Secret takeaways:

-

Wall Street’s year-end Bitcoin projections vary from $133,000 to as high as $200,000.

-

A lot of concur that consistent Bitcoin ETF inflows and gold connection might shoot BTC to brand-new record highs.

Bitcoin (BTC) has actually bounced by over 13% in the previous 7 days and is inching towards its record high of $124,500.

Bitcoin is poised to reach brand-new record levels by the end of 2025, according to leading Wall Street and UK banks.

Citigroup sees BTC reaching $133,000

Citigroup anticipates Bitcoin to end 2025 at around $133,000, setting a brand-new record high. That suggests a fairly modest 8.75% upside from present rate levels at around $122,350.

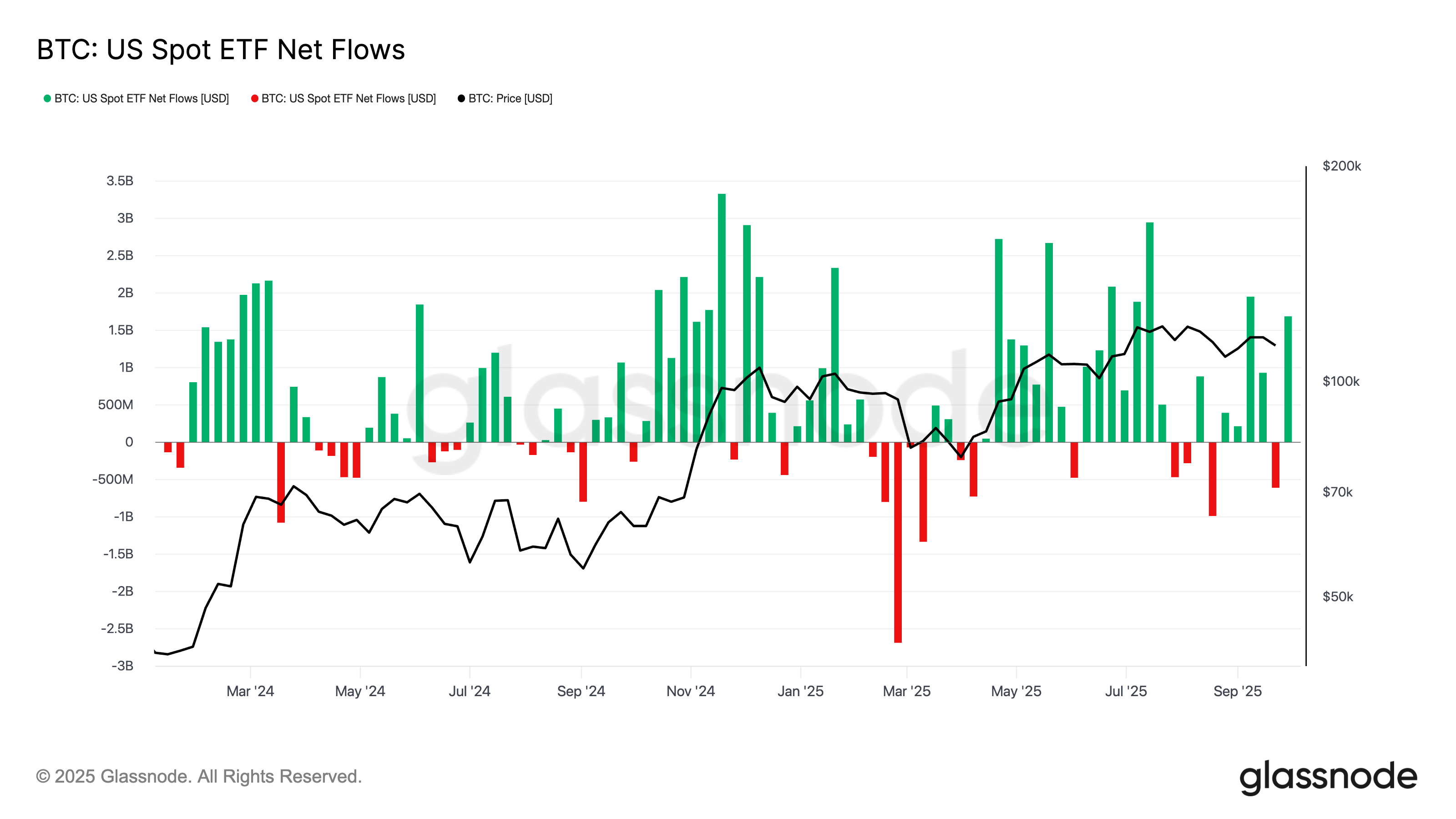

The banking giant’s base case tasks stable development supported by robust inflows from area exchange-traded funds (ETFs) and digital property treasury allotments, which it views as the essential structural motorists of Bitcoin’s next leg greater.

