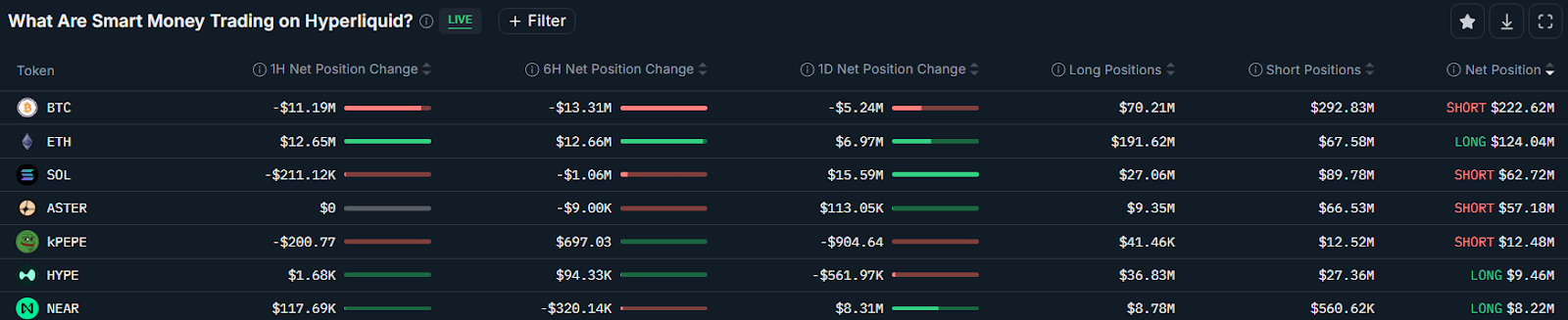

The market’s most effective traders, tracked as “wise cash” traders on Nansen’s blockchain intelligence platform, are likewise placing for more possible disadvantage for Bitcoin.

A lot of wise cash traders were running brief positions on Bitcoin, as the net continuous brief position on Hyperliquid reached $223 million on Monday, with $5.2 million worth of brand-new shorts opened in the previous 24 hr, according to Nansen.

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure develops