London-based fintech business LMAX Group has actually gone into the leveraged crypto derivatives market, revealing continuous futures agreements connected to Bitcoin and Ether focused on institutional customers.

The exchange, which averages over $40 billion in everyday area volume throughout FX and digital properties, stated the relocation was driven by customer need for high-leverage access to crypto markets, according to a Wednesday report by Bloomberg.

” Continuous futures have actually controlled the crypto market for the last 3 or 4 years,” LMAX CEO David Mercer stated. “Our institutional customers, consisting of leading exclusive trading companies and brokers, are trying to find that sort of direct exposure,” Mercer included.

Perpetuals are a kind of monetary derivative that works like a standard futures agreement however without an expiration date. LMAX’s offering will permit as much as 100x utilize. LMAX runs forex brokers in the UK, Europe, New Zealand and Mauritius, per its site.

Cointelegraph connected to LMAX Group for remark, however had actually not gotten an action by publication.

Related: High danger, high benefit: Crypto continuous futures gain momentum in United States

Perps control crypto trading volume

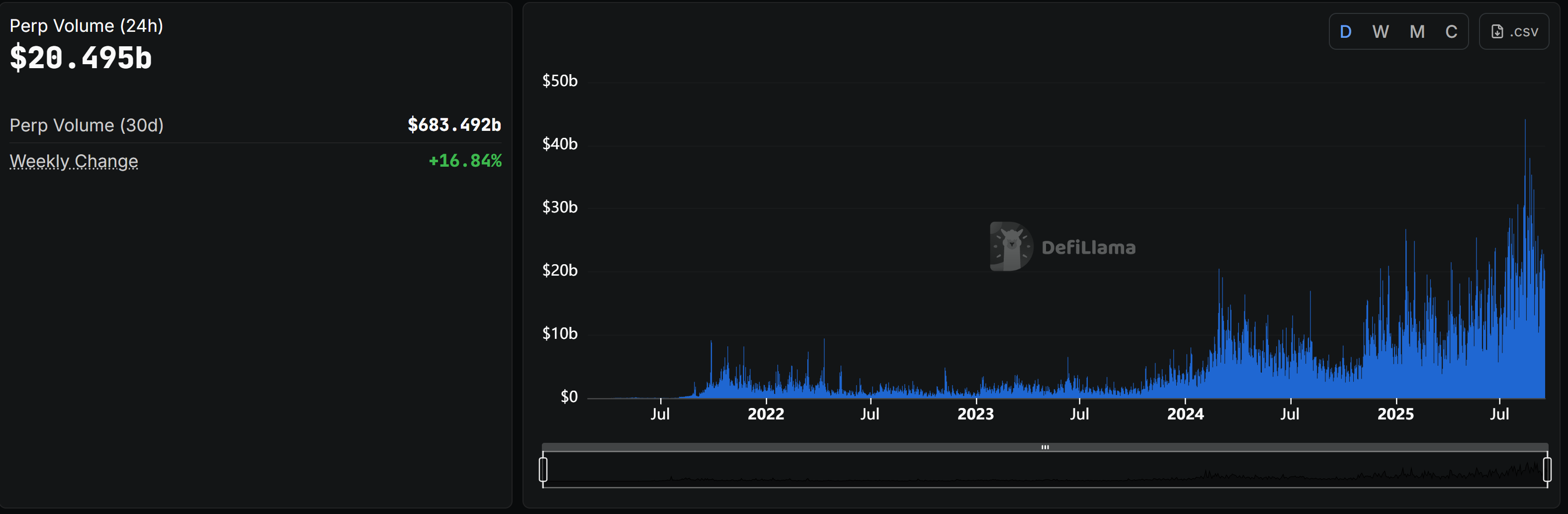

Continuous futures control crypto trading activity, representing 68% of all Bitcoin (BTC) volume up until now in 2025, up from 66% in 2015, according to Kaiko.

Leading exchanges like Binance, Bybit and OKX hold almost 70% of open interest in these items, with everyday perp volumes varying in between $10 billion and $30 billion, and peak days reaching as high as $80 billion on Binance alone, per Kaiko.

According to CoinMarketCap information, perpetuals have actually controlled crypto derivatives selling the previous 24 hr with $1.39 trillion in volume, far exceeding conventional futures agreements, which saw simply $670.61 million.

On the other hand, per information from DefiLlama, decentralized continuous platforms jointly processed $20.5 billion in 24-hour volume, with a 30-day overall topping $683.5 billion, showing a 16.84% weekly rise. Hyperliquid alone contributed over $65 billion in seven-day volume.

Related: Crypto perp futures coming ‘soon,’ states CFTC’s Mersinger

Perps show up in the United States

LMAX Group’s push into the crypto derivatives market comes as significant United States places transfer to use retail access to continuous futures. Coinbase started providing perps to United States consumers in July, and the CBOE prepares to introduce its variation in November.

In April, Europe’s One Trading introduced MiFID II-compliant perpetuals, though the offering is restricted to institutional customers. The platform prepares to broaden the item to qualified retail customers.

Publication: Can Robinhood or Kraken’s tokenized stocks ever be genuinely decentralized?