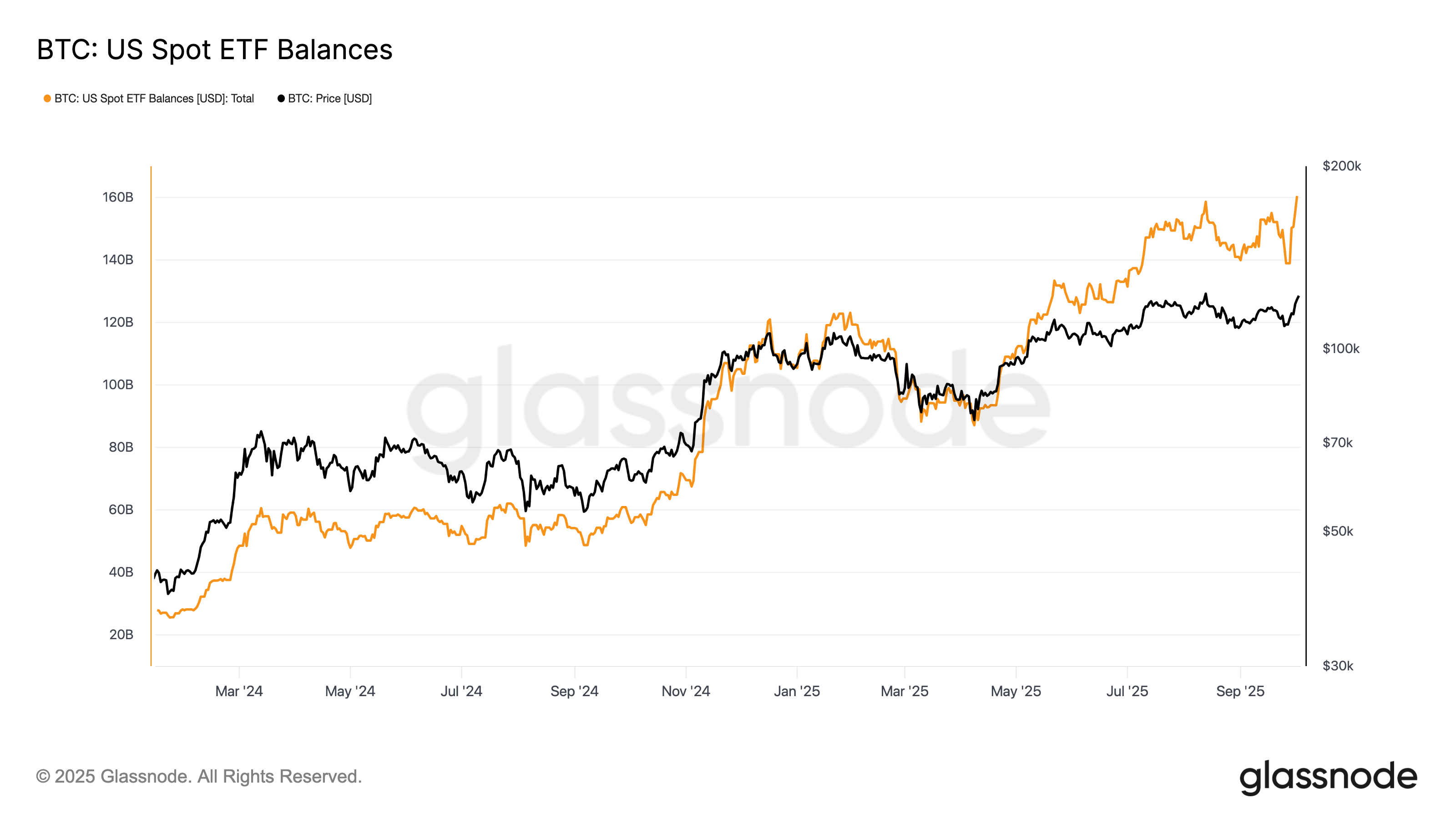

Since Saturday, all US-based Bitcoin ETFs were handling over $163.50 billion in BTC. Citi approximates that fresh ETF inflows will have to do with $7.5 billion by year-end, assisting to sustain need.

Nevertheless, Citi’s bear case puts Bitcoin as low as $83,000 if recessionary pressures magnify and run the risk of belief fades.

