Cryptocurrency exchange Kraken has actually broadened its derivatives trading offering in its home jurisdiction through a brand-new acquisition.

Kraken obtained Small Exchange, a designated agreement market maker (DCM), from the trading business IG Group for $100 million, the business revealed on Thursday.

With the DCM certified by the United States Product Futures Trading Commission (CFTC), the Small Exchange acquisition licenses Kraken to construct markets for exchange-listed derivatives in the United States.

” Under CFTC oversight, Kraken can now incorporate cleaning, threat, and matching into one environment that fulfills the exact same requirements as the biggest exchanges on the planet,” Kraken co-CEO Arjun Sethi stated.

Unified crypto trading platform

The Little Exchange acquisition advances Kraken’s objective to construct a unified trading platform, producing a structure for a “brand-new generation of United States derivatives markets.”

The CFTC-licensed DCM assists Kraken link area, futures and margin trading items inside a single regulated liquidity system, minimizing fragmentation and increasing the speed of trade execution, Sethi stated.

The relocation is likewise part of a bigger effort targeting international derivatives facilities, consisting of Kraken’s derivatives platforms in the UK and the European Union.

” Together, these components produce a network that moves security in genuine time, internet direct exposure throughout jurisdictions, and minimizes capital inadequacies that have actually long kept back United States traders,” the co-CEO kept in mind.

Kraken bets on derivatives markets

Kraken’s Small Exchange acquisition is not the very first relocation by Kraken into derivatives markets in the United States. The exchange released a derivatives platform for United States traders in July through a $1.5 billion acquisition of the futures trading platform NinjaTrader.

Declared in March 2025, the NinjaTrader acquisition allowed Kraken to provide Chicago Mercantile Exchange (CME)- noted crypto futures, together with area crypto items in a combined user interface.

The growth of derivatives items lines up with Kraken’s multi-year dedication to derivatives markets, consisting of the acquisition of UK-based derivatives platform Crypto Facilities in 2019.

Related: Hyperliquid now enables anybody to release continuous futures, for a cost

In May 2025, Kraken released derivatives selling the European Union in compliance with the regional crypto derivatives-related structure, Markets in Financial Instruments Instruction (MiFID II).

Crypto derivatives pattern increasing

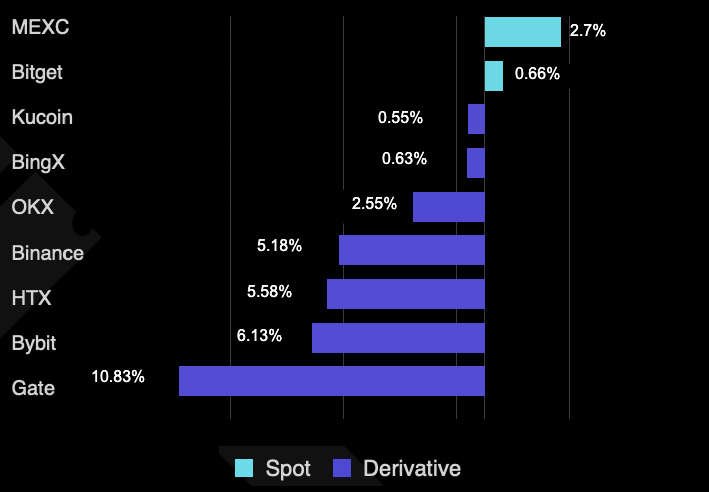

Kraken’s continuous efforts in producing a brand-new generation of crypto derivatives come in the middle of the derivatives sector holding momentum versus area trading on central exchanges (CEXs).

While area trading volumes apparently dropped as much as 22% in the 2nd quarter of 2025, derivatives were more resistant, experiencing a decrease of about 4% and amounting to $20.2 trillion.

According to Mark Jennings, head of Europe at Winklevoss’s crypto exchange Gemini, the international derivatives market has actually taken off in current months and is anticipated to strike $23 trillion by the end of 2025.

With derivatives becoming an essential crypto pattern in 2025, significant derivatives platforms and CEXs have actually been hurrying to broaden their items.

In early October, CME Group stated it will broaden its services to provide always-on trading for crypto derivatives beginning in 2026.

Coinbase, the biggest United States crypto exchange by trading volumes, has actually likewise been actively broadening into derivatives with the Deribit acquisition in May.

Publication: Sharplink officer surprised by level of BTC and ETH ETF hodling: Joseph Chalom