Bitcoin mining business MARA Holdings has actually finished a minority acquisition of 2 Prime, an institutional financial investment consultant handling $1.75 billion in possessions, in an offer that substantially increases the quantity of BTC 2 Prime handles on MARA’s behalf.

The minority stake consisted of a $20 million equity financial investment in 2 Prime, with MARA increasing its Bitcoin (BTC) allotment with the business to 2,000 BTC from 500 BTC, MARA stated Tuesday. The Bitcoin will be kept in a Separately Managed Account and utilized to create yield on MARA’s behalf.

2 Prime is a financial investment consultant signed up with the United States Securities and Exchange Commission (SEC). The business assists organizations and expert financiers get direct exposure to Bitcoin.

MARA holds among the world’s biggest Bitcoin treasuries, at first constructed through its self-mining operations. As reported by Cointelegraph, the business later on revealed strategies to offer stock to obtain extra Bitcoin, a play similar to Michael Saylor’s Technique.

MARA’s primary monetary officer, Salman Khan, stated the method belongs to the business’s more comprehensive effort to trigger its Bitcoin balance, that includes utilizing BTC as more than simply a “passive property connected to cost gratitude.”

Related: 10 public business that silently turned their balance sheets into Bitcoin treasuries

MARA deals with blended lead to a post-halving landscape

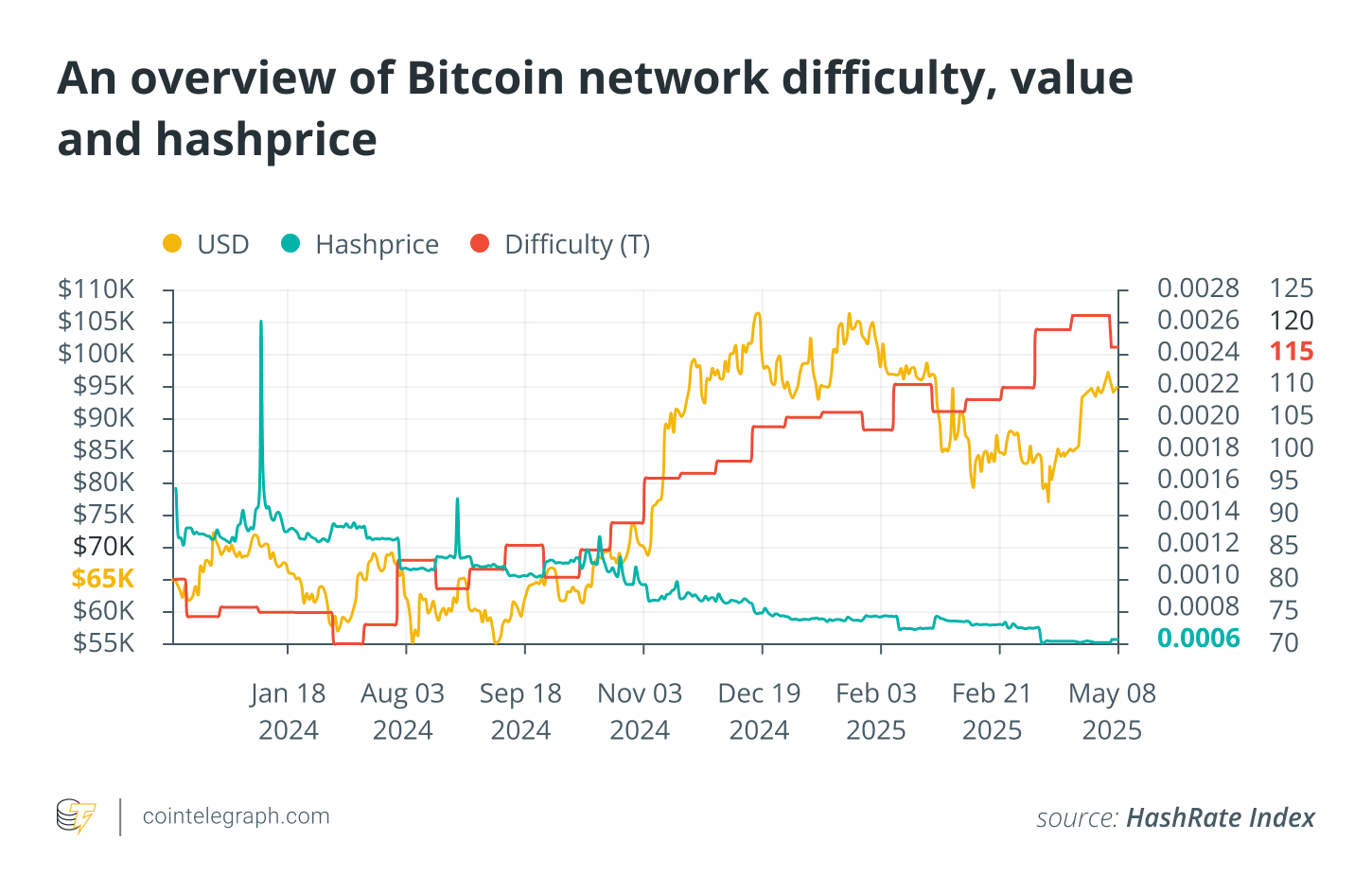

Like numerous mining companies, MARA has actually experienced blended results following Bitcoin’s current quadrennial halving, which cut block benefits by 50%. The minimized income capacity, combined with increasing energy and devices expenses, put pressure on miners’ success.

For MARA, this equated into a $533 million bottom line in Q1, in spite of an almost 30% boost in income to $214 million.

As Cointelegraph reported, simplifying electrical energy expenses has actually ended up being an essential success chauffeur in the post-halving environment.

In action to these difficulties, numerous miners, consisting of Core Scientific and HIVE Digital, have actually started rotating their organization designs towards AI information center hosting and repurposing facilities for high-performance computing (HPC) work.

Nevertheless, Core Scientific’s future in Bitcoin mining is less particular after it was gotten by CoreWeave in a $9 billion all-stock offer. CoreWeave stated it might “repurpose” Core Scientific’s possessions towards HPC or divest its crypto operations totally.

Related: Regardless of record high, S&P 500 is down in Bitcoin terms