JPMorgan experts: Bitcoin to $165,000 in 2025

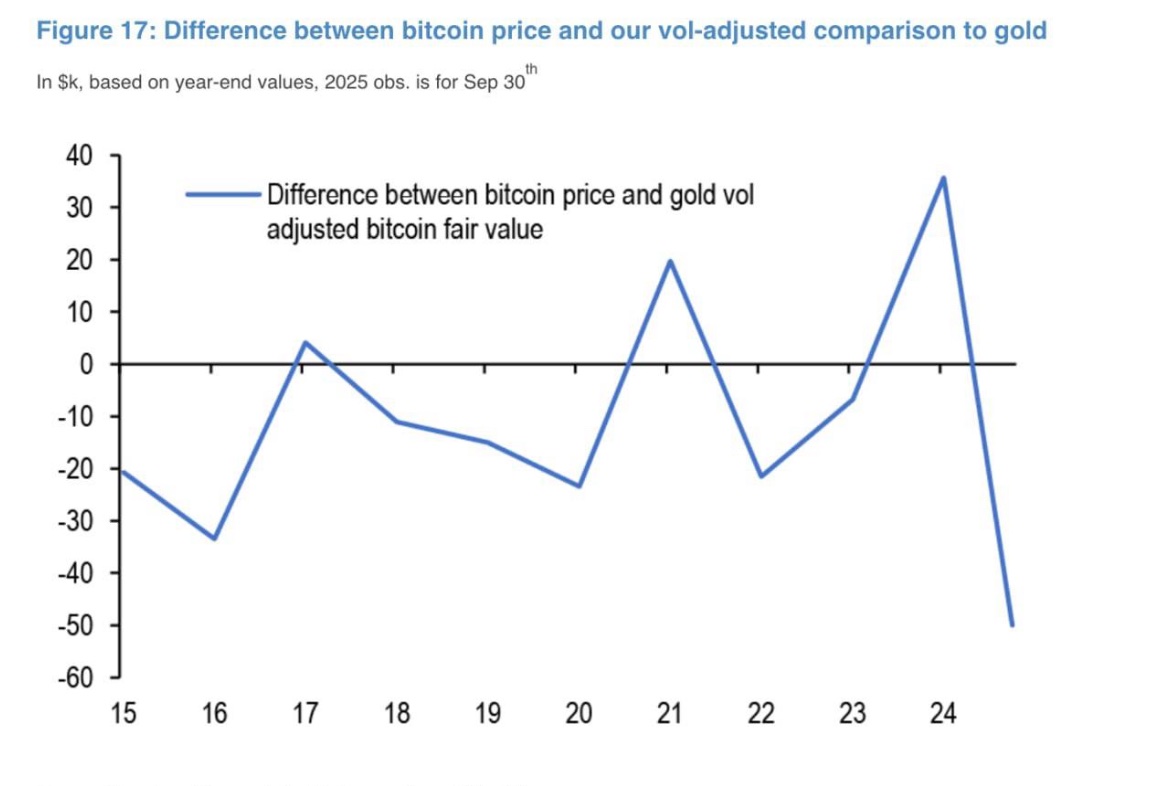

Bitcoin stays underestimated relative to gold when changed for volatility, according to a group of JPMorgan Chase strategists led by handling director Nikolaos Panigirtzoglou.

The Bitcoin-to-gold volatility ratio has actually dropped listed below 2.0, indicating Bitcoin now soaks up about 1.85 times more threat capital than gold, they composed in the most recent report released on Wednesday.

Based upon this ratio, Bitcoin’s present $2.3 trillion market capitalization would require to climb up by approximately 42%, indicating a theoretical BTC rate of around $165,000, to match the approximated $6 trillion in personal gold holdings throughout ETFs, bars, and coins.

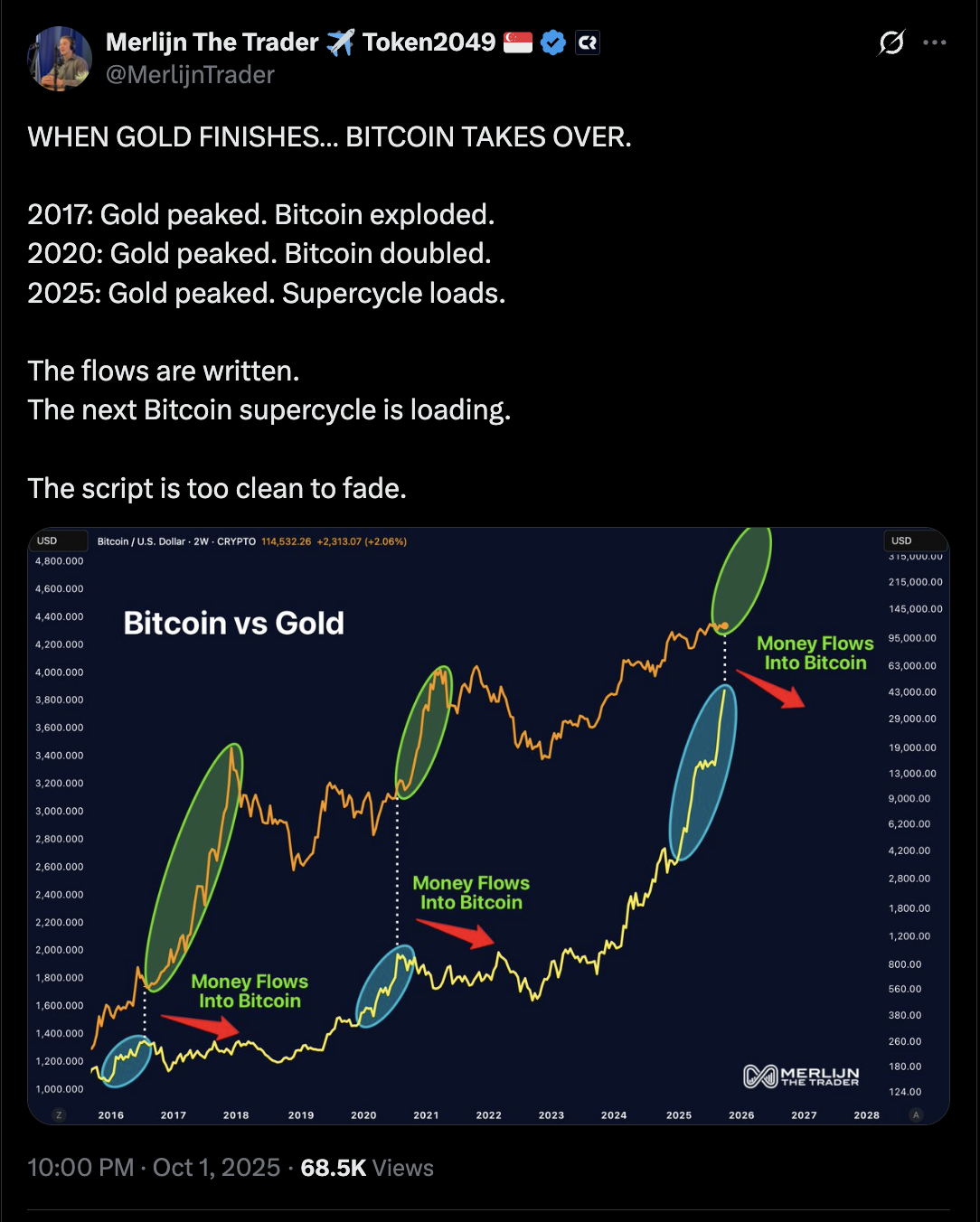

Gold, typically deemed Bitcoin’s standard macro equivalent, is up approximately 48% year-to-date, putting it on track for its finest yearly efficiency given that 1979.

Nevertheless, the annual relative strength index (RSI) for the XAU/USD set has actually reached almost 89, its most overbought reading given that 2012.

This is a level that traditionally preceded deep, multiyear corrections of 40– 60%. For that reason, gold’s uptrend might slow in the coming weeks.

Related: Bitcoin’s uncommon September gains defy history: Data anticipates 50% Q4 rally to $170K

On The Other Hand, BTC has actually revealed an 8-week lagging connection with gold recently, even more strengthening JPMorgan’s outlook for a year-end Bitcoin rally if capital turns from the rare-earth element.

JPMorgan’s bullish outlook likewise presumes a consistent stream of area ETF inflows as the Federal Reserve continues its rate-cutting cycle in the coming months.

Basic Chartered leads with a vibrant $200,000 call

Basic Chartered stays the most positive amongst significant banks, anticipating Bitcoin might reach $200,000 by December.

Like Citigroup and JPMorgan, the bank’s experts mention continual ETF inflows– balancing over $500 million weekly– as a crucial motorist that might raise Bitcoin’s overall market capitalization closer to $4 trillion.

Growing institutional adoption, along with a weakening United States dollar and enhancing worldwide liquidity conditions, might set the phase for another parabolic relocation comparable to Bitcoin’s 2020– 2021 bull run, the experts discuss.

Basic Chartered’s experts frame the $200,000 circumstance as a “structural uptrend” instead of a short-term speculative rally.

VanEck sees Bitcoin reaching $180,000 in 2025

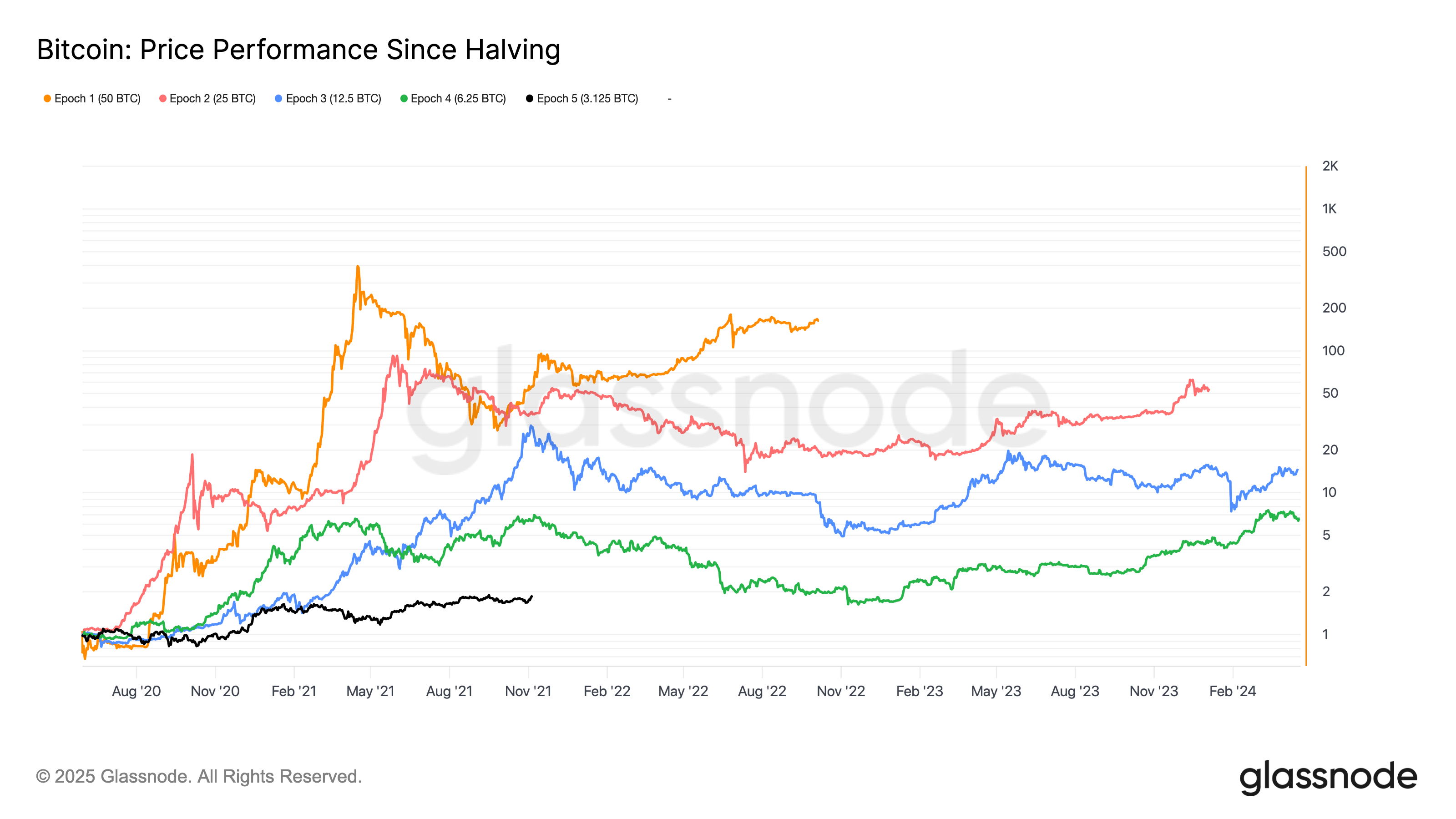

Property supervisor VanEck tasks that Bitcoin might reach around $180,000 by 2025, pointing out post-halving cycle characteristics.

The company argues that the April 2024 halving has actually set the phase for a supply capture, with ETF need and digital property treasuries offering the structural fuel for the next leg of the upward pattern.

Bitcoin’s efficiency given that the halving is when again matching previous four-year cycles, as displayed in the chart below.

Historically, Bitcoin has actually reached its cycle peaks in between 365 and 550 days after a halving. Since Saturday, it has actually been 533 days given that the halving, putting it securely within the historic window for huge rallies.

Saad Ahmed, Gemini’s head of APAC, informed Cointelegraph that Bitcoin’s cycle might extend beyond that variety, keeping in mind that its four-year rhythm is “driven more by human feeling than pure mathematics” and will “highly likely continue in some type” into 2026.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.